Beijing Global Safety Technology Co., Ltd.'s (SZSE:300523) Price Is Right But Growth Is Lacking After Shares Rocket 32%

Beijing Global Safety Technology Co., Ltd. (SZSE:300523) shares have continued their recent momentum with a 32% gain in the last month alone. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

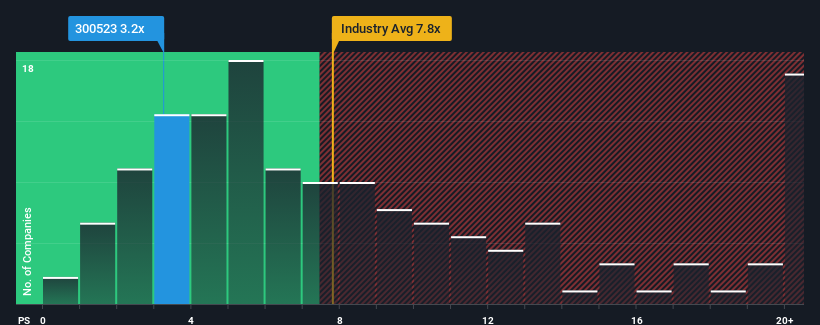

In spite of the firm bounce in price, Beijing Global Safety Technology may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 3.2x, since almost half of all companies in the Software industry in China have P/S ratios greater than 7.8x and even P/S higher than 13x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Beijing Global Safety Technology

How Has Beijing Global Safety Technology Performed Recently?

For instance, Beijing Global Safety Technology's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Beijing Global Safety Technology will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Beijing Global Safety Technology?

The only time you'd be truly comfortable seeing a P/S as depressed as Beijing Global Safety Technology's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 23% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 33% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Beijing Global Safety Technology's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Beijing Global Safety Technology's P/S

Even after such a strong price move, Beijing Global Safety Technology's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Beijing Global Safety Technology revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Plus, you should also learn about these 2 warning signs we've spotted with Beijing Global Safety Technology (including 1 which doesn't sit too well with us).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Beijing Global Safety Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Global Safety Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300523

Beijing Global Safety Technology

Beijing Global Safety Technology Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives