As global markets navigate the uncertainties of the incoming Trump administration and fluctuating interest rate expectations, investors are keenly observing sector-specific impacts such as deregulation in financials and energy, alongside challenges faced by healthcare and electric vehicle sectors. In this environment, identifying undervalued stocks becomes crucial; these are companies whose current market prices may not fully reflect their intrinsic value or future potential amidst shifting economic policies and market dynamics.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$279.00 | NT$554.65 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| Solum (KOSE:A248070) | ₩17280.00 | ₩34265.45 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥16.20 | CN¥32.31 | 49.9% |

| XD (SEHK:2400) | HK$22.40 | HK$44.60 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44600.00 | ₩88907.79 | 49.8% |

| iFLYTEKLTD (SZSE:002230) | CN¥53.07 | CN¥105.85 | 49.9% |

Let's explore several standout options from the results in the screener.

BioArctic (OM:BIOA B)

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK15.80 billion.

Operations: Revenue Segments (in millions of SEK):

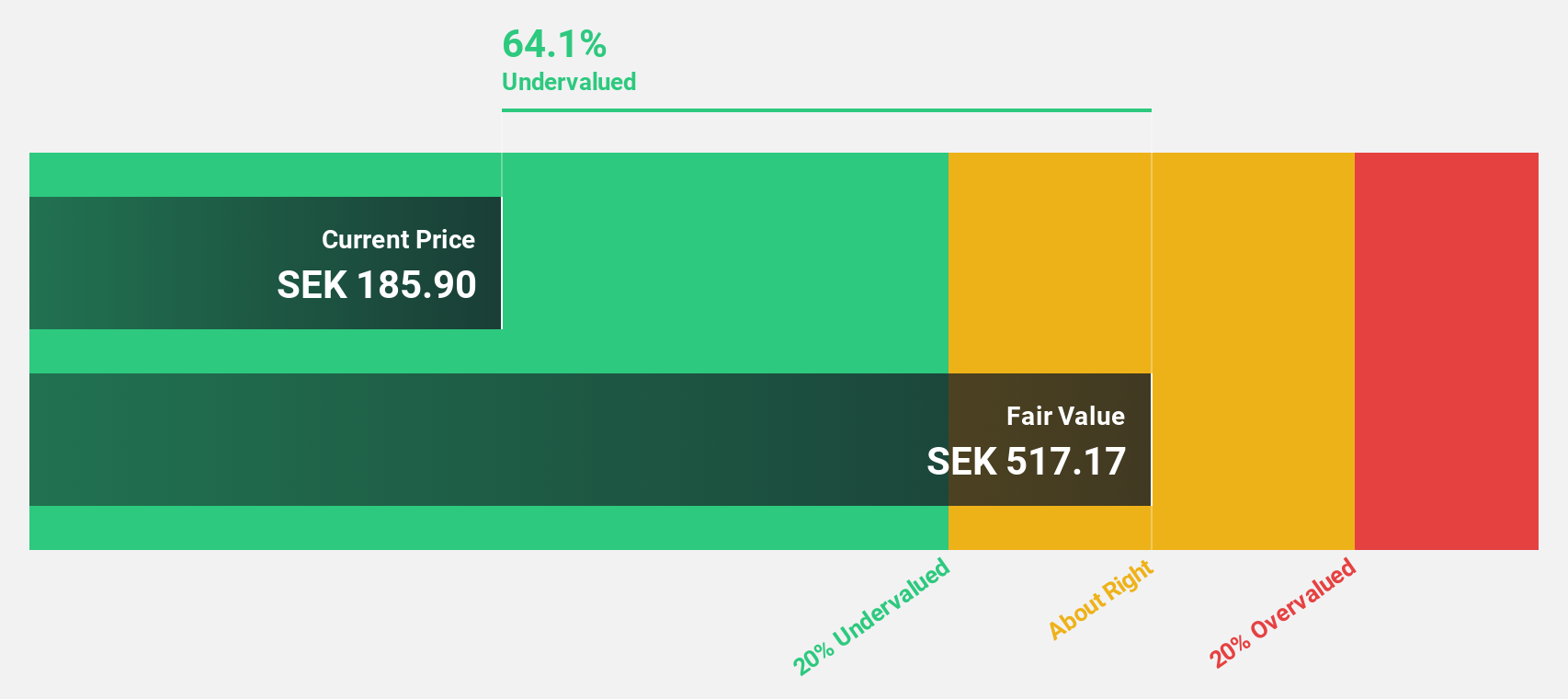

Estimated Discount To Fair Value: 29.2%

BioArctic AB is trading at a significant discount, approximately 29.2% below its estimated fair value of SEK252.65, based on discounted cash flow analysis. Despite recent financial setbacks with a net loss of SEK 145.62 million over nine months, BioArctic's revenue is projected to grow rapidly at 49.2% annually, outpacing the Swedish market and indicating potential for future profitability within three years. Recent positive developments include the EMA's recommendation for lecanemab's approval in Europe.

- Our expertly prepared growth report on BioArctic implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of BioArctic with our comprehensive financial health report here.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited develops data centers and other technology campuses, with a market cap of CN¥60.22 billion.

Operations: The company's revenue primarily comes from IDC Services, amounting to CN¥8.08 billion.

Estimated Discount To Fair Value: 37.6%

Range Intelligent Computing Technology Group is trading significantly below its fair value, estimated at CNY 56.06, with a current price of CNY 35. Despite high share price volatility and a dividend not well covered by free cash flows, the company's earnings are forecast to grow significantly at 30.6% annually, outpacing the Chinese market's growth rate. Recent results show robust sales and net income growth over nine months, indicating strong operational performance amidst undervaluation concerns.

- In light of our recent growth report, it seems possible that Range Intelligent Computing Technology Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Range Intelligent Computing Technology Group's balance sheet health report.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.69 billion.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated $9.68 billion.

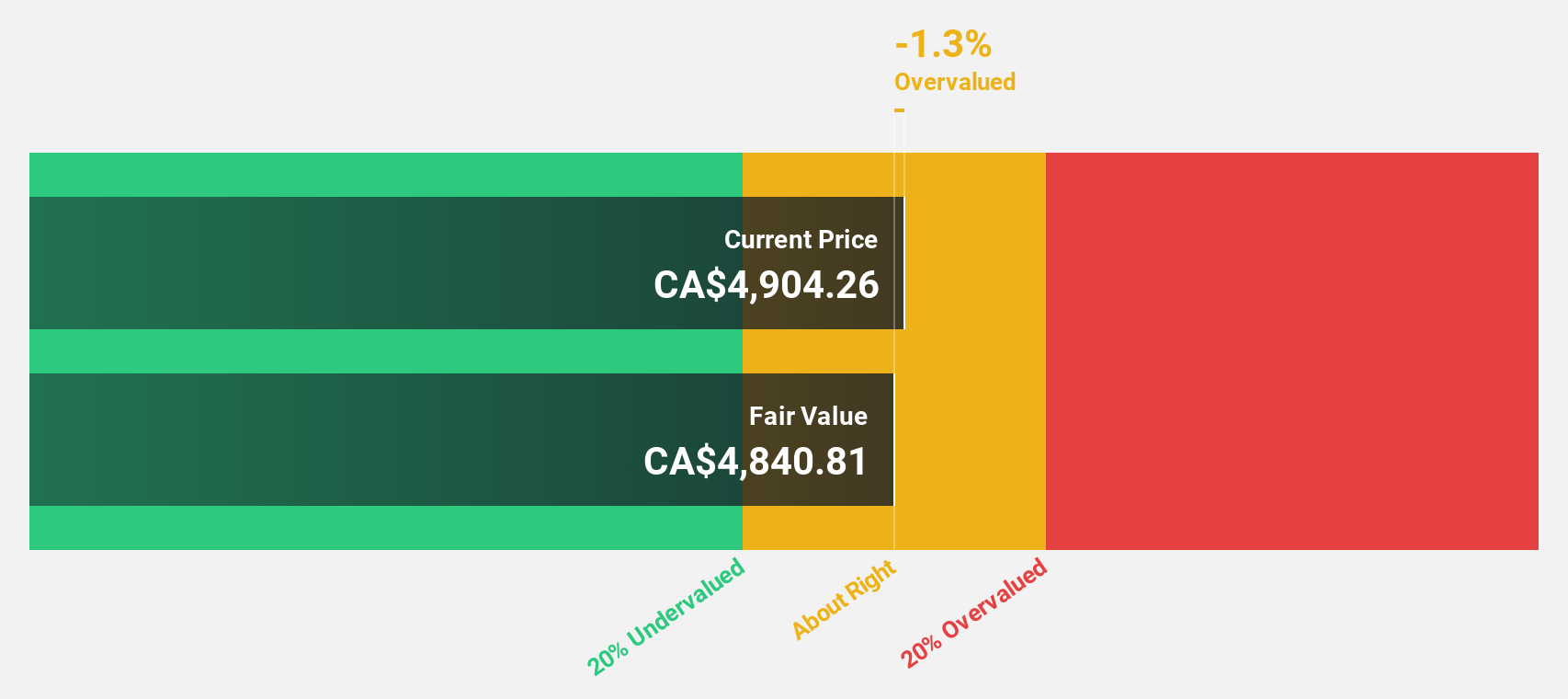

Estimated Discount To Fair Value: 17.9%

Constellation Software is trading at CA$4,420.89, below its estimated fair value of CA$5,384.71. Despite a high debt level and recent quarterly net income decline to US$164 million from US$227 million year-over-year, the company shows robust growth potential with earnings forecasted to rise 26.8% annually over the next three years—surpassing Canadian market averages. Revenue for nine months increased to US$7.36 billion from US$6.08 billion last year, supporting its undervaluation based on cash flows analysis.

- Our comprehensive growth report raises the possibility that Constellation Software is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this financial health report.

Where To Now?

- Click this link to deep-dive into the 935 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOA B

BioArctic

Develops biological drugs for patients with central nervous system disorders in Sweden.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives