Eastone Century Technology Co.,Ltd. (SZSE:300310) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

Eastone Century Technology Co.,Ltd. (SZSE:300310) shares have had a horrible month, losing 27% after a relatively good period beforehand. Looking at the bigger picture, even after this poor month the stock is up 69% in the last year.

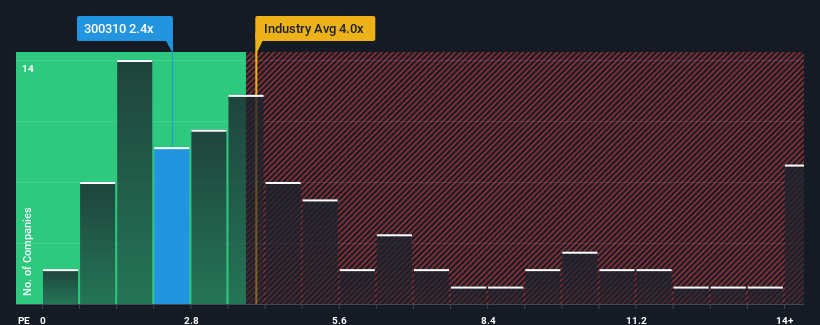

In spite of the heavy fall in price, Eastone Century TechnologyLtd's price-to-sales (or "P/S") ratio of 2.4x might still make it look like a buy right now compared to the IT industry in China, where around half of the companies have P/S ratios above 4x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Eastone Century TechnologyLtd

What Does Eastone Century TechnologyLtd's P/S Mean For Shareholders?

For instance, Eastone Century TechnologyLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Eastone Century TechnologyLtd will help you shine a light on its historical performance.How Is Eastone Century TechnologyLtd's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Eastone Century TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 1.9% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Eastone Century TechnologyLtd's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Eastone Century TechnologyLtd's recently weak share price has pulled its P/S back below other IT companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

In line with expectations, Eastone Century TechnologyLtd maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Eastone Century TechnologyLtd, and understanding should be part of your investment process.

If you're unsure about the strength of Eastone Century TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eastone Century TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300310

Eastone Century TechnologyLtd

Provides communication network technology services and system solutions to telecom operators and equipment manufacturers in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives