- China

- /

- Capital Markets

- /

- SZSE:002961

Undiscovered Gems in Global Featuring 3 Promising Small Cap Stocks

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by record highs in major U.S. stock indexes and robust job growth, smaller-cap stocks have been capturing attention with their impressive performance, as seen in the S&P MidCap 400 and Russell 2000 indexes' recent gains. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential for growth amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Chongqing Machinery & Electric | 25.60% | 7.97% | 18.73% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 10.29% | 36.24% | 62.32% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Taekwang Industrial (KOSE:A003240)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taekwang Industrial Co., Ltd. operates in the petrochemical, synthetic fiber, textile, and advanced material sectors both in South Korea and internationally, with a market cap of approximately ₩949.36 billion.

Operations: Taekwang Industrial generates its revenue primarily from the petrochemical, synthetic fiber, textile, and advanced material sectors. The company focuses on these diverse segments to drive its financial performance.

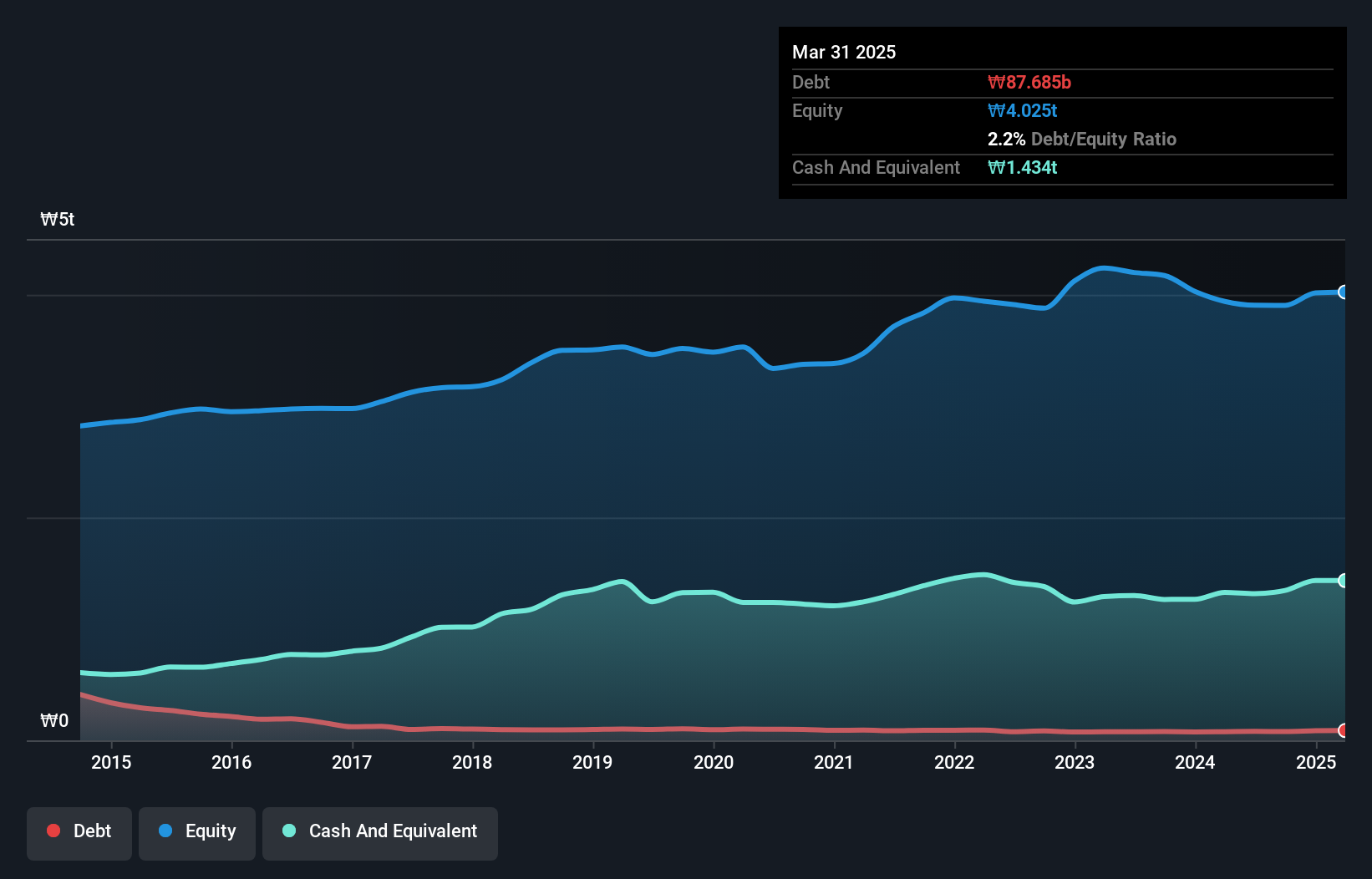

Taekwang Industrial, a smaller player in the chemicals sector, has shown significant earnings growth of 2285.5% over the past year, surpassing industry averages. This surge is partly due to a one-off gain of ₩158.3 billion impacting its recent financials. Despite a 1.1% annual decline in earnings over five years, its debt-to-equity ratio improved from 2.9 to 2.2, suggesting better financial health with more cash than total debt on hand. Recent private placement of bonds worth ₩318 billion indicates strategic moves for future growth and stability while trading at 86.3% below estimated fair value offers potential upside for investors seeking undervalued opportunities.

Ruida FuturesLtd (SZSE:002961)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ruida Futures Co., Ltd. operates as a futures company in China with a market capitalization of CN¥9.44 billion.

Operations: The company generates revenue primarily through its futures trading services. It has a market capitalization of CN¥9.44 billion, indicating its substantial presence in the financial sector.

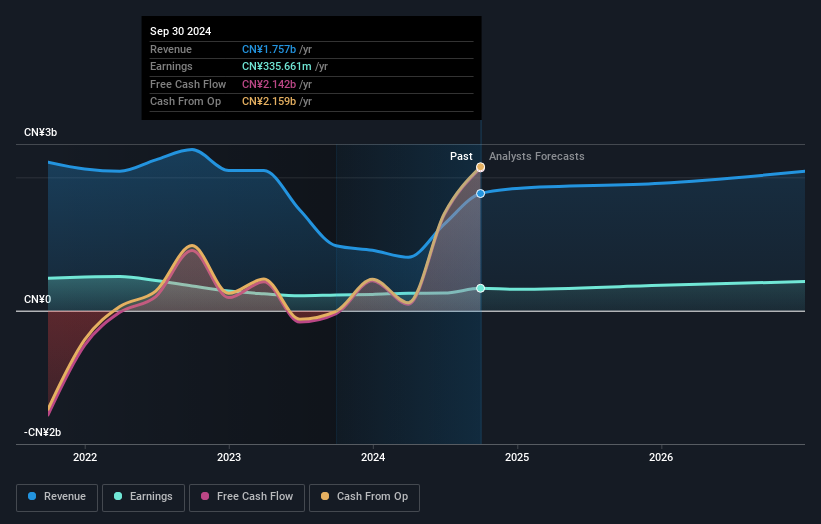

Ruida Futures Ltd. showcases a compelling profile with its earnings growth of 49.7% over the past year, outpacing the Capital Markets industry average of 34.3%. Despite a decrease in profit margins from 32.7% to 20.4%, Ruida remains profitable, with more cash than total debt, suggesting financial stability. Recent events include an approved final cash dividend of CNY 2 per share and revenue for Q1 2025 at CNY 382.61 million compared to CNY 279.57 million last year, highlighting robust performance amidst market volatility and potential for continued growth in the sector.

- Delve into the full analysis health report here for a deeper understanding of Ruida FuturesLtd.

Gain insights into Ruida FuturesLtd's past trends and performance with our Past report.

Pansoft (SZSE:300996)

Simply Wall St Value Rating: ★★★★★★

Overview: Pansoft Company Limited offers management information solutions and IT integrated services for large enterprises in China, with a market cap of CN¥4.45 billion.

Operations: Revenue streams primarily include management information solutions and IT integrated services for large enterprises in China. The company's net profit margin is a key financial indicator to consider, reflecting its profitability after all expenses.

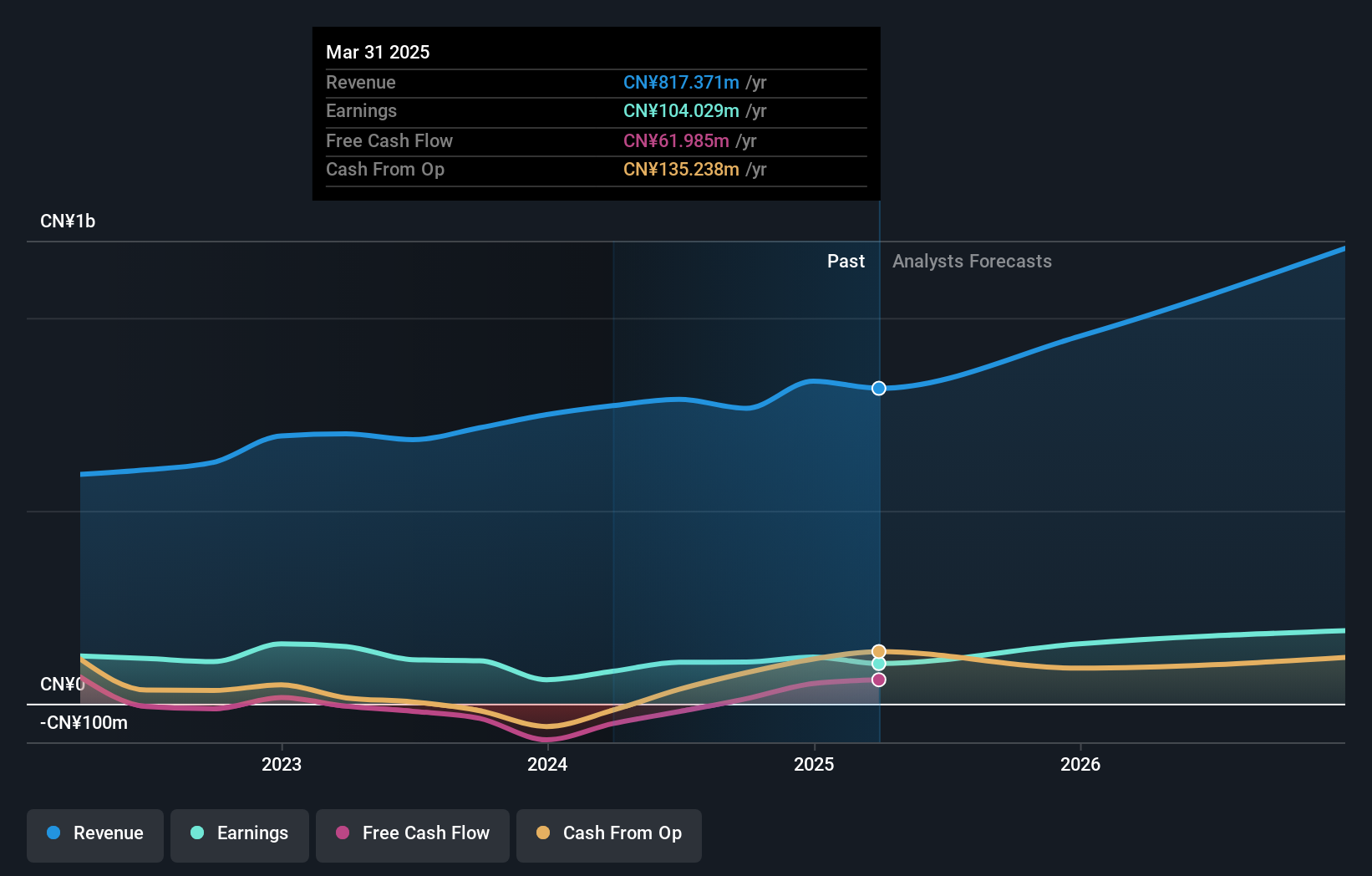

Pansoft, a small player in the software industry, stands out with its debt-free status and high-quality earnings. Over the past year, earnings surged by 23.7%, outpacing the industry average of -2%. The company trades at a value 31.8% below its estimated fair value, indicating potential for appreciation. Despite reporting a net loss of CNY 13.95 million in Q1 2025 compared to last year's profit of CNY 3.27 million, Pansoft remains free cash flow positive and is set to grow earnings by an impressive forecasted rate of 32.22% annually, suggesting robust future prospects amidst recent challenges like decreased sales revenue from CNY 77.52 million to CNY 58.76 million year-over-year.

- Take a closer look at Pansoft's potential here in our health report.

Examine Pansoft's past performance report to understand how it has performed in the past.

Make It Happen

- Gain an insight into the universe of 3165 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002961

Proven track record with adequate balance sheet.

Market Insights

Community Narratives