As global markets navigate a turbulent period marked by AI competition fears and fluctuating corporate earnings, tech stocks have experienced notable volatility, particularly within the Nasdaq Composite. Amidst this backdrop, identifying high-growth tech stocks involves assessing their innovation potential and resilience to market shifts such as those seen with the emergence of new AI technologies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| CD Projekt | 24.52% | 34.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. specializes in the manufacturing and sale of polarized multifunctional active phased array radars in China, with a market capitalization of approximately CN¥10.82 billion.

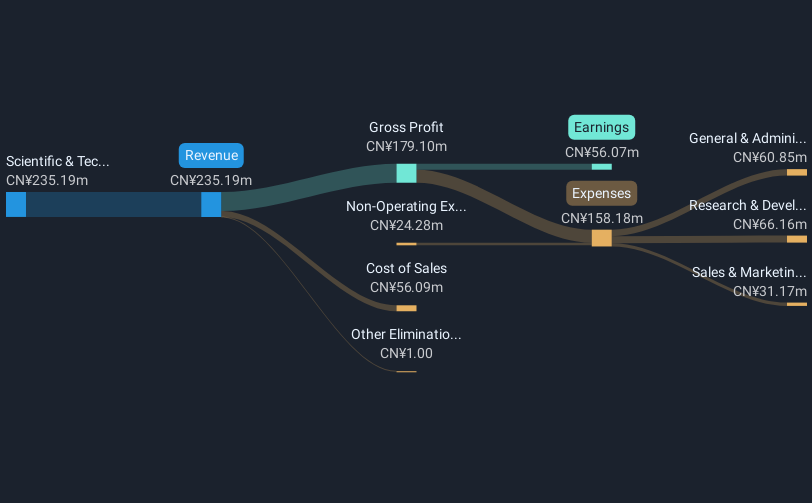

Operations: Naruida Technology generates revenue primarily from the Scientific & Technical Instruments segment, totaling CN¥235.19 million. The company focuses on producing polarized multifunctional active phased array radars for the Chinese market.

Naruida Technology, amidst a dynamic tech landscape, has demonstrated robust growth metrics that eclipse many of its peers. With an annual revenue growth rate of 55.6% and earnings expansion at 67.5%, the firm is outpacing the broader Chinese market averages significantly, which stand at 13.3% and 25.1% respectively. However, despite these impressive figures, Naruida faces challenges such as a recent decline in profit margins from 39.5% to 23.8%. The company's strategic movements include a private placement aimed at enhancing capital structure and supporting further expansion, indicating proactive management actions to sustain its rapid growth trajectory in a highly competitive sector.

- Dive into the specifics of Naruida Technology here with our thorough health report.

Explore historical data to track Naruida Technology's performance over time in our Past section.

Shanghai Newtouch Software (SHSE:688590)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Newtouch Software Co., Ltd. is a Chinese software and information technology services company with a market capitalization of CN¥4.81 billion.

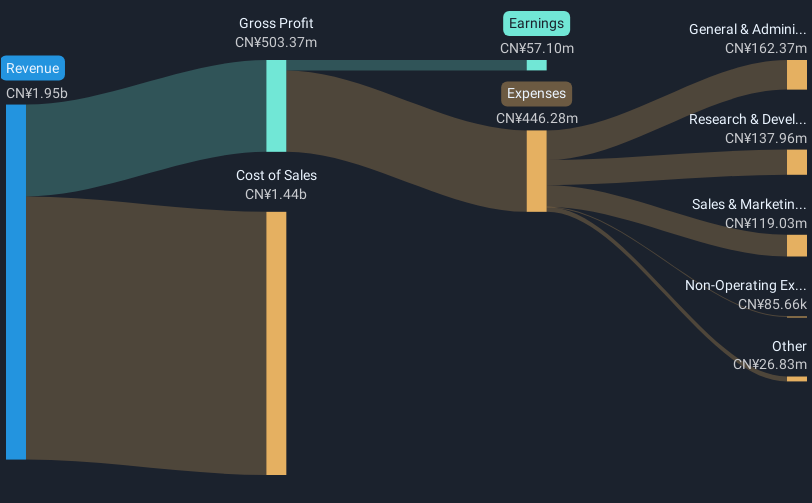

Operations: Newtouch Software focuses on providing software and IT services within China, with a market capitalization of CN¥4.81 billion. The company generates revenue through its diverse offerings in the technology sector, though specific revenue segment details are not provided.

Shanghai Newtouch Software Co., Ltd. stands out in the tech sector with its impressive annual revenue and earnings growth rates of 24.8% and 58.1%, respectively, significantly outpacing the broader Chinese market averages of 13.3% and 25.1%. Despite a highly volatile share price in recent months, the company's strategic focus on innovation is evidenced by substantial R&D investments, which have positioned it for future competitiveness in emerging technologies. Moreover, its recent completion of a significant share repurchase program underscores management's confidence in the firm’s trajectory and commitment to enhancing shareholder value.

Beijing eGOVA Co (SZSE:300075)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing eGOVA Co., Ltd specializes in the development and sale of professional smart city application software in China, with a market capitalization of CN¥9.15 billion.

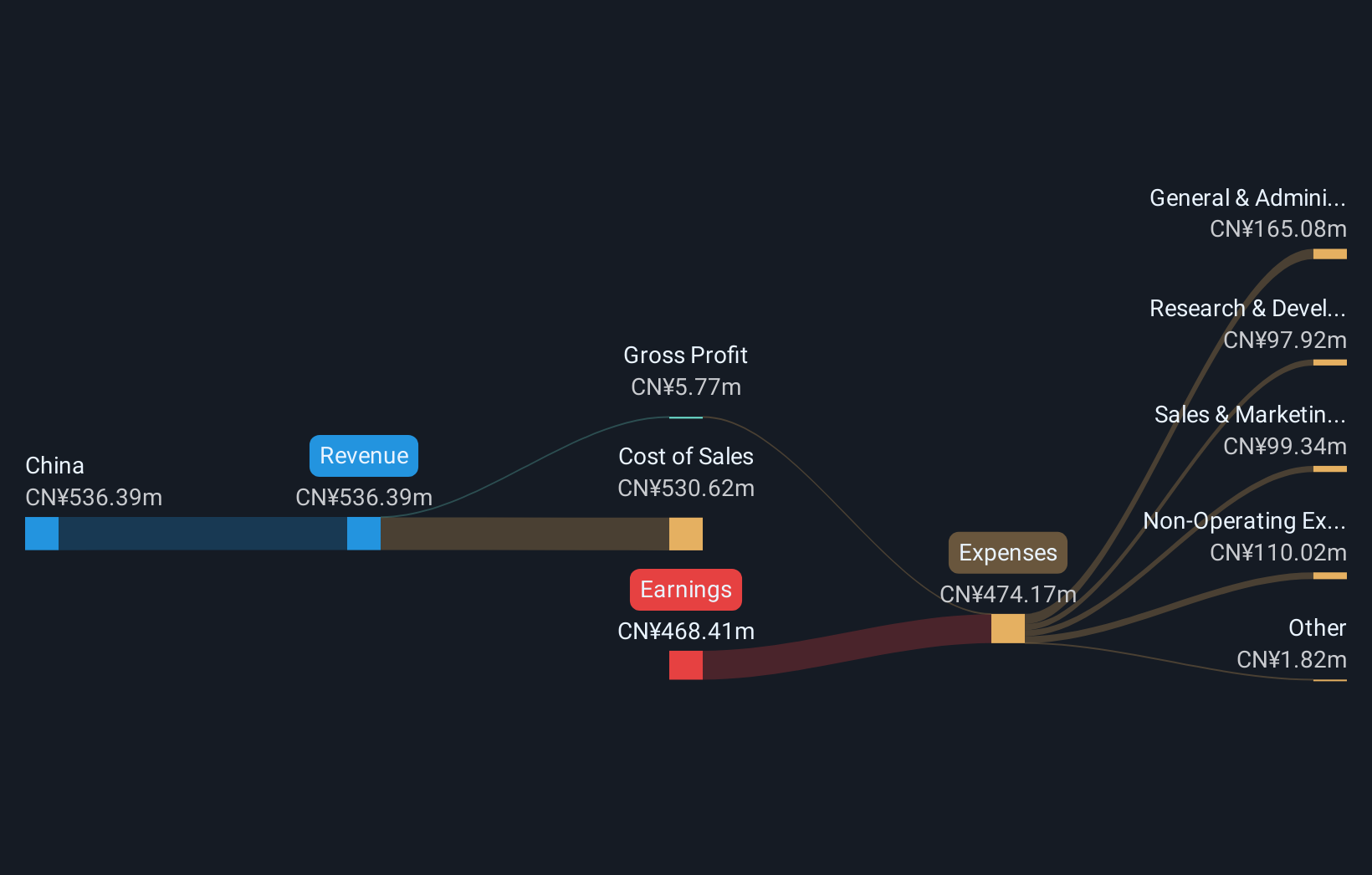

Operations: The company focuses on creating smart city application software, generating revenue primarily through software sales in China. The business model emphasizes leveraging technology to enhance urban management and services.

Beijing eGOVA Co. has demonstrated robust growth with a projected annual revenue increase of 31%, significantly outstripping the broader Chinese market's average of 13.3%. This growth is complemented by an anticipated earnings surge of 60.06% per year, positioning the company well above its industry peers. The firm's commitment to innovation is evident from its R&D spending, which aligns with its strategic goals and supports sustained competitiveness in evolving tech landscapes. Additionally, a recent shareholders meeting highlighted strategic financial decisions aimed at bolstering operational capabilities and governance structures, suggesting a proactive approach to scaling operations and enhancing investor confidence in its future prospects.

- Click here and access our complete health analysis report to understand the dynamics of Beijing eGOVA Co.

Examine Beijing eGOVA Co's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1225 more companies for you to explore.Click here to unveil our expertly curated list of 1228 High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing eGOVA Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300075

Beijing eGOVA Co

Develops and sells of professional smart city application software in China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.