- China

- /

- Electronic Equipment and Components

- /

- SZSE:301391

High Growth Tech Stocks To Watch In October 2024

Reviewed by Simply Wall St

As rising U.S. Treasury yields have put pressure on global markets, the tech-heavy Nasdaq Composite Index has shown resilience by slightly gaining amid a broader decline in equities. In this environment, identifying high-growth tech stocks requires a focus on companies that can thrive despite economic headwinds and demonstrate strong potential for innovation and market leadership.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hengdian EntertainmentLTD (SHSE:603103)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hengdian Entertainment Co., LTD operates theaters in China and has a market cap of CN¥7.95 billion.

Operations: The company generates revenue primarily through its theater operations in China. It focuses on providing entertainment services, with income driven by ticket sales and related activities.

Hengdian EntertainmentLTD, navigating through a transformative phase in the entertainment industry, showcases a robust revenue growth forecast at 26.3% annually, outpacing the CN market's average of 13.9%. Despite recent setbacks reflected in a net income drop to CNY 17.39 million from last year's CNY 235.87 million, the company is poised for a rebound with earnings expected to surge by an impressive 113.6% per year. This potential turnaround is underpinned by substantial R&D investments aimed at innovating within its digital and live entertainment segments, ensuring it remains competitive in a rapidly evolving market landscape.

Jilin University Zhengyuan Information Technologies (SZSE:003029)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jilin University Zhengyuan Information Technologies Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥4.55 billion.

Operations: The company focuses on providing information technology solutions, with primary revenue streams derived from software development and IT services. Its operations are supported by a market capitalization of CN¥4.55 billion.

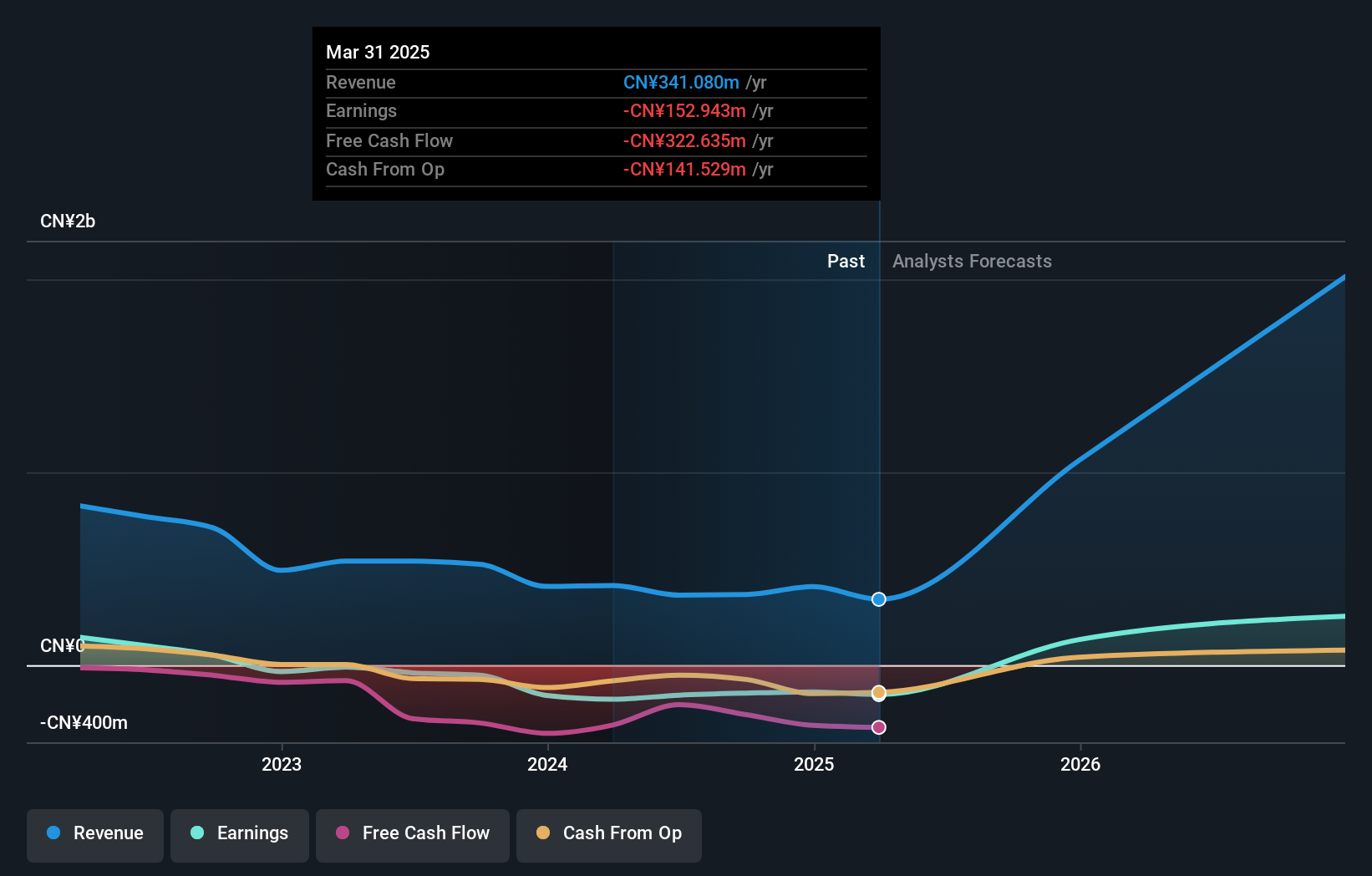

Jilin University Zhengyuan Information Technologies, despite a challenging fiscal year with a revenue decrease to CNY 281.35 million from CNY 323.48 million, signals potential recovery with strategic R&D investments. Notably, the company's commitment to innovation is evident as it channels significant resources into research; however, recent figures reflect a net loss reduction to CNY 71.29 million from CNY 83.21 million previously. Looking ahead, earnings are expected to surge by an impressive 98.6% annually, underpinned by a forecasted revenue growth of 49% per year—well above the CN market average of 13.9%. This aggressive growth trajectory could position them favorably if they continue enhancing their technological offerings and optimizing operations.

Colorlight Cloud Tech (SZSE:301391)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colorlight Cloud Tech Ltd is involved in the research, development, manufacture, and sale of LED display control systems and related equipment globally, with a market cap of CN¥3.94 billion.

Operations: Colorlight Cloud Tech Ltd generates revenue primarily from the sale of LED display control system equipment, amounting to CN¥878.11 million. The company focuses on developing and manufacturing video processing equipment, play servers, and cloud network players for a global market.

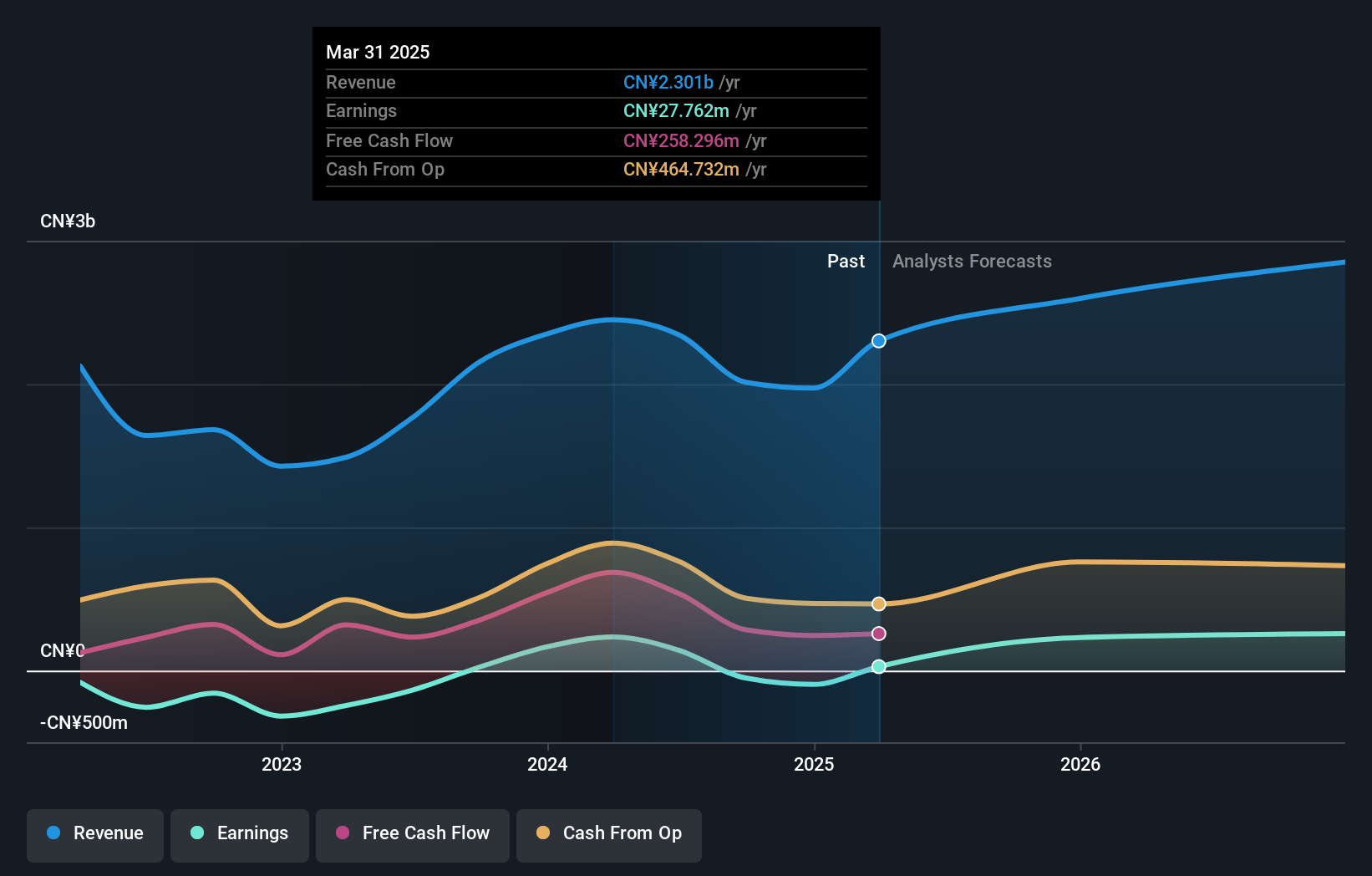

Colorlight Cloud Tech, amidst a challenging market, has demonstrated resilience with an anticipated revenue growth rate of 45.4% per year, outpacing the CN market's 13.9%. This growth is underpinned by strategic R&D investments which accounted for a significant portion of expenses, aligning with the company's focus on innovation to drive future earnings, forecasted to surge by 53.9% annually. Despite recent dips in net income and sales figures reported for the nine months ending September 2024, these investments in technology could catalyze recovery and position the company advantageously in its sector.

- Unlock comprehensive insights into our analysis of Colorlight Cloud Tech stock in this health report.

Assess Colorlight Cloud Tech's past performance with our detailed historical performance reports.

Where To Now?

- Access the full spectrum of 1279 High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301391

Colorlight Cloud Tech

Engages in the research and development, manufacture, and sale of LED display control systems, video processing equipment, play servers, and cloud network players worldwide.

High growth potential and good value.