- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1415

High Growth Tech Stocks To Watch In The None Exchange

Reviewed by Simply Wall St

In recent weeks, global markets have shown mixed performance, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks in the Russell 2000 index saw a decline after previous outperformance. This divergence highlights the ongoing rally in growth stocks, particularly within sectors such as consumer discretionary and information technology, which have gained momentum despite broader economic uncertainties including labor market fluctuations and geopolitical developments. In this environment, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability to changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1293 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that engages in the design, development, manufacturing, trading, and sale of optical modules and systems integration products for smartphones and other mobile devices across various international markets, with a market cap of approximately HK$23.20 billion.

Operations: Cowell e Holdings Inc. generates revenue primarily through its photographic equipment and supplies segment, amounting to $1.14 billion. The company operates in diverse markets including the People's Republic of China, India, and the Republic of Korea.

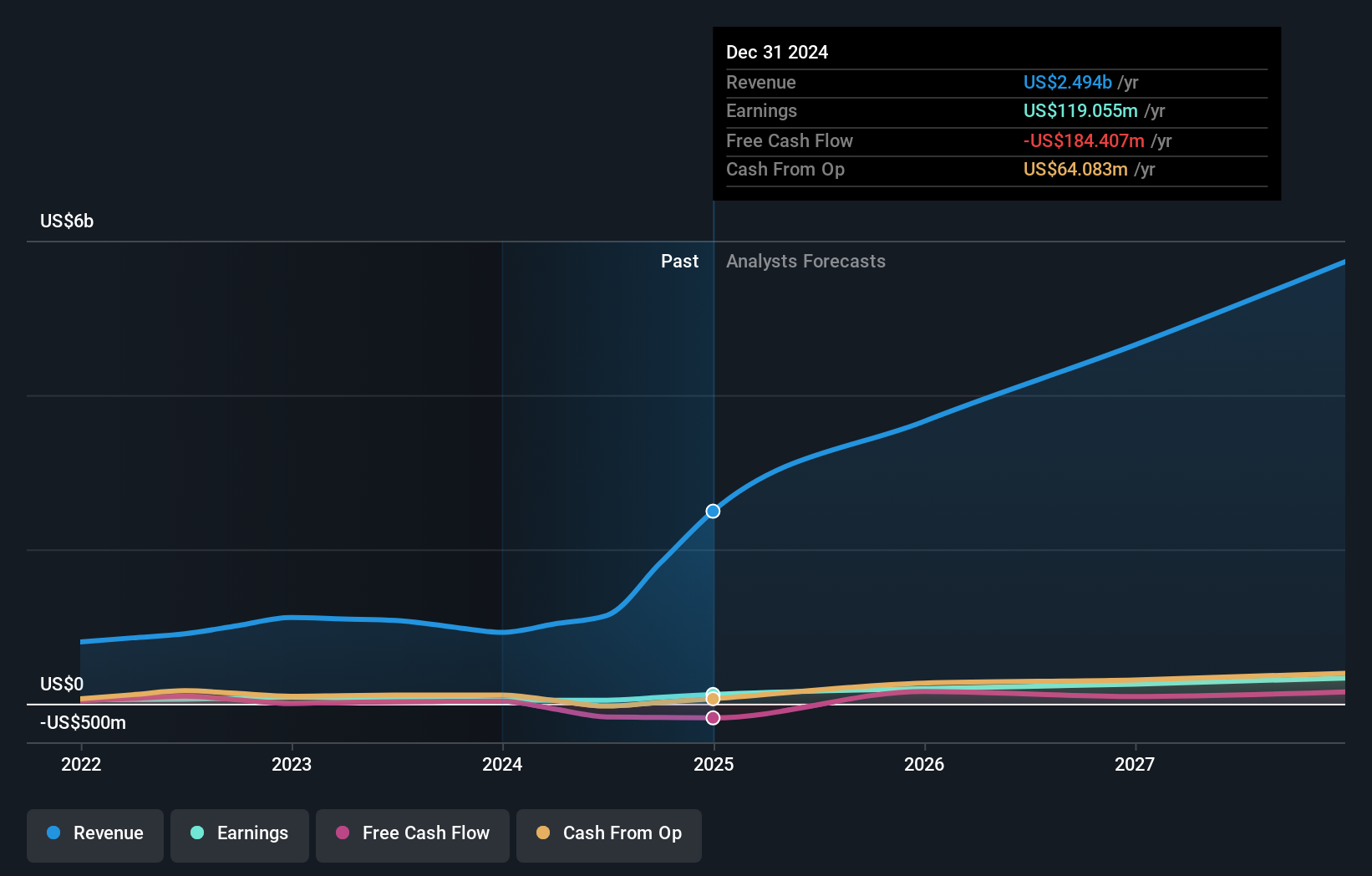

Cowell e Holdings, despite a challenging year with earnings down by 37.1%, is poised for significant recovery with forecasts suggesting a robust annual growth of 41.9%. This projected growth outpaces the broader Hong Kong market's expectation of 11.4% and reflects a strategic emphasis on innovation, as evidenced by substantial R&D investments which align closely with revenue increases—R&D expenses surged to support anticipated developments in emerging tech sectors. Moreover, Cowell’s commitment to expanding its market share is underscored by an aggressive revenue growth rate forecast at 32% annually, substantially higher than the industry average of 7.8%. This strategic focus on high-value sectors likely positions Cowell for impactful future advancements within the tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Cowell e Holdings.

Evaluate Cowell e Holdings' historical performance by accessing our past performance report.

Beijing SuperMap Software (SZSE:300036)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing SuperMap Software Co., Ltd. provides geographic information system (GIS) and geospatial intelligence software products and services both in China and internationally, with a market cap of CN¥9.18 billion.

Operations: The company generates revenue through the sale of GIS and geospatial intelligence software products and services across domestic and international markets. Its business model focuses on leveraging advanced technology to provide comprehensive solutions in geographic information systems, catering to a diverse client base.

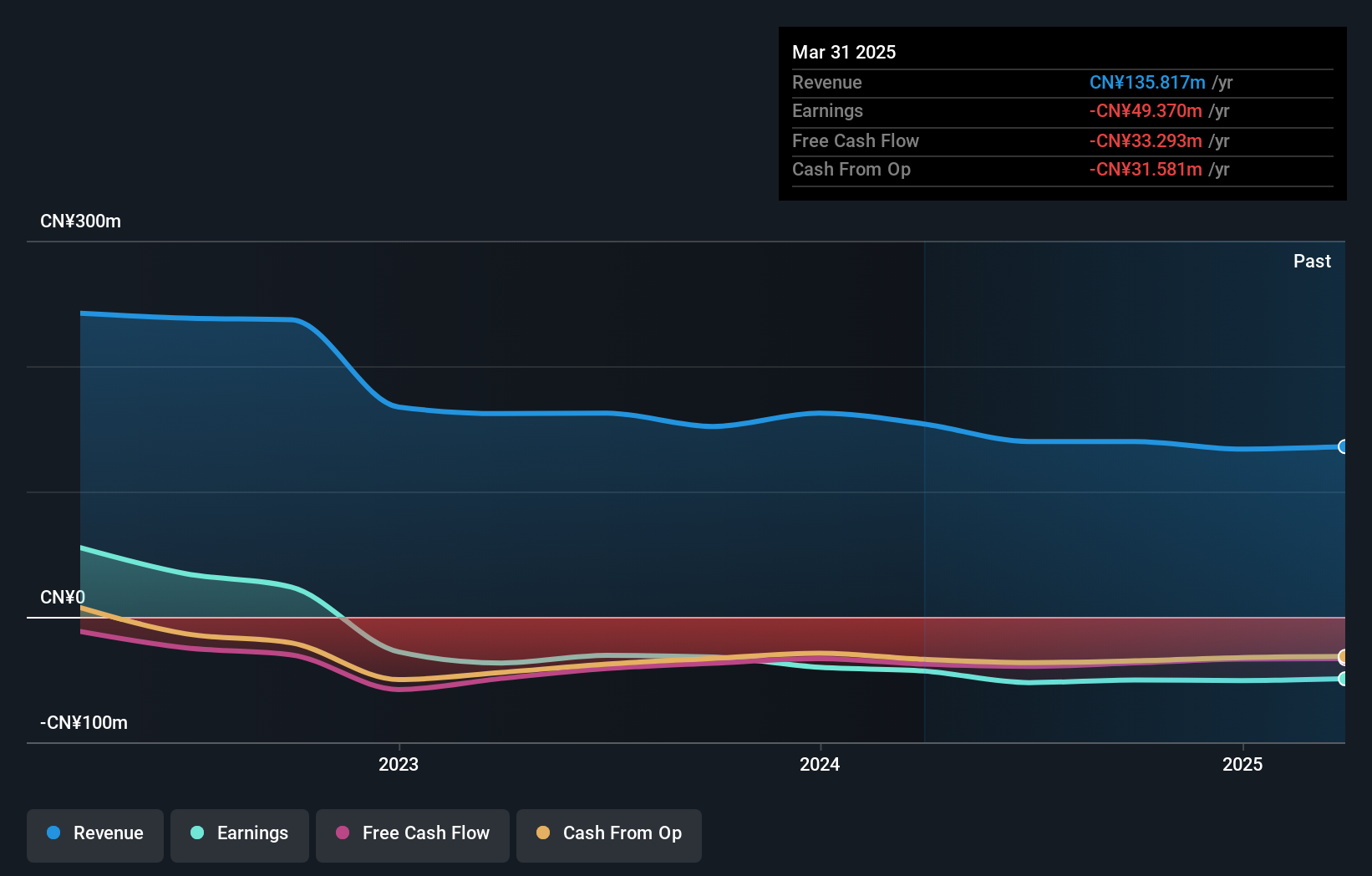

Beijing SuperMap Software stands out in the tech landscape with its projected revenue growth of 26.6% annually, surpassing the Chinese market's average of 13.7%. This growth is underpinned by significant R&D investments, which have been strategically aligned with emerging tech trends; last year alone, R&D expenses constituted a substantial portion of revenue, reflecting the company's commitment to innovation. Moreover, earnings are expected to surge by 53.1% per year, indicating robust future prospects and a strong competitive stance in the software industry. These financial indicators suggest that Beijing SuperMap is not only expanding its technological capabilities but also securing a sustainable growth trajectory amidst dynamic market conditions.

- Click here to discover the nuances of Beijing SuperMap Software with our detailed analytical health report.

Gain insights into Beijing SuperMap Software's past trends and performance with our Past report.

Beijing YJK Building SoftwareLtd (SZSE:300935)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing YJK Building Software Co., Ltd. specializes in the development and sale of building structure design software and BIM-related products, with a market capitalization of approximately CN¥1.90 billion.

Operations: YJK Building Software focuses on developing and selling software for building structure design and BIM-related products, catering to both domestic and international markets. The company leverages its expertise in the construction software industry to generate revenue through these specialized offerings.

Beijing YJK Building SoftwareLtd demonstrates a promising trajectory in the tech sector, with its revenue expected to climb by 24.9% annually, significantly outpacing the Chinese market's growth rate of 13.7%. This surge is bolstered by a robust commitment to research and development, evidenced by R&D expenses growing to 108.8% year-over-year, aligning closely with strategic innovations that cater to evolving market demands. Despite current unprofitability, the company is poised for substantial earnings growth at an anticipated rate of 108.84% annually, reflecting potential for strong future performance as it continues to expand its technological frontiers and enhance client solutions within the competitive software landscape.

- Dive into the specifics of Beijing YJK Building SoftwareLtd here with our thorough health report.

Understand Beijing YJK Building SoftwareLtd's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 1293 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1415

Cowell e Holdings

An investment holding company, engages in the design, development, manufacture and sale of modules and system integration products for smartphones, multimedia tablets and other mobile devices.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives