Jiangsu Zeyu Intelligent PowerLtd's (SZSE:301179) Earnings Might Not Be As Promising As They Seem

Jiangsu Zeyu Intelligent Power Co.,Ltd. (SZSE:301179) posted some decent earnings, but shareholders didn't react strongly. We think that they might be concerned about some underlying details that our analysis found.

View our latest analysis for Jiangsu Zeyu Intelligent PowerLtd

Zooming In On Jiangsu Zeyu Intelligent PowerLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

That means a negative accrual ratio is a good thing, because it shows that the company is bringing in more free cash flow than its profit would suggest. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

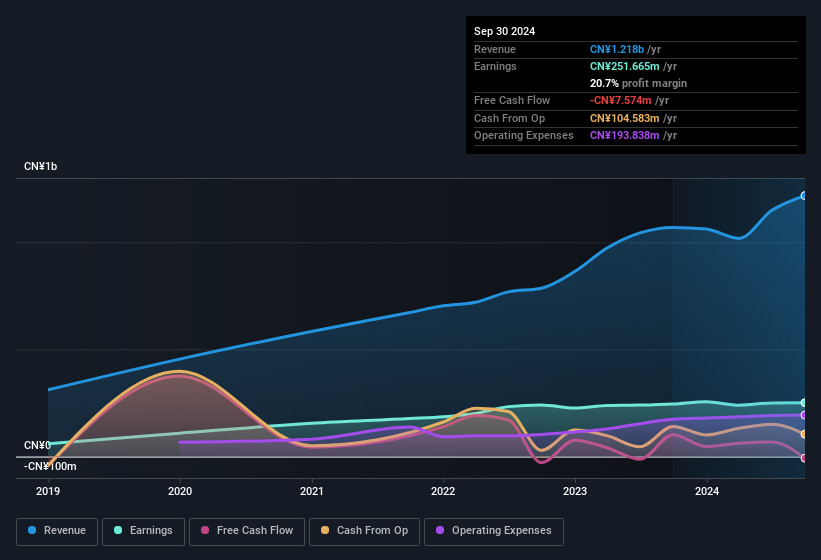

Jiangsu Zeyu Intelligent PowerLtd has an accrual ratio of 0.67 for the year to September 2024. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Even though it reported a profit of CN¥251.7m, a look at free cash flow indicates it actually burnt through CN¥7.6m in the last year. We saw that FCF was CN¥102m a year ago though, so Jiangsu Zeyu Intelligent PowerLtd has at least been able to generate positive FCF in the past. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Jiangsu Zeyu Intelligent PowerLtd's profit was boosted by unusual items worth CN¥32m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. If Jiangsu Zeyu Intelligent PowerLtd doesn't see that contribution repeat, then all else being equal we'd expect its profit to drop over the current year.

Our Take On Jiangsu Zeyu Intelligent PowerLtd's Profit Performance

Summing up, Jiangsu Zeyu Intelligent PowerLtd received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Jiangsu Zeyu Intelligent PowerLtd's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Jiangsu Zeyu Intelligent PowerLtd, you'd also look into what risks it is currently facing. For example, Jiangsu Zeyu Intelligent PowerLtd has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Our examination of Jiangsu Zeyu Intelligent PowerLtd has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301179

Jiangsu Zeyu Intelligent PowerLtd

Engages in provision of engineering construction, operation and maintenance, system integration, and design and consulting services for the power industry in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026