- China

- /

- Communications

- /

- SZSE:301191

High Growth Tech Stocks Including Jiangsu Zeyu Intelligent PowerLtd And 2 Others

Reviewed by Simply Wall St

In a week marked by volatility, global markets reacted to various economic developments, with U.S. stocks experiencing mixed performance amid concerns over AI competition and ongoing earnings reports. As central banks across regions adjusted interest rates in response to inflationary pressures and economic growth data, investors are closely monitoring the tech sector's resilience and adaptability in this dynamic environment. In such conditions, high-growth tech companies like Jiangsu Zeyu Intelligent Power Ltd stand out for their potential to innovate and navigate competitive challenges effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 1233 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangsu Zeyu Intelligent PowerLtd (SZSE:301179)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Zeyu Intelligent Power Co., Ltd. provides engineering construction, operation and maintenance, system integration, and design and consulting services for the power industry in China, with a market cap of CN¥5.65 billion.

Operations: Zeyu Intelligent Power focuses on the power industry in China, offering services that include engineering construction, operation and maintenance, system integration, as well as design and consulting. The company operates with a market capitalization of CN¥5.65 billion.

Jiangsu Zeyu Intelligent PowerLtd is distinguishing itself in the tech sector with an impressive annual revenue growth of 26.1%, outpacing the Chinese market average of 13.3%. This growth is complemented by a robust annual earnings increase projected at 30.4%, significantly higher than the market's 25.1%. The company's commitment to innovation is evident from its strategic R&D investments, crucial for maintaining its competitive edge in a rapidly evolving industry. Recent executive changes, including the election of new directors and supervisors, signal a refreshed strategic direction which could further enhance its market position and influence future performance.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

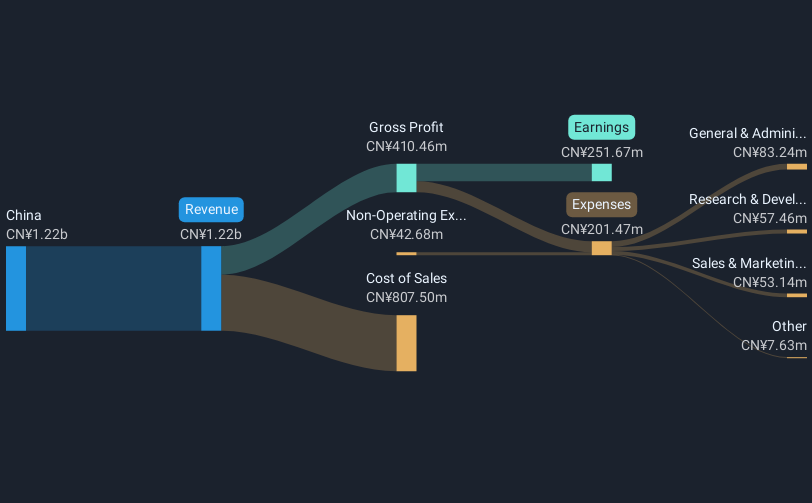

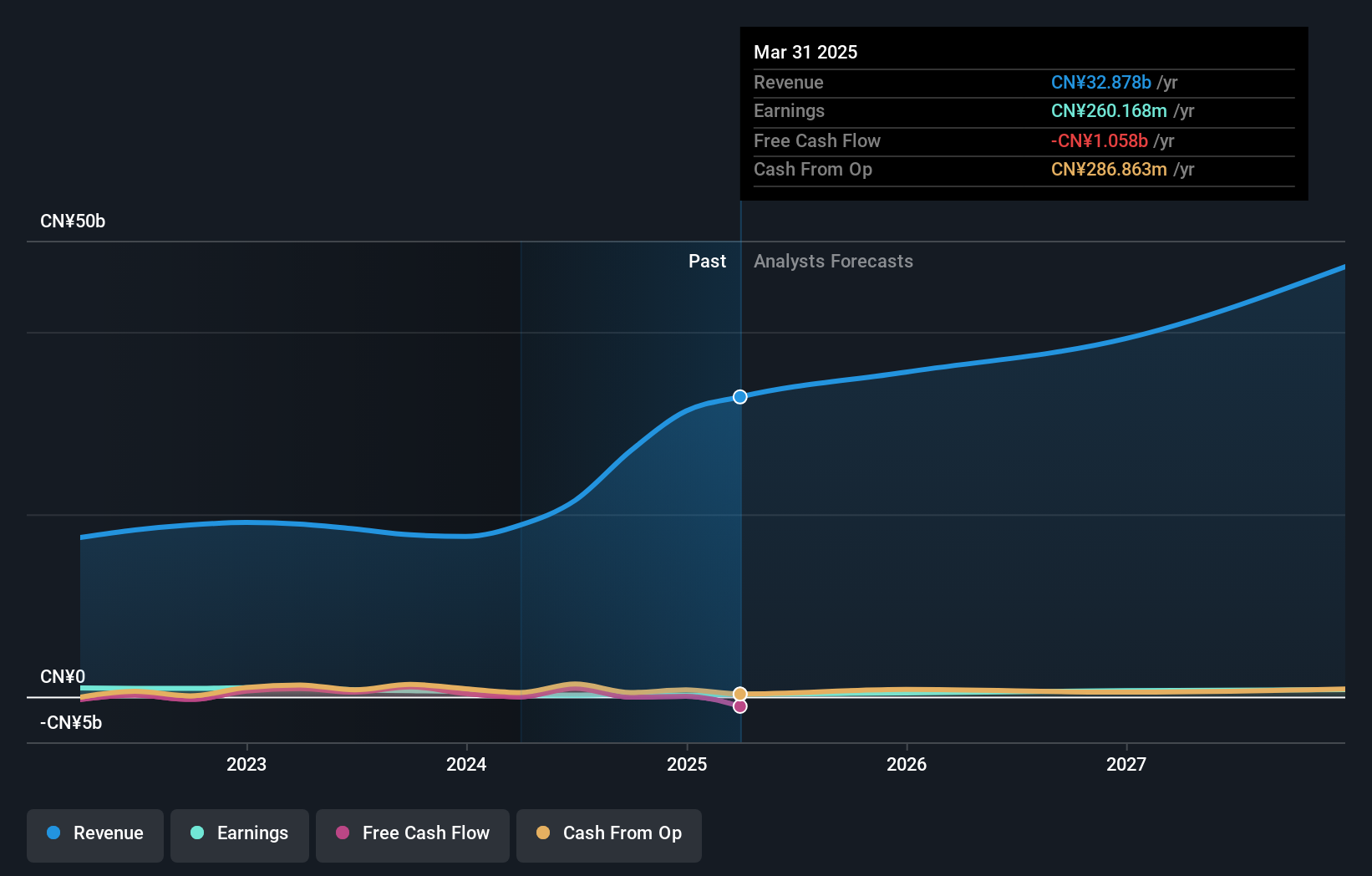

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. is a company that specializes in the development and manufacturing of wireless communications equipment, with a market capitalization of CN¥5.84 billion.

Operations: Phoenix Telecom generates revenue primarily from its wireless communications equipment segment, totaling CN¥1.84 billion.

Shenzhen Phoenix Telecom TechnologyLtd stands out in the tech landscape with a notable annual revenue growth rate of 23.2%, surpassing the broader Chinese market average of 13.3%. This performance is bolstered by an impressive projected earnings growth of 29.4% per year, indicating a robust upward trajectory compared to its peers. The company's strategic focus on R&D, which accounts for a significant portion of its budget, underpins its innovative capabilities and positions it well for sustained competitive advantage in evolving telecom technologies. Recent governance enhancements and bylaw amendments reflect an agile management approach, poised to adapt effectively in a dynamic industry environment.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Phoenix Telecom TechnologyLtd.

Understand Shenzhen Phoenix Telecom TechnologyLtd's track record by examining our Past report.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company with a market cap of CN¥51.15 billion, engaged in providing IT services and solutions across various industries.

Operations: iSoftStone focuses on delivering IT services and solutions, generating revenue primarily through its engagements across diverse industry sectors. The company's operations are rooted in leveraging technology to meet the specific needs of its clients.

iSoftStone Information Technology (Group) Co., Ltd. demonstrates a strong growth trajectory with an annual revenue increase of 16.9% and even more impressive earnings growth projected at 31.4% per year, outpacing the broader Chinese market's average. This robust financial performance is underpinned by significant investment in R&D, which has been strategically allocated to foster innovation and maintain competitive edge within the tech sector. Despite challenges like a slight dip in profit margins from 3.7% to 1%, the company's recent shareholder meeting highlights proactive steps towards financial prudence and strategic reorientation, including providing guarantees for subsidiary credit lines and initiating hedging businesses, positioning it well for future operational resilience and market adaptability.

- Get an in-depth perspective on iSoftStone Information Technology (Group)'s performance by reading our health report here.

Learn about iSoftStone Information Technology (Group)'s historical performance.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1233 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301191

Shenzhen Phoenix Telecom TechnologyLtd

Shenzhen Phoenix Telecom Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives