Some Confidence Is Lacking In Qtone Education Group (Guangdong) Co.,Ltd (SZSE:300359) As Shares Slide 28%

Qtone Education Group (Guangdong) Co.,Ltd (SZSE:300359) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The recent drop has obliterated the annual return, with the share price now down 7.3% over that longer period.

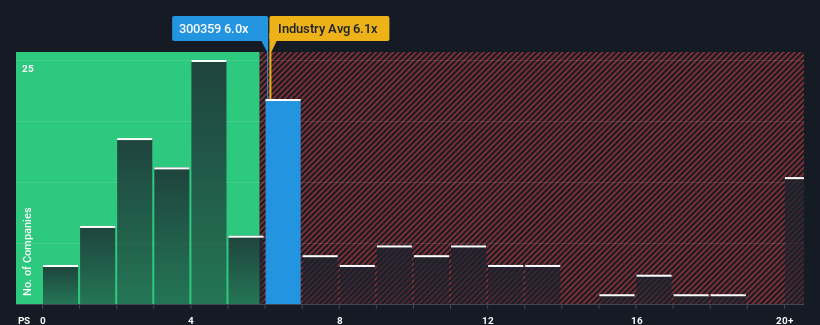

Even after such a large drop in price, there still wouldn't be many who think Qtone Education Group (Guangdong)Ltd's price-to-sales (or "P/S") ratio of 6x is worth a mention when the median P/S in China's Software industry is similar at about 6.1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Qtone Education Group (Guangdong)Ltd

How Qtone Education Group (Guangdong)Ltd Has Been Performing

As an illustration, revenue has deteriorated at Qtone Education Group (Guangdong)Ltd over the last year, which is not ideal at all. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Qtone Education Group (Guangdong)Ltd's earnings, revenue and cash flow.How Is Qtone Education Group (Guangdong)Ltd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Qtone Education Group (Guangdong)Ltd's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. The last three years don't look nice either as the company has shrunk revenue by 32% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 30% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Qtone Education Group (Guangdong)Ltd's P/S sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Qtone Education Group (Guangdong)Ltd's P/S

Qtone Education Group (Guangdong)Ltd's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Qtone Education Group (Guangdong)Ltd revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Qtone Education Group (Guangdong)Ltd with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Qtone Education Group (Guangdong)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Qtone Education Group (Guangdong)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300359

Qtone Education Group (Guangdong)Ltd

Provides online education services in China.

Flawless balance sheet with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026