While shareholders of Sinodata (SZSE:002657) are in the black over 3 years, those who bought a week ago aren't so fortunate

Sinodata Co., Ltd. (SZSE:002657) shareholders have seen the share price descend 13% over the month. But that doesn't change the fact that the returns over the last three years have been pleasing. In the last three years the share price is up, 78%: better than the market.

In light of the stock dropping 6.9% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Sinodata

Sinodata wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

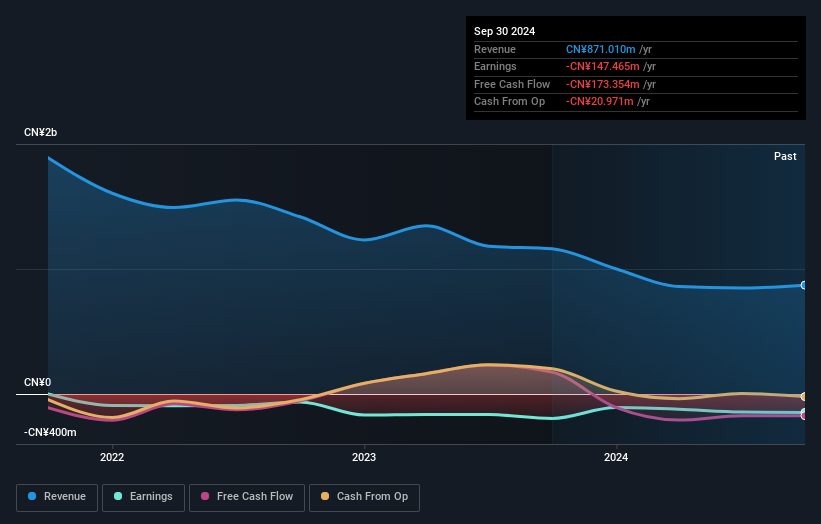

Sinodata actually saw its revenue drop by 25% per year over three years. Despite the lack of revenue growth, the stock has returned 21%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Sinodata stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Sinodata shareholders have received returns of 14% over twelve months, which isn't far from the general market return. Most would be happy with a gain, and it helps that the year's return is actually better than the average return over five years, which was 4%. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Sinodata is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002657

Sinodata

Engages in the application software development, and provision of technical services and related computer information system integration services in China and internationally.

Flawless balance sheet and overvalued.