- China

- /

- Electronic Equipment and Components

- /

- SZSE:000733

High Growth Tech Stocks in China for October 2024

Reviewed by Simply Wall St

As Chinese equities experience a rise, buoyed by the central bank's stimulus measures, the tech sector in China presents intriguing opportunities amid these economic shifts. In this context, identifying high-growth tech stocks involves looking for companies that are well-positioned to benefit from policy support and demonstrate resilience in adapting to changing market dynamics.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.11% | 33.26% | ★★★★★★ |

| Zhongji Innolight | 32.39% | 32.11% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 28.76% | 30.25% | ★★★★★★ |

| Cubic Sensor and InstrumentLtd | 25.81% | 42.86% | ★★★★★★ |

| Eoptolink Technology | 40.26% | 34.57% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 37.55% | 103.97% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Gan & Lee Pharmaceuticals (SHSE:603087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gan & Lee Pharmaceuticals is a biopharmaceutical company focused on the research, development, production, and sale of insulin analog active pharmaceutical ingredients (APIs) and injections in China, with a market capitalization of CN¥30.70 billion.

Operations: Gan & Lee Pharmaceuticals specializes in the development and commercialization of insulin analog APIs and injections, primarily serving the Chinese market. The company generates revenue through its pharmaceutical products, focusing on diabetes treatment solutions.

Gan & Lee Pharmaceuticals showcases a robust trajectory in China's high-tech sector, with a projected annual revenue growth of 27.7%, outpacing the market’s average of 13.6%. This growth is complemented by an impressive forecast of earnings increasing by 43.2% annually, significantly higher than the broader Chinese market's 24.3%. The company has also actively repurchased shares, spending CNY 15.13 million to buy back 396,900 shares recently, signaling confidence in its financial health and commitment to shareholder value. In terms of innovation and market positioning, Gan & Lee's recent earnings report for the nine months ending September 2024 revealed revenues soaring to CNY 2,245.01 million from CNY 1,905.67 million year-over-year and net income more than doubling to CNY 507.27 million from CNY 266.48 million previously reported last year during this period—evidence of their operational efficiency and growing dominance in biotechnology within China’s competitive landscape.

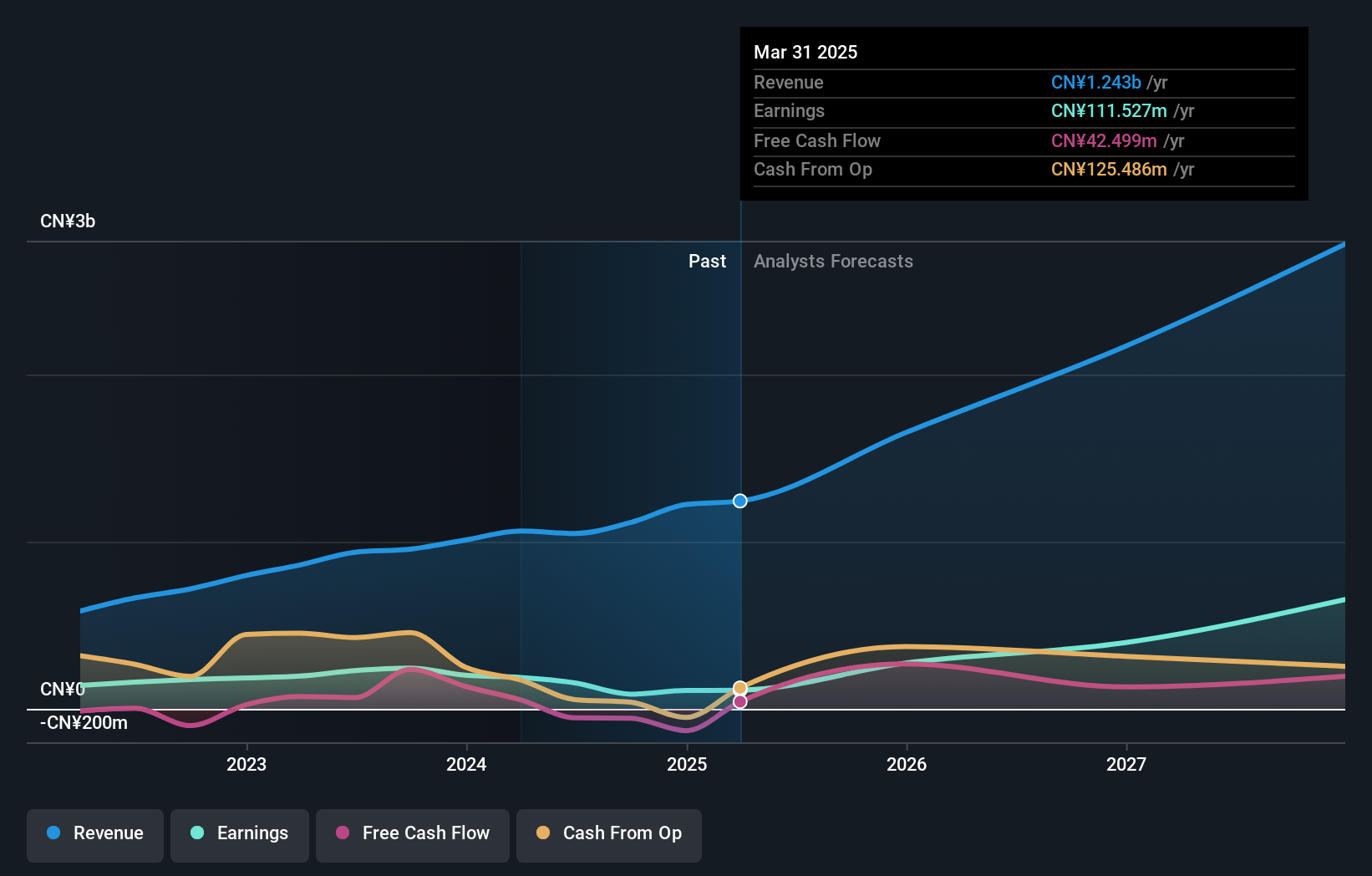

China Zhenhua (Group) Science & Technology (SZSE:000733)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Zhenhua (Group) Science & Technology Co., Ltd specializes in the manufacturing and sale of electronic components in China, with a market capitalization of CN¥27.48 billion.

Operations: The company generates revenue primarily through the sale of electronic components, focusing on the domestic Chinese market. It operates within a competitive industry, where cost management and efficient production processes are crucial for sustaining profitability.

China Zhenhua (Group) Science & Technology Co., Ltd, despite recent setbacks in net income and sales, which saw a significant reduction from the previous year, maintains a strong outlook with expected revenue growth of 20.3% annually. This forecast surpasses the Chinese market average of 13.5%, illustrating resilience and potential for recovery. The company's commitment to innovation is evident in its R&D investments, crucial for maintaining competitive advantage in China's tech sector. With earnings projected to grow at 24.6% per year, outpacing the broader market forecast of 24%, Zhenhua is poised to strengthen its market position further, leveraging advanced technologies and strategic initiatives to enhance shareholder value.

- Dive into the specifics of China Zhenhua (Group) Science & Technology here with our thorough health report.

Understand China Zhenhua (Group) Science & Technology's track record by examining our Past report.

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Empyrean Technology Co., Ltd. is engaged in the development, sale, and servicing of electronic design automation (EDA) software with a market capitalization of CN¥56.47 billion.

Operations: Specializing in electronic design automation (EDA) software, Empyrean Technology focuses on development, sales, and service offerings.

Empyrean Technology, amid a challenging market backdrop, has demonstrated resilience with its recent half-year earnings report. Despite a dip in net income to CN¥37.87 million from CN¥83.81 million year-over-year, the company managed an increase in revenue to CN¥443.79 million, up from CN¥404.83 million—a growth rate of 30.8% annually that significantly surpasses the Chinese market average of 13.6%. This performance is bolstered by strategic presentations at key industry events like the Design Automation Conference, signaling ongoing engagement with technological advancements and sector trends. Moreover, Empyrean's commitment to innovation is underscored by its R&D investments which are poised to fuel an expected annual earnings growth of 47.7%, more than doubling the broader market forecast of 24.3%.

- Delve into the full analysis health report here for a deeper understanding of Empyrean Technology.

Gain insights into Empyrean Technology's past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 260 Chinese High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000733

China Zhenhua (Group) Science & Technology

Manufactures and sells electronic components in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives