NavInfo Co., Ltd. (SZSE:002405) Analysts Are Reducing Their Forecasts For This Year

One thing we could say about the analysts on NavInfo Co., Ltd. (SZSE:002405) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon. The stock price has risen 7.8% to CN¥7.46 over the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

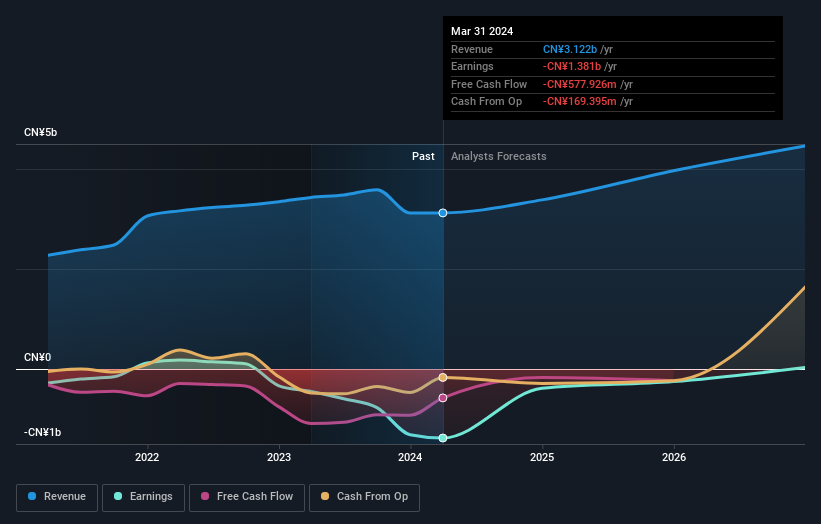

Following the downgrade, the most recent consensus for NavInfo from its nine analysts is for revenues of CN¥3.4b in 2024 which, if met, would be a solid 8.3% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 72% to CN¥0.17 per share. However, before this estimates update, the consensus had been expecting revenues of CN¥4.2b and CN¥0.12 per share in losses. Ergo, there's been a clear change in sentiment, with the analysts administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

View our latest analysis for NavInfo

The consensus price target fell 9.7% to CN¥7.51, implicitly signalling that lower earnings per share are a leading indicator for NavInfo's valuation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the NavInfo's past performance and to peers in the same industry. We can infer from the latest estimates that forecasts expect a continuation of NavInfo'shistorical trends, as the 11% annualised revenue growth to the end of 2024 is roughly in line with the 11% annual revenue growth over the past five years. Compare this with the broader industry (in aggregate), which analyst estimates suggest will see revenues grow 22% annually. So it's pretty clear that NavInfo is expected to grow slower than similar companies in the same industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at NavInfo. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of NavInfo.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for NavInfo going out to 2026, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if NavInfo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002405

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success