Asian Growth Companies With High Insider Ownership September 2025

Reviewed by Simply Wall St

As of September 2025, Asian markets have been navigating a complex landscape marked by global economic shifts and local developments, with Chinese stock markets showing gains amid high domestic liquidity and Japan's indices rising despite tempered interest rate expectations. In this environment, companies with strong insider ownership can often provide a sense of stability and alignment between management and shareholder interests, making them attractive options for investors seeking growth opportunities in the region.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here's a peek at a few of the choices from the screener.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Growth Rating: ★★★★☆☆

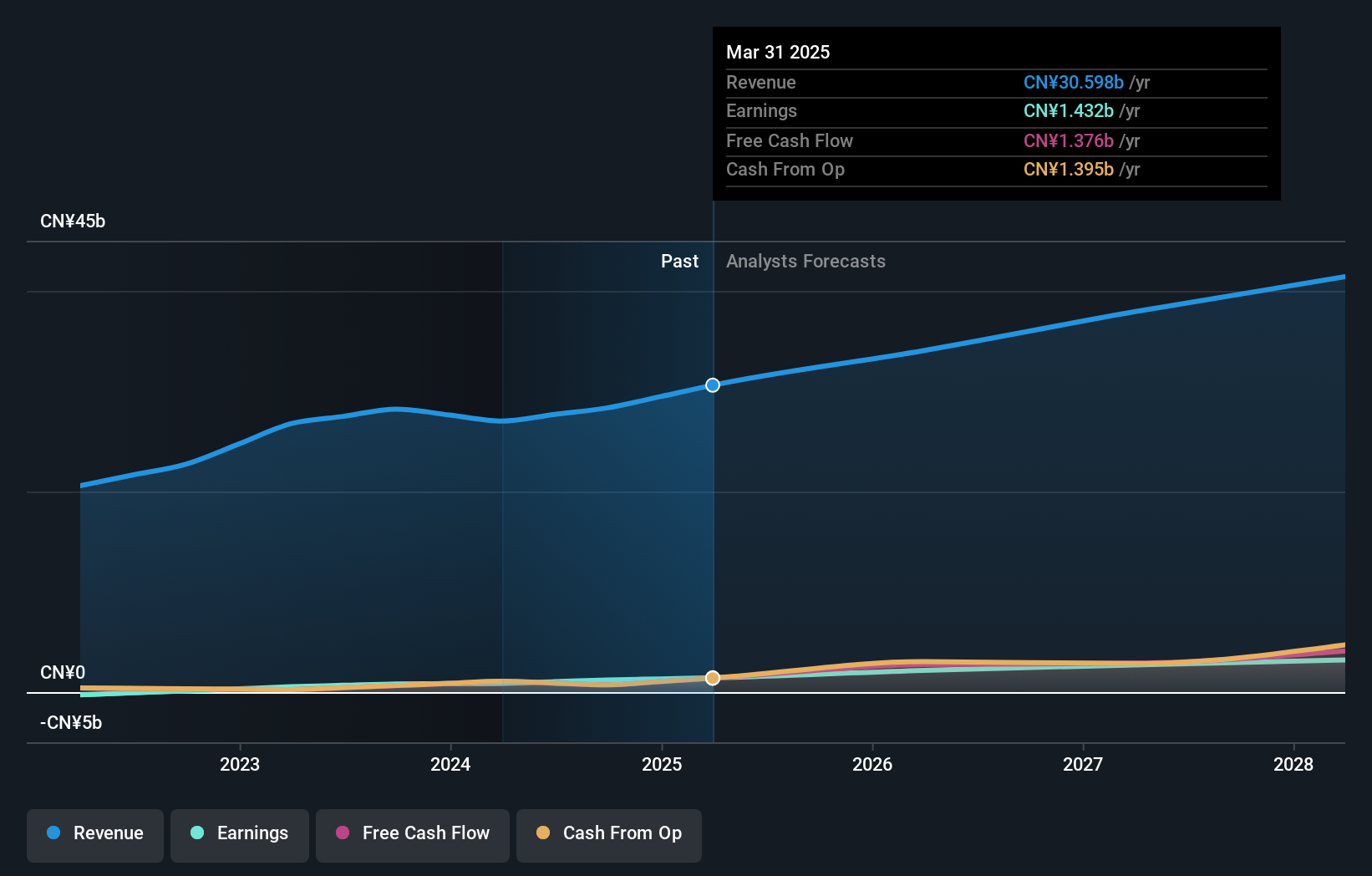

Overview: Alibaba Health Information Technology Limited operates in Mainland China and Hong Kong, focusing on pharmaceutical direct sales, a pharmaceutical e-commerce platform, and healthcare and digital services, with a market cap of HK$107.32 billion.

Operations: The company generates revenue of CN¥30.60 billion from its distribution and development of pharmaceutical and healthcare operations.

Insider Ownership: 19.3%

Earnings Growth Forecast: 20.3% p.a.

Alibaba Health Information Technology trades at a significant discount to its estimated fair value and is expected to see substantial earnings growth of over 20% annually. Despite slower revenue growth projections at 9.9% per year, it surpasses the Hong Kong market average. The company has experienced strong past earnings performance, growing by 62.1% last year, but faces challenges with low forecasted return on equity and large one-off items affecting earnings quality.

- Take a closer look at Alibaba Health Information Technology's potential here in our earnings growth report.

- The analysis detailed in our Alibaba Health Information Technology valuation report hints at an inflated share price compared to its estimated value.

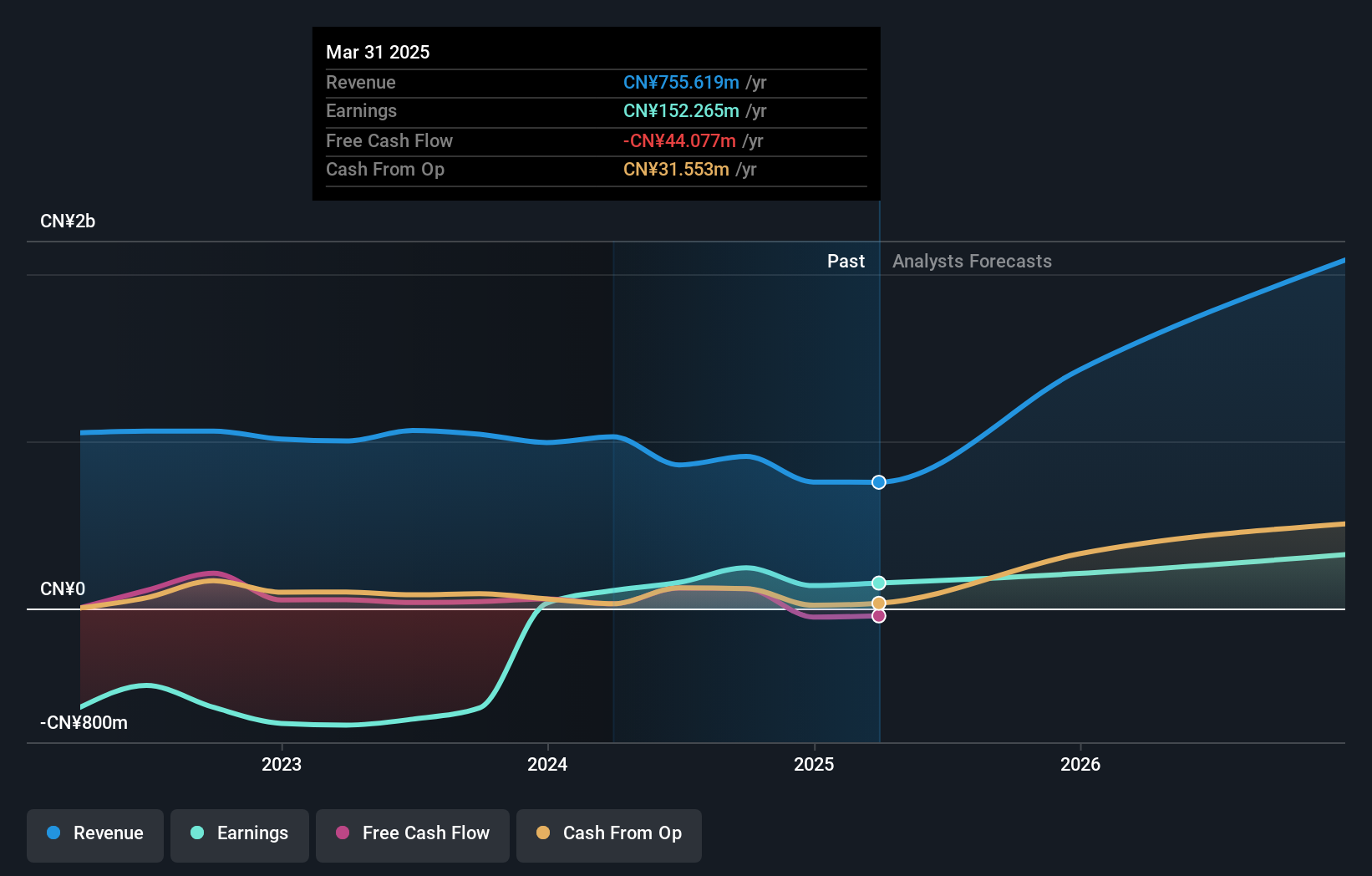

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. specializes in the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥39.97 billion.

Operations: Raytron Technology Co., Ltd. generates revenue primarily through its uncooled infrared imaging and MEMS sensor technology operations in China.

Insider Ownership: 25.7%

Earnings Growth Forecast: 26.9% p.a.

Raytron Technology Ltd. demonstrates robust growth potential with forecasted annual earnings growth of 26.9%, outpacing the broader Chinese market. Recent product innovations, such as their advanced automotive infrared night vision systems, highlight their commitment to technological advancement and market expansion. Despite a lower return on equity forecast of 15.3%, Raytron's revenue is expected to grow at 16.1% annually, surpassing the national average, supported by strong past earnings growth and strategic partnerships in emerging sectors like autonomous driving and security solutions.

- Click here and access our complete growth analysis report to understand the dynamics of Raytron TechnologyLtd.

- Our valuation report here indicates Raytron TechnologyLtd may be overvalued.

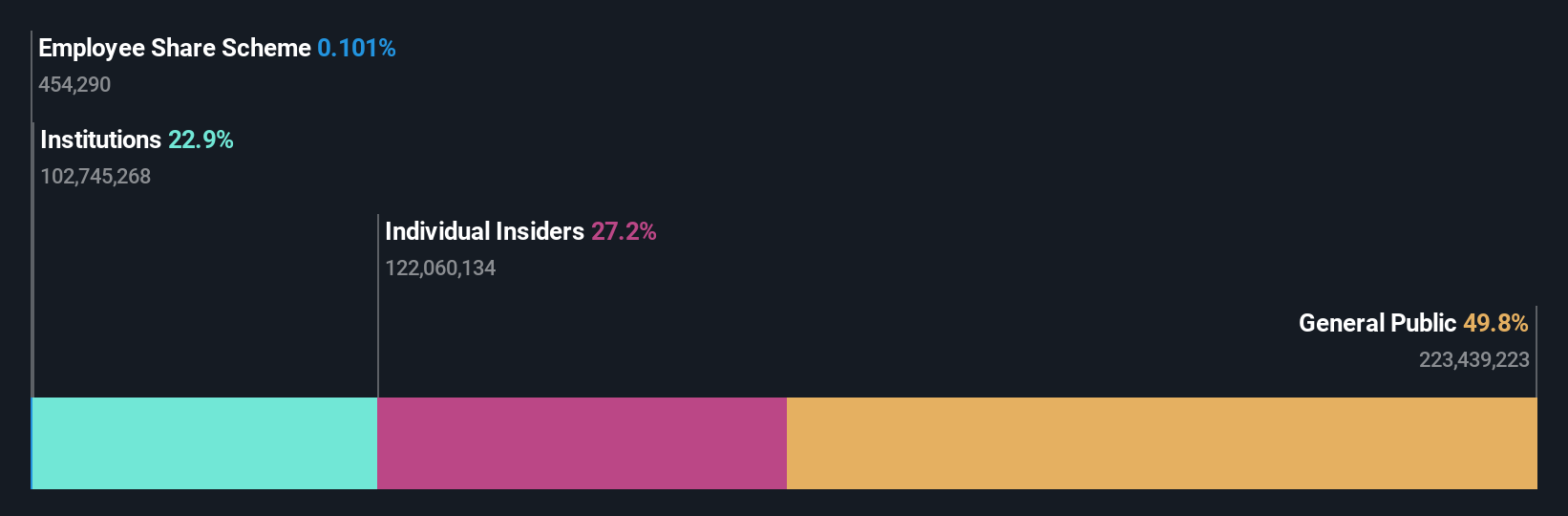

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Doushen (Beijing) Education & Technology focuses on providing educational technology solutions and has a market cap of CN¥17.11 billion.

Operations: The company's revenue segment includes Information Technology Service, generating CN¥876.06 million.

Insider Ownership: 24.1%

Earnings Growth Forecast: 43% p.a.

Doushen (Beijing) Education & Technology shows strong growth prospects with forecasted annual earnings and revenue increases of 43% and 42.8%, respectively, outpacing the Chinese market averages. Recent earnings for the half year ended June 30, 2025, indicate significant sales growth to CNY 445.72 million from CNY 326.39 million a year ago, alongside improved net income. Despite high non-cash earnings impacting quality metrics, insider ownership remains a key factor in its strategic direction.

- Unlock comprehensive insights into our analysis of Doushen (Beijing) Education & Technology stock in this growth report.

- The valuation report we've compiled suggests that Doushen (Beijing) Education & Technology's current price could be inflated.

Make It Happen

- Click here to access our complete index of 616 Fast Growing Asian Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives