NavInfo Co., Ltd.'s (SZSE:002405) 28% Price Boost Is Out Of Tune With Revenues

NavInfo Co., Ltd. (SZSE:002405) shares have continued their recent momentum with a 28% gain in the last month alone. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 7.4% over the last year.

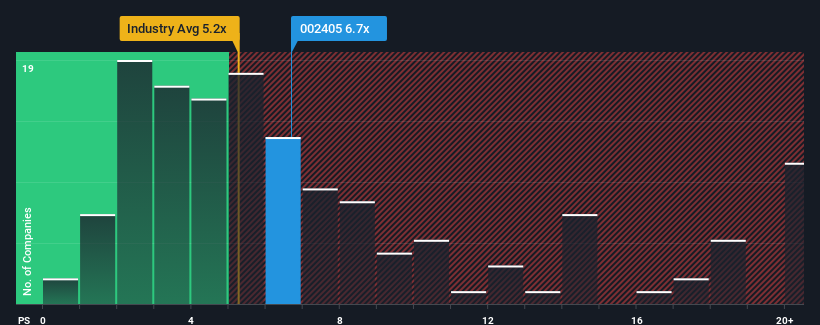

Following the firm bounce in price, you could be forgiven for thinking NavInfo is a stock not worth researching with a price-to-sales ratios (or "P/S") of 6.7x, considering almost half the companies in China's Software industry have P/S ratios below 5.2x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for NavInfo

What Does NavInfo's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, NavInfo's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on NavInfo.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as NavInfo's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's top line. Even so, admirably revenue has lifted 38% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 13% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 26%, which is noticeably more attractive.

In light of this, it's alarming that NavInfo's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

NavInfo's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've concluded that NavInfo currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for NavInfo you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NavInfo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002405

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.