Jiangsu Hoperun Software Co., Ltd.'s (SZSE:300339) P/S Is Still On The Mark Following 26% Share Price Bounce

Those holding Jiangsu Hoperun Software Co., Ltd. (SZSE:300339) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Notwithstanding the latest gain, the annual share price return of 3.6% isn't as impressive.

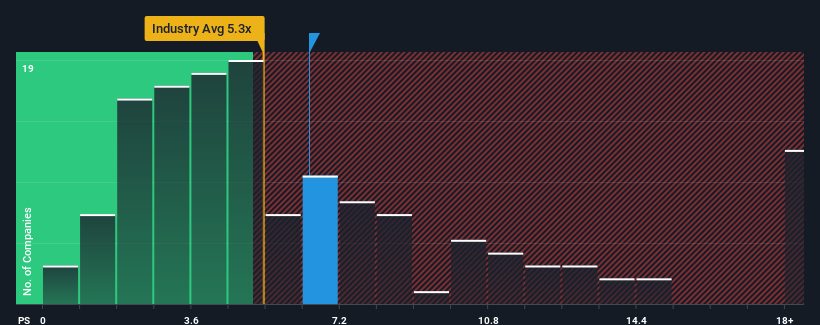

Following the firm bounce in price, you could be forgiven for thinking Jiangsu Hoperun Software is a stock not worth researching with a price-to-sales ratios (or "P/S") of 6.5x, considering almost half the companies in China's Software industry have P/S ratios below 5.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Jiangsu Hoperun Software

How Jiangsu Hoperun Software Has Been Performing

Jiangsu Hoperun Software could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Jiangsu Hoperun Software's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Jiangsu Hoperun Software's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.1%. Even so, admirably revenue has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the dual analysts following the company. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Jiangsu Hoperun Software's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Jiangsu Hoperun Software's P/S

The large bounce in Jiangsu Hoperun Software's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Hoperun Software maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Jiangsu Hoperun Software you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Jiangsu Hoperun Software, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300339

Jiangsu Hoperun Software

Operates as a software company that provides products, solutions, and services based on new generation information technology in China, Japan, Southeast Asia, North America, and internationally.

Excellent balance sheet with reasonable growth potential.