As global markets navigate a holiday-shortened week, U.S. stocks have shown moderate gains, with large-cap growth stocks leading the charge before giving back some of their advances later in the week. Amidst declining consumer confidence and mixed economic indicators, investors are keeping a close eye on high-growth tech stocks that demonstrate resilience and innovation potential in such fluctuating conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

DuoLun Technology (SHSE:603528)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DuoLun Technology Corporation Ltd. specializes in developing intelligent training, testing, and application systems for motor vehicle drivers in China with a market cap of CN¥5.86 billion.

Operations: The company generates revenue primarily through its electronic security devices segment, which contributes CN¥527.80 million.

DuoLun Technology, amidst a challenging market, is navigating its path to profitability with an expected earnings growth of 89.2% annually. Recently achieving CNY 42 million in net income from CNY 5.88 million the previous year shows a robust turnaround, particularly impressive given the broader electronic industry's modest growth of 1.9%. This performance is underpinned by strategic moves like the recent acquisition by Zhang Aoxing of a 5% stake for approximately CNY 270 million, signaling confidence in DuoLun's future prospects and stability. With revenue growth forecasted at an annual rate of 18.3%, surpassing China's average market growth of 13.7%, DuoLun is setting itself apart by effectively capitalizing on emerging tech trends and solidifying its market position through significant R&D investments and strategic partnerships.

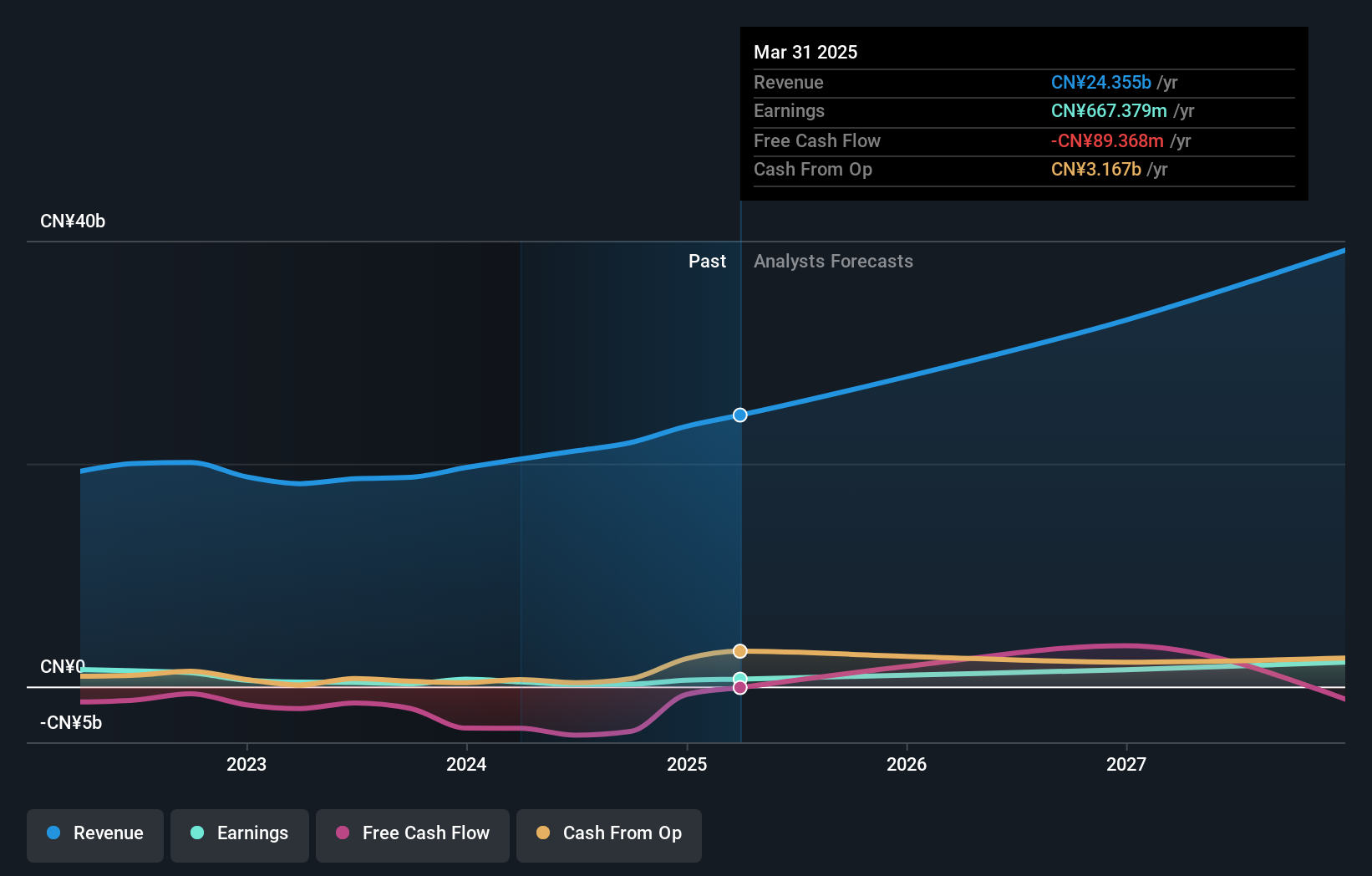

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: iFLYTEK CO., LTD. specializes in providing artificial intelligence (AI) technology services in China and has a market capitalization of CN¥114.57 billion.

Operations: iFLYTEK focuses on AI technology services within China, with its business model primarily generating revenue through various AI-driven products and solutions. The company leverages its expertise in speech recognition and natural language processing to cater to sectors such as education, healthcare, and smart cities.

iFLYTEK, amid a challenging fiscal year, reported a significant revenue increase to CNY 14.85 billion, up from CNY 12.61 billion, marking an annual growth rate of 15.5%. However, the company faced a net loss of CNY 343.7 million compared to the previous year’s net profit of CNY 99.36 million, reflecting volatile earnings amidst aggressive expansion efforts. This performance underscores iFLYTEK's commitment to growth through innovation and market adaptation but also highlights the financial strains associated with high R&D expenditures which have been pivotal in driving its technological advancements forward.

- Unlock comprehensive insights into our analysis of iFLYTEKLTD stock in this health report.

Assess iFLYTEKLTD's past performance with our detailed historical performance reports.

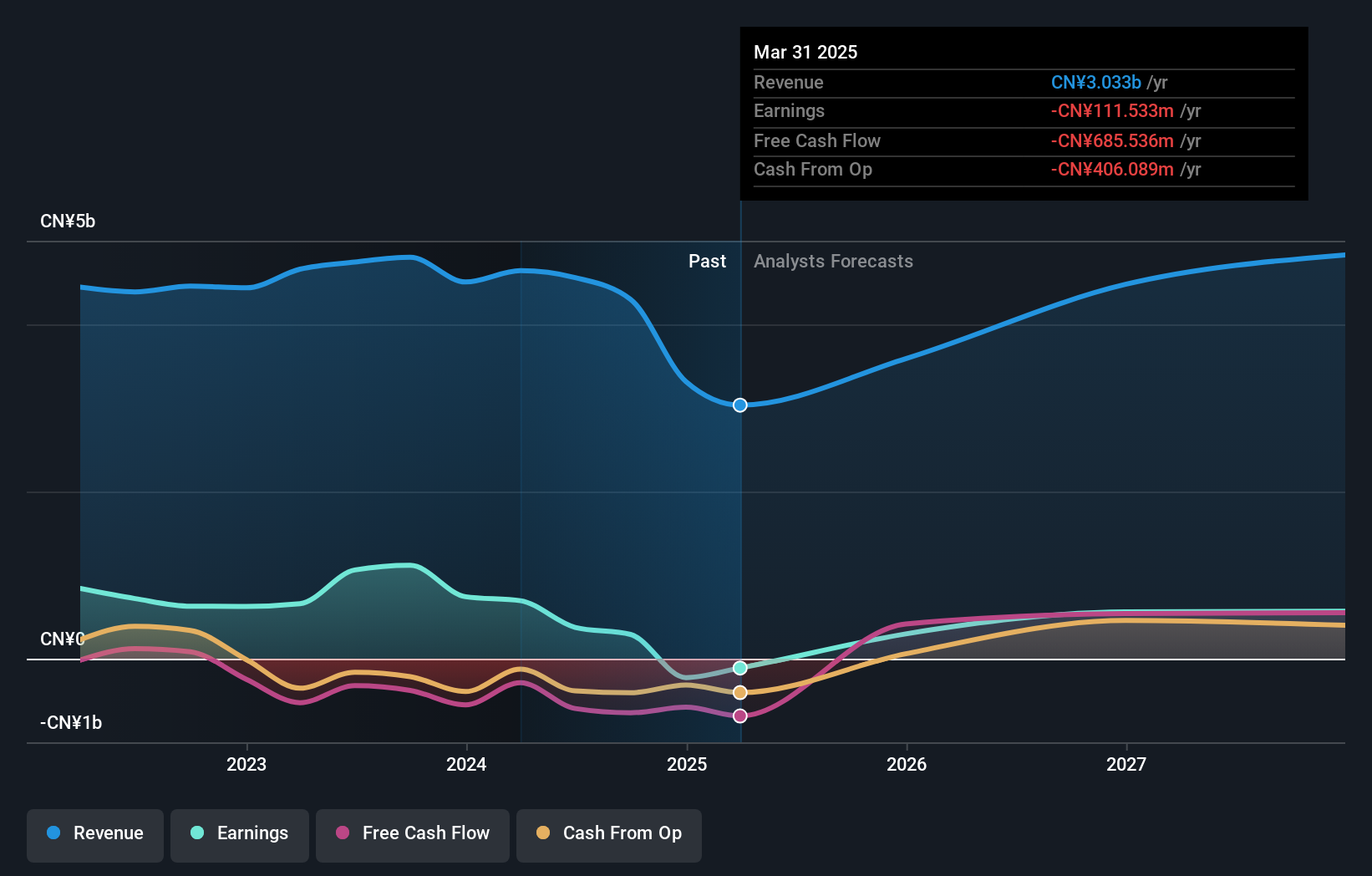

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services and solutions globally, with a market cap of CN¥20.04 billion.

Operations: The company's primary revenue streams include network security products and specialized security services. It operates on a global scale, providing trusted security management platforms.

Venustech Group's recent financial performance reveals a challenging landscape, with a reported net loss of CNY 210.07 million for the nine months ending September 2024, starkly contrasting last year’s net income of CNY 241.39 million. Despite these hurdles, the company is poised for recovery with projected earnings growth at an impressive rate of 33.6% annually. This optimism is tempered by its current revenue trajectory which has dipped to CNY 2,326.05 million from CNY 2,533.57 million year-over-year but still outpaces the broader Chinese market's growth rate (16.4% vs 13.7%). Venustech's commitment to innovation remains evident in its R&D strategy; however, specifics on expenditure were not disclosed in the latest reports. The firm’s ability to navigate through recent setbacks while laying groundwork for substantial earnings acceleration highlights its resilience and adaptability within the tech sector. Moving forward, Venustech must bolster its operational efficiencies and continue driving technological advancements to regain momentum and enhance shareholder value amidst competitive pressures and fluctuating market demands.

Taking Advantage

- Click this link to deep-dive into the 1269 companies within our High Growth Tech and AI Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002439

Venustech Group

Provides network security products, trusted security management platforms, and specialized security services and solutions worldwide.

Flawless balance sheet and good value.

Market Insights

Community Narratives