As global trade tensions show signs of easing, Asian markets are experiencing a renewed sense of optimism, with investors closely watching for potential opportunities amidst shifting economic dynamics. In this environment, identifying stocks that exhibit strong fundamentals and resilience to external shocks can be particularly rewarding, as these qualities often signal the potential for growth even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | NA | 21.03% | 21.51% | ★★★★★★ |

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| Woori Technology Investment | NA | 19.59% | -2.63% | ★★★★★★ |

| Synmosa Biopharma | 30.18% | 16.26% | 21.16% | ★★★★★★ |

| Shenzhen TVT Digital Technology | 2.68% | 10.54% | 29.43% | ★★★★★★ |

| Fuling Technology | 12.25% | 15.82% | 20.63% | ★★★★★★ |

| Zhejiang Chinastars New Materials Group | 38.79% | 0.20% | 4.21% | ★★★★★☆ |

| YagiLtd | 38.98% | -8.93% | 16.36% | ★★★★★☆ |

| Techshine ElectronicsLtd | 4.78% | 15.06% | 17.63% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Linkage Software (SHSE:688588)

Simply Wall St Value Rating: ★★★★★☆

Overview: Linkage Software Co., LTD is a financial software company with a market capitalization of CN¥5.56 billion.

Operations: Linkage Software generates revenue primarily through its financial software solutions. The company's net profit margin stands at 15.4%, reflecting its efficiency in converting revenue into profit after accounting for all expenses.

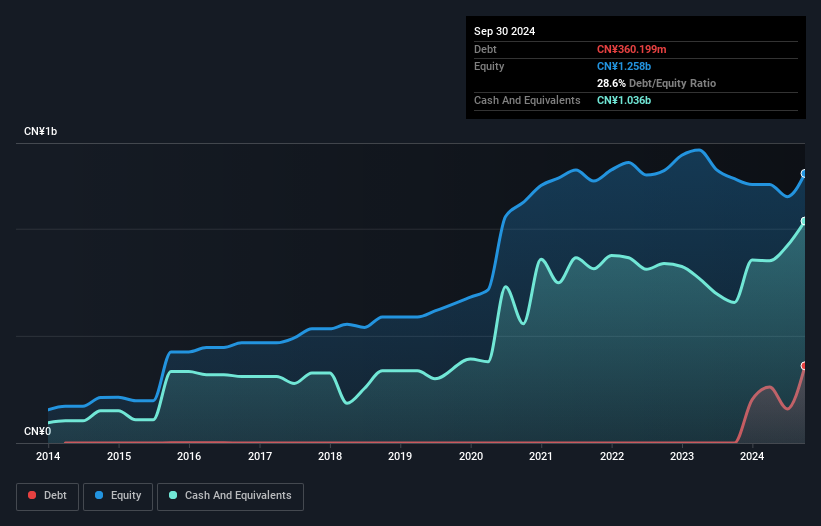

Linkage Software is carving a niche in the Asian market with impressive financials. Its earnings surged 43.6% last year, outpacing the software industry which saw a dip of 12.4%. Despite a volatile share price recently, the company showcases high-quality earnings and maintains profitability with more cash than total debt. The P/E ratio stands at 44.7x, offering better value compared to the industry average of 91.6x. Recent buybacks totaling CNY 1.09 million reflect confidence in its future prospects, while net income rose to CNY 126.92 million from CNY 86.53 million year-on-year, highlighting robust growth potential.

- Click to explore a detailed breakdown of our findings in Linkage Software's health report.

Evaluate Linkage Software's historical performance by accessing our past performance report.

Toenec (TSE:1946)

Simply Wall St Value Rating: ★★★★★★

Overview: Toenec Corporation is an integrated facility company focused on constructing and enhancing social infrastructure in the energy, environment, and information technology sectors in Japan, with a market capitalization of approximately ¥104.88 billion.

Operations: Toenec generates revenue from constructing and improving infrastructure in the energy, environment, and IT sectors.

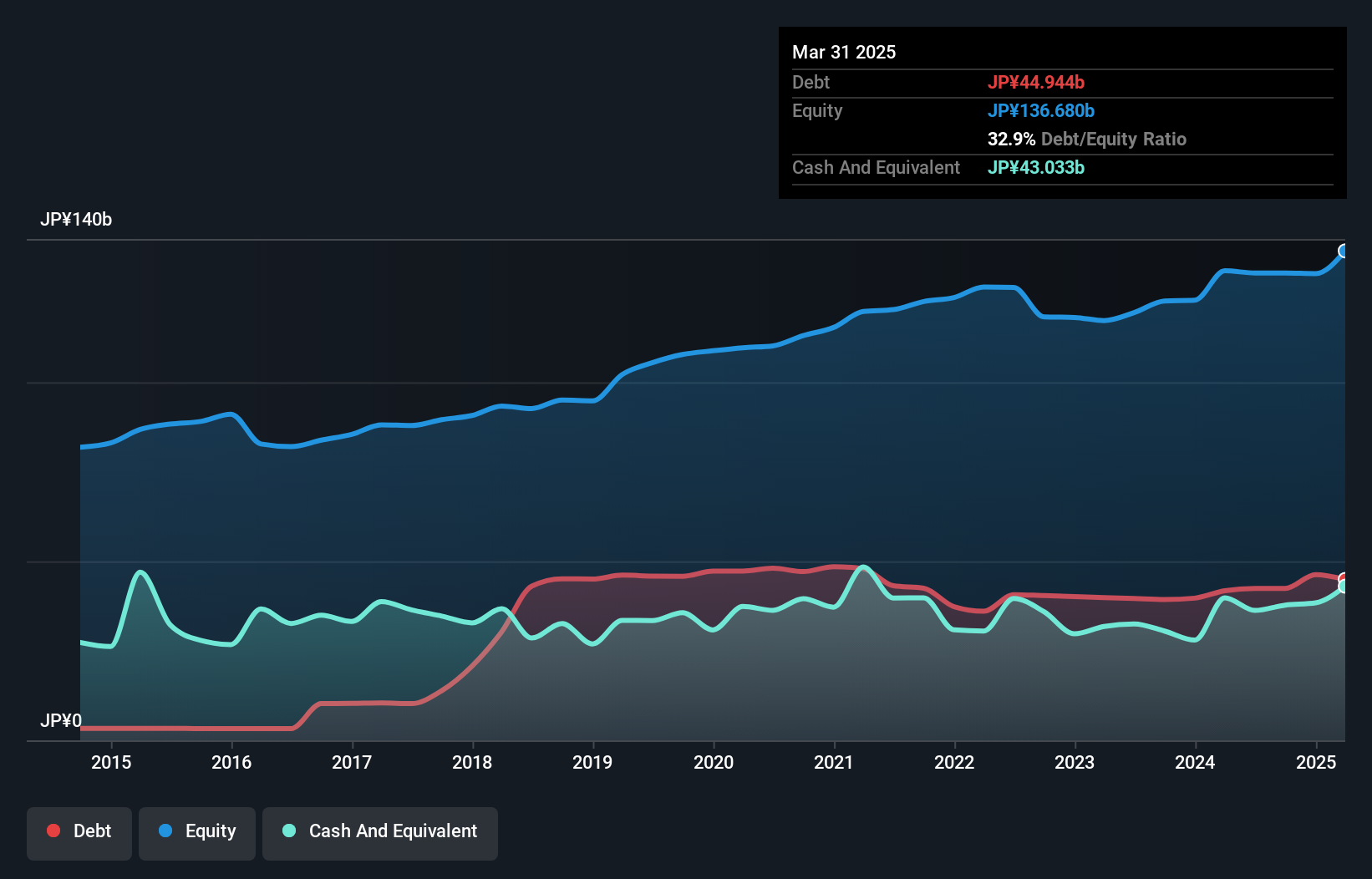

In the bustling Asian market, Toenec stands out with its robust financial health and strategic positioning. Trading at 50.7% below its estimated fair value, this company is a potential bargain for investors. Over the past five years, it has successfully reduced its debt to equity ratio from 43.1% to 32.9%, demonstrating prudent financial management. Despite a yearly earnings decline of 5.5%, recent growth hit 15.2%. With interest payments well covered by EBIT at an impressive 11.3 times and positive free cash flow, Toenec seems poised for stability amidst industry challenges and opportunities in the construction sector.

- Click here to discover the nuances of Toenec with our detailed analytical health report.

Gain insights into Toenec's past trends and performance with our Past report.

Chang Wah Electromaterials (TWSE:8070)

Simply Wall St Value Rating: ★★★★★★

Overview: Chang Wah Electromaterials Inc. specializes in the trading of electrical, telecommunication, and semiconductor materials and parts across Taiwan, Asia, and internationally with a market capitalization of NT$30.26 billion.

Operations: Chang Wah Electromaterials generates revenue primarily from its main entity, contributing NT$7.32 billion, and Chang Wah Technology Co., Ltd. and its subsidiary, adding NT$11.99 billion.

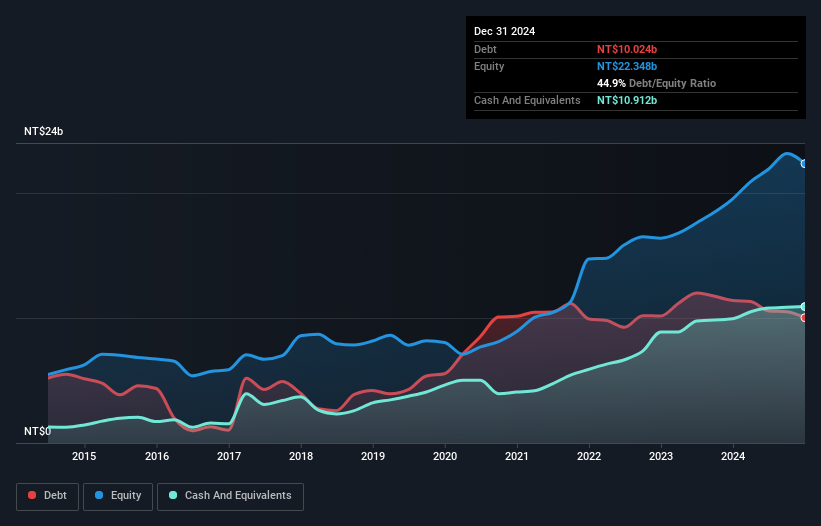

Chang Wah Electromaterials, a nimble player in the electronics sector, has shown resilience with its debt to equity ratio improving from 68.8% to 44.9% over five years. Despite not outpacing the broader industry's earnings growth of 26.1%, it maintains a steady annual earnings increase of 9.6%. The company enjoys robust cash flow and holds more cash than its total debt, signaling financial stability. Recent results highlighted sales reaching TWD 17,231 million and net income at TWD 1,592 million for the year ending December 2024, reflecting consistent performance with earnings per share also seeing slight improvement from previous figures.

Taking Advantage

- Access the full spectrum of 2673 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688588

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives