Top Chinese Growth Stocks With High Insider Ownership September 2024

Reviewed by Simply Wall St

As Chinese equities face a retreat amid weak corporate earnings and economic data, investors are increasingly looking for growth opportunities within the market. One key indicator of potential success is high insider ownership, which often signals confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.9% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Bio-Thera Solutions (SHSE:688177)

Simply Wall St Growth Rating: ★★★★★★

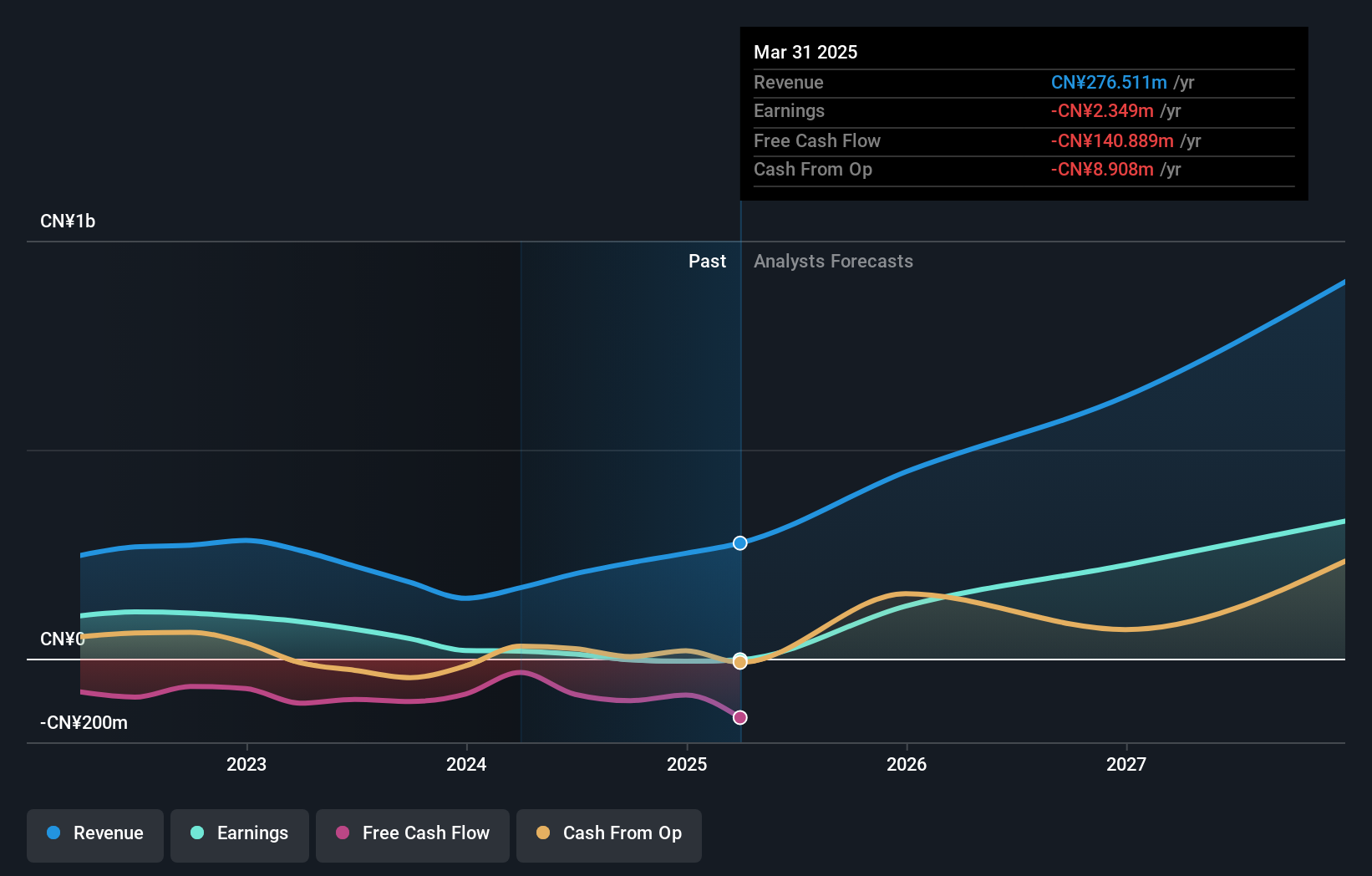

Overview: Bio-Thera Solutions, Ltd. is a biopharmaceutical company that researches and develops novel therapeutics for serious medical conditions such as cancer and autoimmune diseases, with a market cap of CN¥8.33 billion.

Operations: The company generates revenue primarily from its biopharmaceutical segment, amounting to CN¥792.41 million.

Insider Ownership: 18.2%

Revenue Growth Forecast: 26.8% p.a.

Bio-Thera Solutions, a growth company with high insider ownership in China, is forecast to grow earnings by 117.16% annually and revenue by 26.8% per year, outpacing the market. Despite a volatile share price and trading at 71.8% below its fair value estimate, Bio-Thera's recent EMA approval for BAT1706 and ongoing biosimilar developments signal strong potential. The company's net loss decreased to CNY 236.85 million from CNY 253.62 million year-over-year as of June 2024.

- Dive into the specifics of Bio-Thera Solutions here with our thorough growth forecast report.

- According our valuation report, there's an indication that Bio-Thera Solutions' share price might be on the cheaper side.

Yuanjie Semiconductor Technology (SHSE:688498)

Simply Wall St Growth Rating: ★★★★★☆

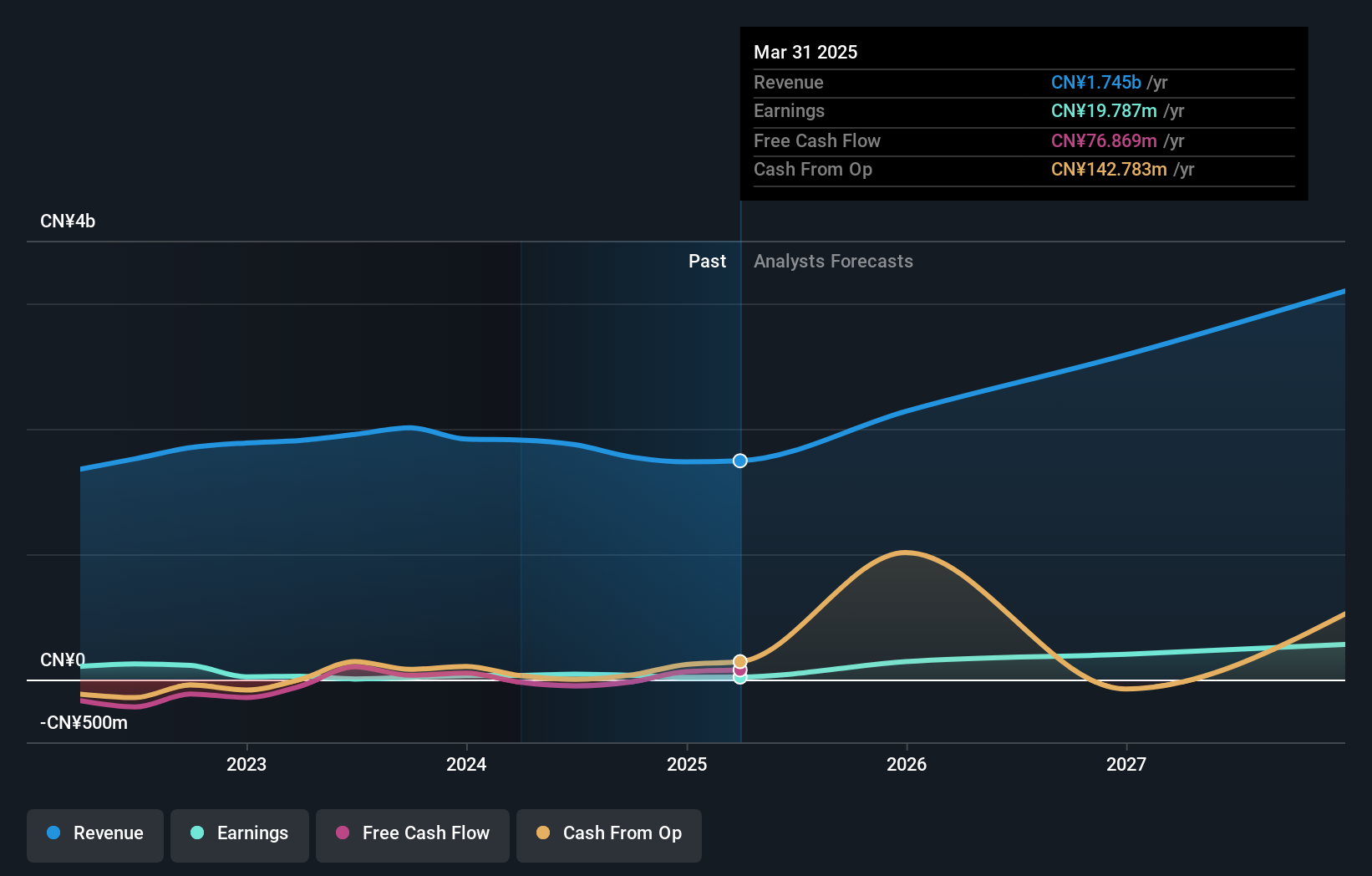

Overview: Yuanjie Semiconductor Technology Co., Ltd. (ticker: SHSE:688498) is a company engaged in the semiconductor industry with a market cap of CN¥7.07 billion.

Operations: Yuanjie Semiconductor Technology Co., Ltd. generates revenue from various segments within the semiconductor industry.

Insider Ownership: 27.7%

Revenue Growth Forecast: 40.3% p.a.

Yuanjie Semiconductor Technology is forecast to grow earnings by 71.78% annually and revenue by 40.3% per year, surpassing market averages. Despite a volatile share price and a decline in net profit margins from 31.9% to 5.3%, the company reported sales of CNY 120.16 million for the first half of 2024, doubling from last year’s CNY 61.32 million, though net income fell to CNY 10.75 million from CNY 19.39 million year-over-year due to large one-off items impacting financial results.

- Navigate through the intricacies of Yuanjie Semiconductor Technology with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Yuanjie Semiconductor Technology is trading beyond its estimated value.

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. provides banking software and technology services to financial institutions globally, with a market cap of CN¥6.25 billion.

Operations: Shenzhen Sunline Tech generates revenue from providing software and technology services to banking and finance customers worldwide.

Insider Ownership: 22.7%

Revenue Growth Forecast: 16.6% p.a.

Shenzhen Sunline Tech reported half-year sales of CNY 704.24 million, down from CNY 749.08 million a year ago, but turned a net profit of CNY 1.84 million compared to a net loss previously. The company completed a private placement raising CNY 417.17 million, with significant institutional participation and incurred issuance expenses of nearly CNY 7.80 million. Despite shareholder dilution and high share price volatility, earnings are forecast to grow significantly at 37% annually, outpacing market averages.

- Take a closer look at Shenzhen Sunline Tech's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shenzhen Sunline Tech's shares may be trading at a premium.

Taking Advantage

- Delve into our full catalog of 381 Fast Growing Chinese Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Thera Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688177

Bio-Thera Solutions

A biopharmaceutical company, researches and develops novel therapeutics for the treatment of cancer, autoimmune, cardiovascular, eye diseases, and other severe unmet medical needs in China and internationally.

Moderate growth potential with mediocre balance sheet.