- China

- /

- Entertainment

- /

- SZSE:300031

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience amid global economic uncertainties, with technology stocks in particular capturing investor attention due to their potential for significant growth. As we explore three high-growth tech stocks in Asia, it's important to consider companies that demonstrate strong fundamentals and adaptability within the dynamic landscape of technological advancement and market fluctuations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 37.19% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Intsig Information (SHSE:688615)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intsig Information Co., Ltd. focuses on the research and development of text recognition and commercial big data core technologies in China, with a market cap of CN¥28.35 billion.

Operations: Intsig Information Co., Ltd. specializes in developing text recognition and commercial big data technologies, generating revenue primarily from software solutions and related services. The company's business model leverages its expertise to cater to various industries requiring advanced data processing capabilities.

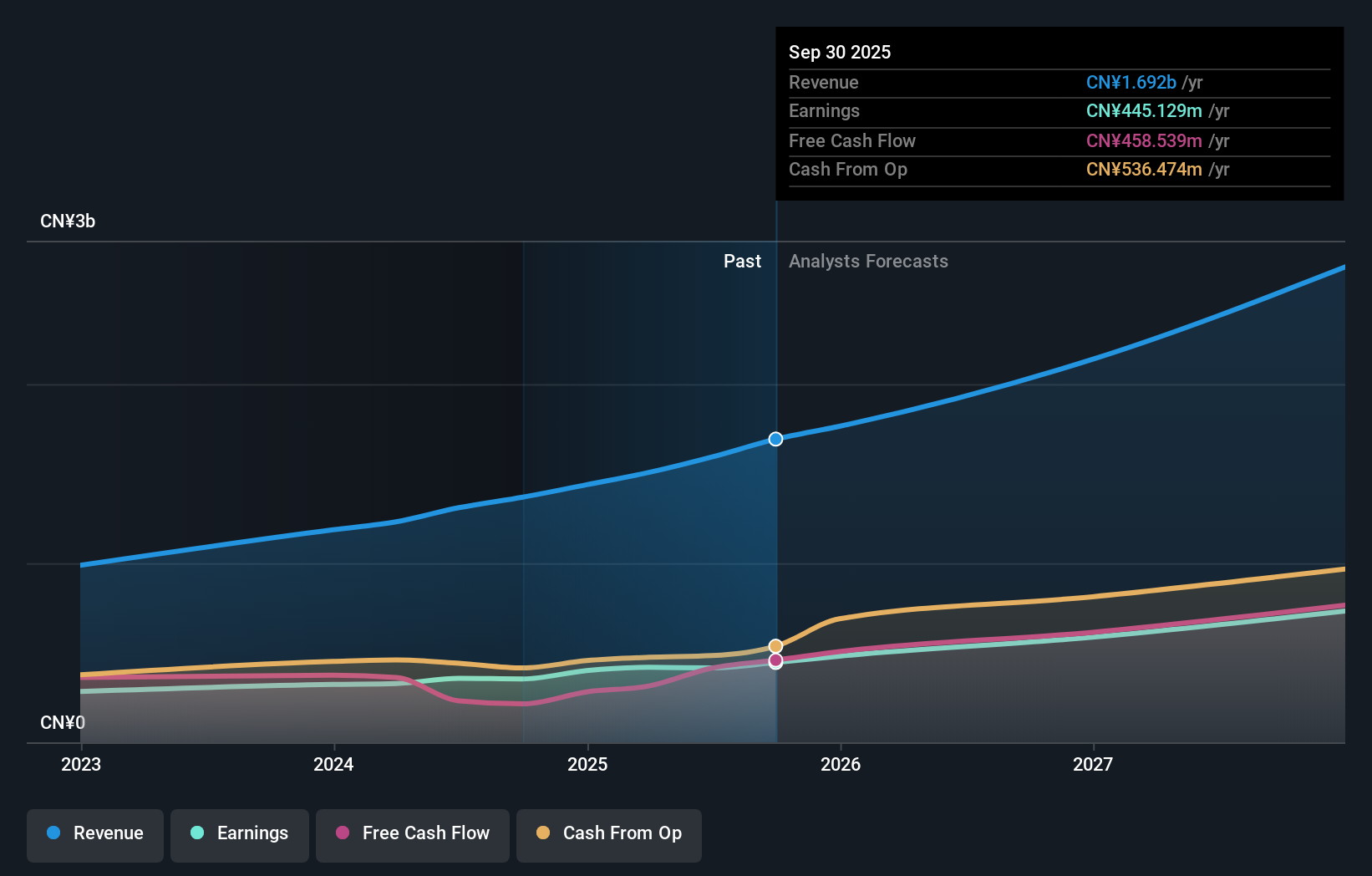

Intsig Information, a prominent player in the Asian tech landscape, demonstrated robust growth with a 24% increase in sales to CNY 1.3 billion and a net income rise to CNY 351.1 million this year. This performance is underpinned by significant investment in R&D, crucial for maintaining its competitive edge in software innovation. Despite earnings per share dipping to CNY 2.51 from CNY 2.92, the company's revenue growth rate at 20.5% annually surpasses the Chinese market average of 14.6%. Looking ahead, while its earnings are projected to grow at an annual rate of 22.1%, slightly below the broader market expectation of 27.6%, Intsig continues to outpace industry growth rates significantly, positioning it well for sustained advancements within high-growth sectors.

- Take a closer look at Intsig Information's potential here in our health report.

Explore historical data to track Intsig Information's performance over time in our Past section.

Wuxi Boton Technology (SZSE:300031)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuxi Boton Technology Co., Ltd. operates in the industrial bulk material handling and mobile Internet sectors both within China and internationally, with a market capitalization of approximately CN¥9.16 billion.

Operations: Wuxi Boton Technology Co., Ltd. focuses on two main business areas: industrial bulk material handling and mobile Internet services, serving both domestic and international markets. The company has a market capitalization of approximately CN¥9.16 billion, reflecting its significant presence in these sectors.

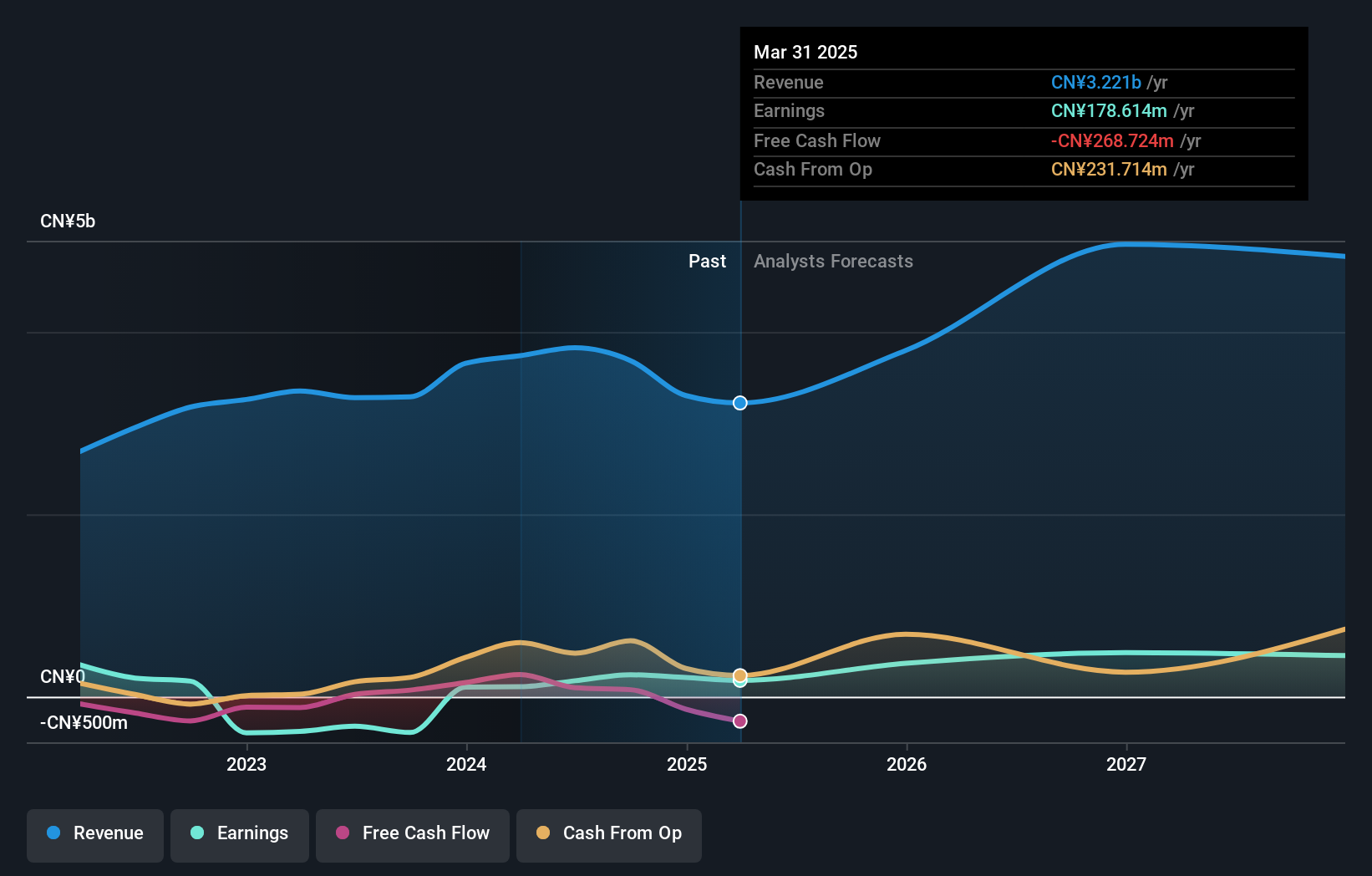

Wuxi Boton Technology, amidst a challenging fiscal period, reported a slight revenue increase to CNY 2.46 billion, up from CNY 2.45 billion year-over-year for the nine months ending September 2025. However, net income dipped to CNY 208.8 million from CNY 237.7 million, reflecting a decrease in profitability despite stable sales figures. The company's commitment to innovation is evident in its R&D spending trends but requires careful balance as earnings growth projections (27.8% annually) outpace its recent performance metrics and industry averages (27.6%). This scenario underscores the importance of strategic investment in technology and operational efficiency to harness potential future growth within Asia's competitive tech landscape.

Suzhou Sushi Testing GroupLtd (SZSE:300416)

Simply Wall St Growth Rating: ★★★☆☆☆

Overview: Suzhou Sushi Testing Group Co., Ltd. specializes in providing environmental and reliability test verification and analysis services, with a market capitalization of CN¥7.89 billion.

Operations: The company focuses on delivering environmental and reliability test verification and analysis services. It operates with a market capitalization of CN¥7.89 billion, providing specialized solutions in its field.

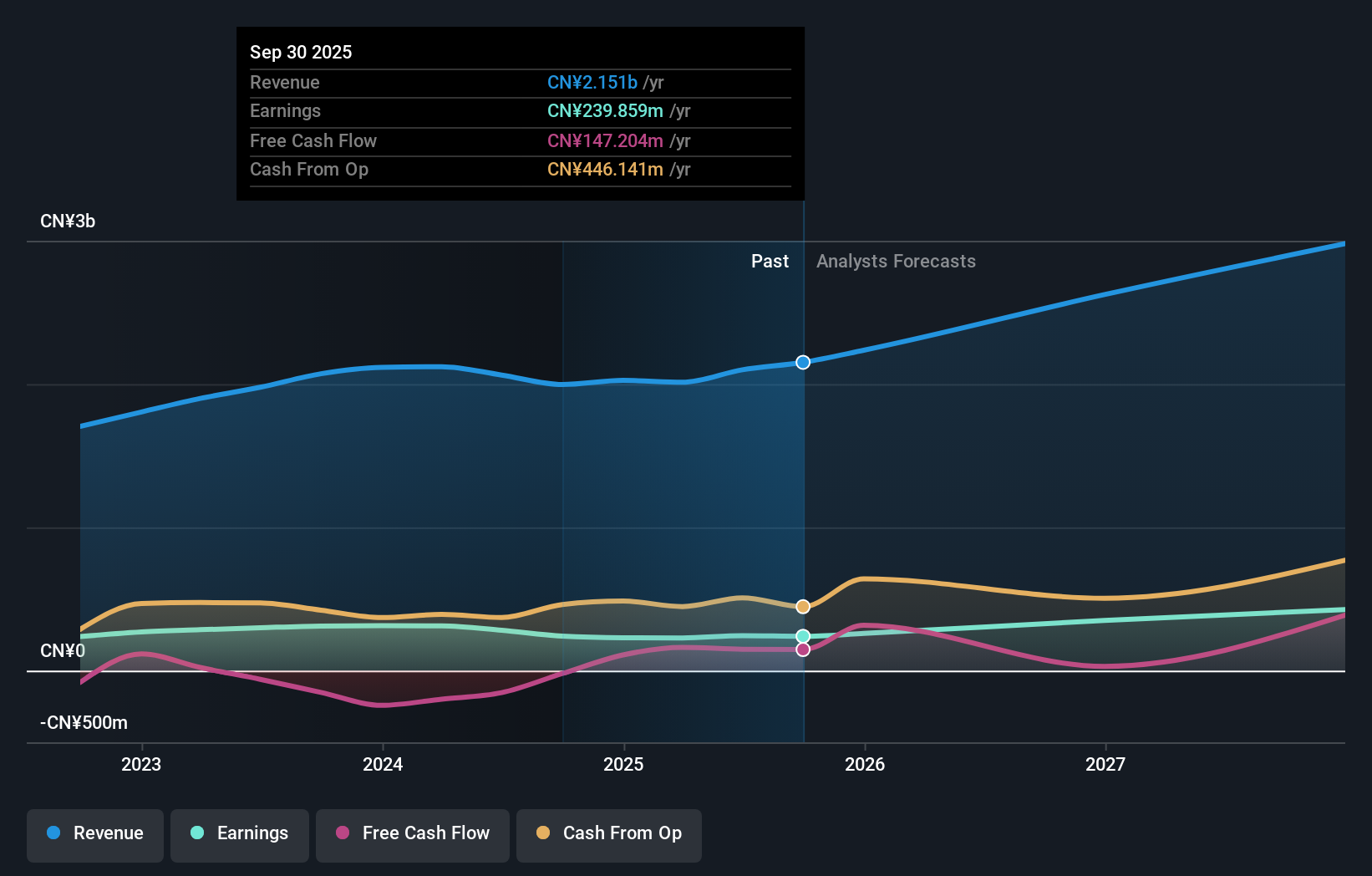

Suzhou Sushi Testing GroupLtd, navigating a competitive landscape, showcased resilience with a 9% year-over-year revenue increase to CNY 1.53 billion and a net income rise to CNY 156.84 million for the nine months ending September 2025. This performance is underpinned by robust annualized revenue growth of 14.8%, slightly outpacing the broader Chinese market's growth of 14.6%. The company's commitment to innovation is reflected in its strategic R&D investments, aligning with industry trends towards enhanced testing solutions in tech sectors critical for future expansions such as semiconductor manufacturing and telecommunications infrastructure.

Taking Advantage

- Dive into all 188 of the Asian High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Boton Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300031

Wuxi Boton Technology

Engages in the industrial bulk material handling and mobile Internet businesses in China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026