- France

- /

- Entertainment

- /

- ENXTPA:UBI

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the start of 2025, U.S. stocks have shown resilience with the S&P 500 and Nasdaq Composite closing out another strong year despite recent mixed performances influenced by economic indicators such as the Chicago PMI and GDP forecasts from the Atlanta Fed. In this environment, identifying high-growth tech stocks requires a keen eye for companies that demonstrate robust innovation potential and adaptability to shifting market dynamics, making them noteworthy contenders in an ever-evolving landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Ubisoft Entertainment (ENXTPA:UBI)

Simply Wall St Growth Rating: ★★★★☆☆

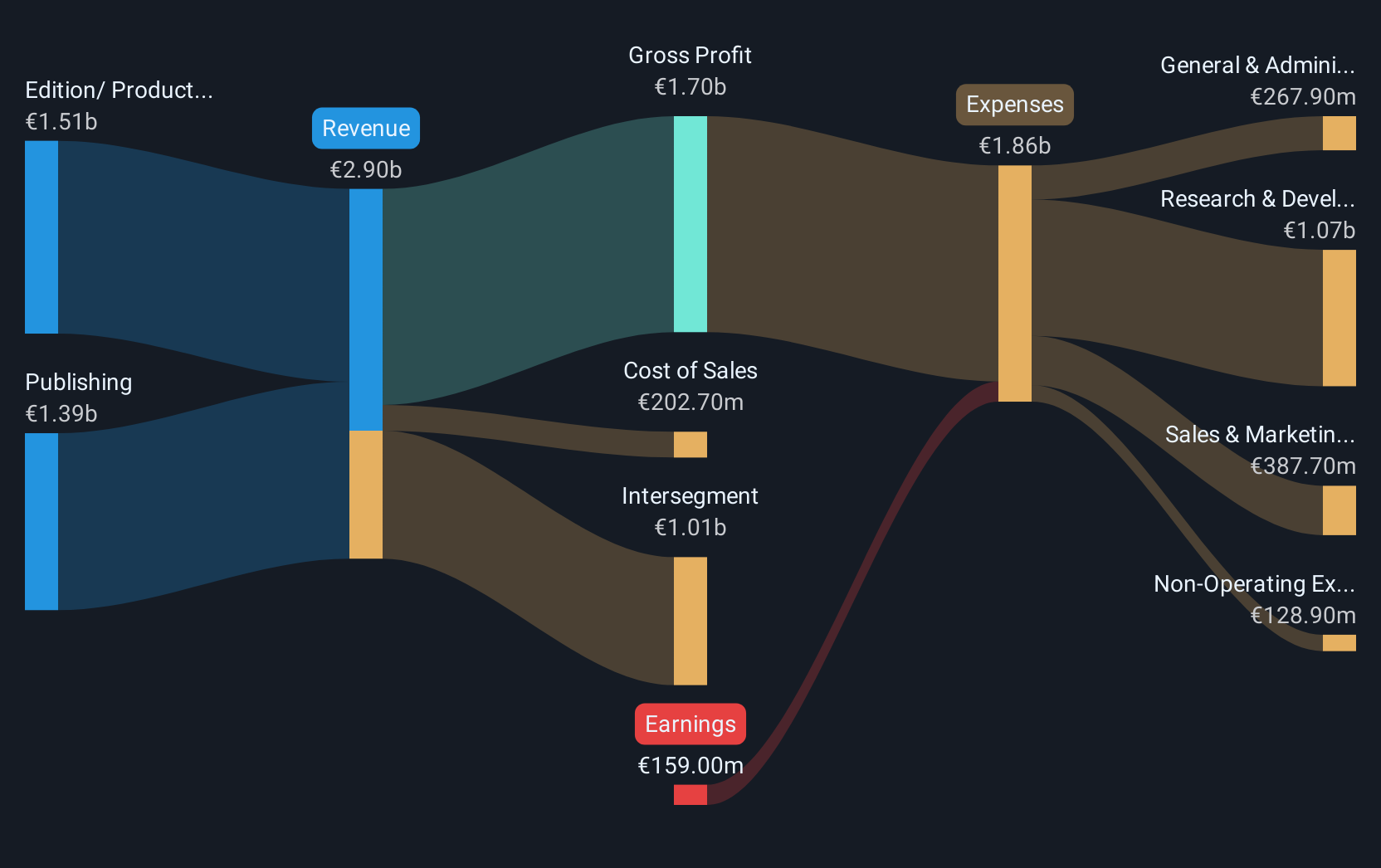

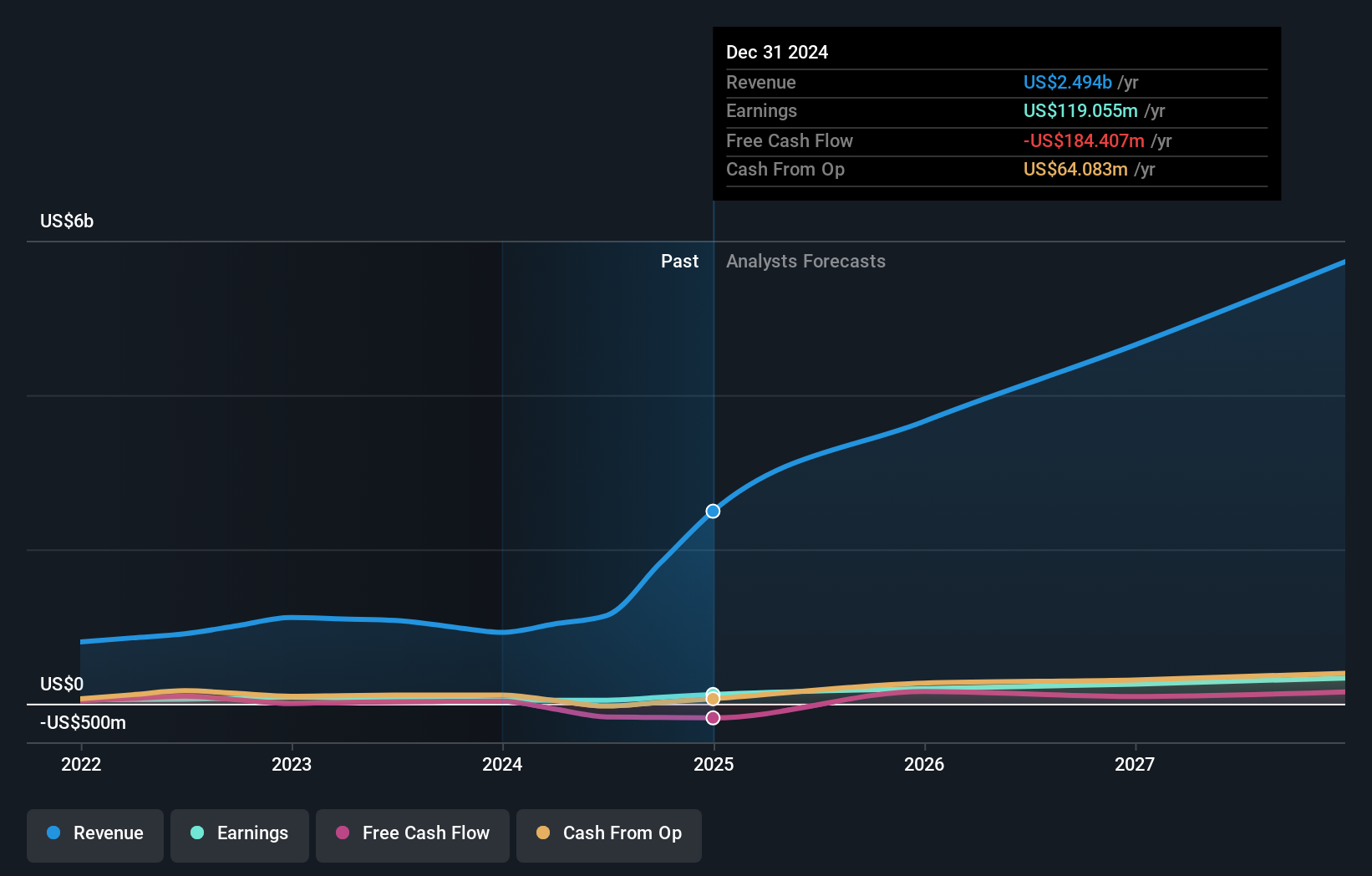

Overview: Ubisoft Entertainment SA is a company that produces, publishes, and distributes video games for consoles, PC, smartphones, and tablets in both physical and digital formats across Europe, North America, and internationally with a market capitalization of approximately €1.61 billion.

Operations: Ubisoft generates revenue primarily through its Publishing and Edition/Production Cloud gaming segments, with Publishing contributing €1.81 billion and Edition/Production Cloud gaming adding €1.66 billion. The company's business model focuses on creating and distributing video games across various platforms globally.

Ubisoft Entertainment, grappling with a challenging H1 in 2025, reported a significant net loss of €246.7 million, starkly contrasting last year's €34.3 million. Despite this downturn, the company's forward-looking stance includes anticipated net bookings of around €1.95 billion for the fiscal year and aims for break-even non-IFRS operating income and free cash flow. This strategy underscores Ubisoft’s resilience and adaptability in navigating market fluctuations while maintaining a focus on growth—evidenced by an expected annual revenue increase of 5.4%. The firm's commitment to innovation is further highlighted by its strategic R&D investments aimed at revitalizing its product offerings and enhancing competitive edge in the dynamic entertainment sector.

Cowell e Holdings (SEHK:1415)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cowell e Holdings Inc. is an investment holding company that focuses on designing, developing, manufacturing, and selling optical modules and systems integration products for smartphones and other mobile devices across various international markets, with a market cap of approximately HK$22.26 billion.

Operations: Cowell e Holdings generates revenue primarily from the sale of photographic equipment and supplies, amounting to $1.14 billion. The company operates in markets including China, India, and South Korea, focusing on optical modules and systems integration for mobile devices.

Cowell e Holdings, amid a robust tech landscape, is poised for significant growth with projected annual revenue and earnings increases of 27.4% and 30.5%, respectively, outpacing the Hong Kong market averages of 7.6% and 11.1%. This performance is underpinned by strategic R&D investments which have notably enhanced its product offerings, positioning it well above industry norms in both innovation and financial health. Despite a dip in net profit margins from 6.6% to 3.9% over the past year, the company's aggressive growth strategy and high return on equity forecast at 27.6% signal strong future prospects in an increasingly competitive sector.

- Delve into the full analysis health report here for a deeper understanding of Cowell e Holdings.

Gain insights into Cowell e Holdings' past trends and performance with our Past report.

Taiji Computer (SZSE:002368)

Simply Wall St Growth Rating: ★★★★☆☆

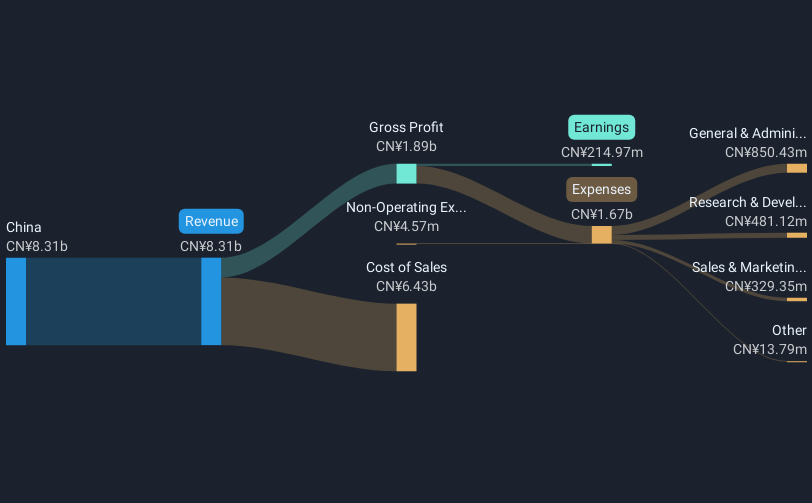

Overview: Taiji Computer Corporation Limited is a software and information technology service company with a market capitalization of CN¥13.06 billion.

Operations: The company focuses on providing software and IT services. It generates revenue primarily from its software development and IT service offerings, with a market capitalization of CN¥13.06 billion.

Taiji Computer, navigating a challenging fiscal period with a 16.9% annual revenue growth, still outperforms the Chinese market average of 13.6%. Despite recent setbacks including a net loss this year compared to profit last year, the company's commitment to innovation is evident in its R&D investments which are crucial for long-term competitiveness in tech. Looking ahead, Taiji's earnings are expected to surge by 37.5% annually, showcasing potential recovery and growth driven by strategic adjustments and market dynamics.

- Dive into the specifics of Taiji Computer here with our thorough health report.

Explore historical data to track Taiji Computer's performance over time in our Past section.

Summing It All Up

- Delve into our full catalog of 1253 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:UBI

Ubisoft Entertainment

Ubisoft Entertainment SA produce, publishes, and distributes video games for consoles, PC, smartphones, and tablets in both physical and digital formats in Europe, North America, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives