High Growth Tech in Asia Featuring BeiJing Seeyon Internet Software and 2 Other Stocks

Reviewed by Simply Wall St

As global markets navigate through economic uncertainties, Asian tech stocks are capturing attention amid the region's dynamic growth landscape. In this environment, identifying high-growth companies like BeiJing Seeyon Internet Software can be crucial for investors seeking to capitalize on technological advancements and market opportunities in Asia.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.73% | 30.71% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. offers collaborative management software, solutions, platforms, and cloud services to organizational customers in China with a market capitalization of CN¥2.98 billion.

Operations: Seeyon Internet Software focuses on delivering collaborative management software and cloud-based solutions tailored for organizational clients in China. The company generates revenue primarily through the sale of its software platforms and related services.

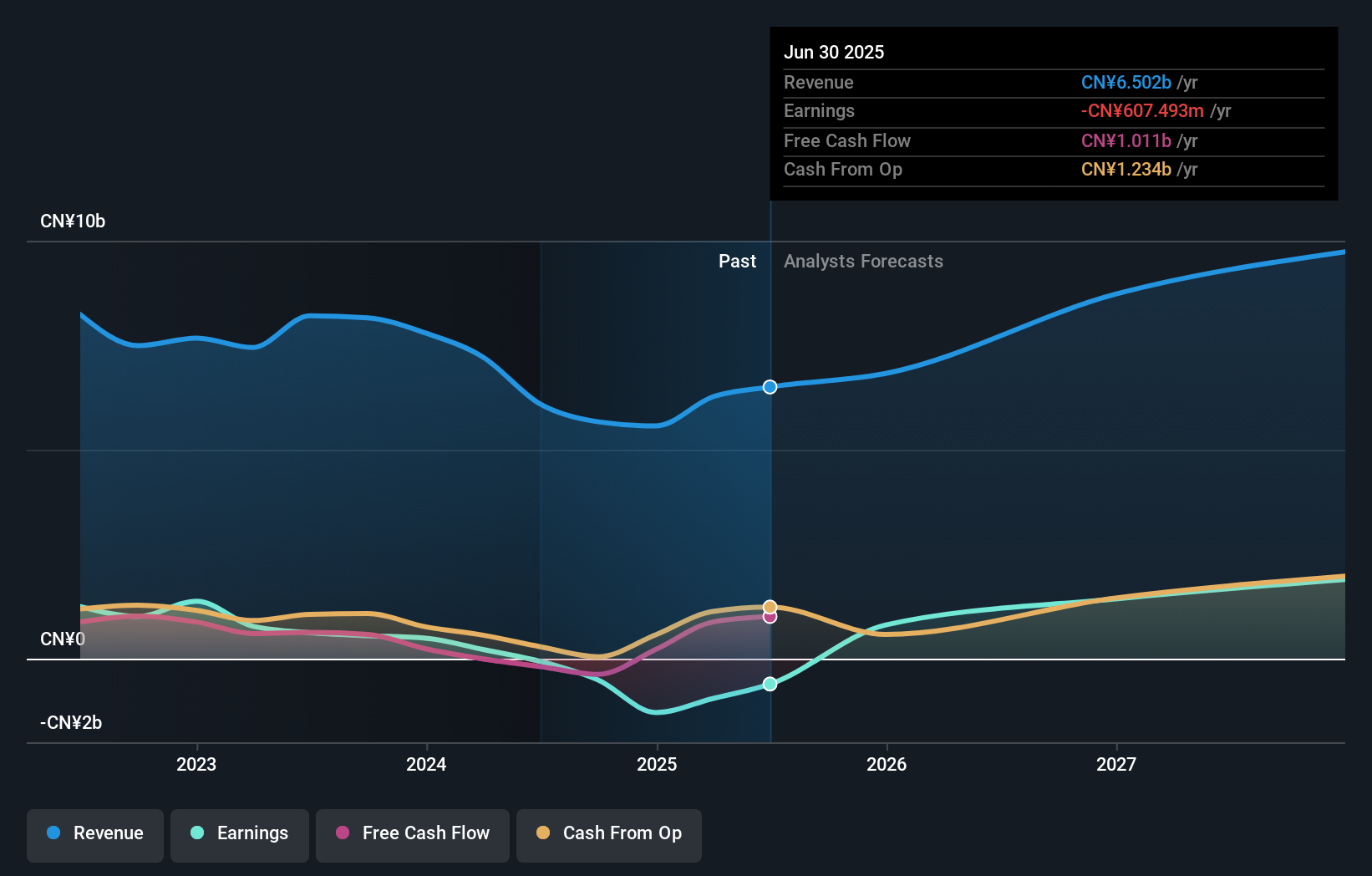

BeiJing Seeyon Internet Software, amidst a challenging fiscal period, reported a net loss of CNY 135.49 million for the first half of 2025, widening from CNY 68.42 million in the previous year. Despite this setback, the company's revenue growth forecast remains robust at 14.2% annually, slightly outpacing the broader Chinese market's 14.1%. This suggests resilience and potential in its core software operations. Moreover, with an anticipated shift to profitability within three years and an impressive projected annual earnings growth rate of 113.86%, Seeyon is strategically positioning itself for a strong recovery and sustained growth in the competitive tech landscape of Asia.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. specializes in providing intelligent parking solutions and related services, with a market cap of CN¥6.42 billion.

Operations: Jieshun focuses on intelligent parking solutions, generating revenue primarily from its Intelligent Management System for Car Parks (CN¥684.18 million) and Parking Time and Parking Fee Business (CN¥373.35 million). The company also derives income from Software and Cloud Services (CN¥246.63 million) and Smart Parking Operation (CN¥167.81 million), with additional contributions from Property Lease activities.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. has shown promising growth, with a 17.9% annual increase in revenue and an impressive 50.1% surge in earnings per year, outpacing the broader Chinese market's growth rates of 14.1% and 26.7%, respectively. This performance is bolstered by strategic expansions approved at recent extraordinary general meetings, including broadening its business scope and amending company bylaws to enhance governance—a move that may further secure its competitive edge in the tech industry. Additionally, significant R&D investments underscore its commitment to innovation; however, a detailed breakdown of these expenses was not provided.

Perfect World (SZSE:002624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Perfect World Co., Ltd. is involved in the research, development, distribution, and operation of online games both in China and internationally, with a market cap of CN¥37.99 billion.

Operations: The company's primary revenue stream is its gaming segment, generating CN¥5.45 billion, while the film and television segment contributes CN¥1.20 billion.

Perfect World Co., Ltd. has demonstrated a robust recovery, with revenues soaring to CNY 3.69 billion, up from CNY 2.76 billion year-over-year, and transitioning from a net loss of CNY 176.86 million to a net profit of CNY 503.21 million in the first half of 2025 alone. This turnaround is underscored by an annualized revenue growth rate of 17.8% and an anticipated earnings surge of approximately 82% per year over the next three years, positioning it favorably against the broader Chinese market's growth metrics. The company's commitment to innovation is evident in its strategic R&D investments which are integral to sustaining its competitive edge in the rapidly evolving tech landscape of Asia.

Summing It All Up

- Reveal the 185 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeiJing Seeyon Internet Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688369

BeiJing Seeyon Internet Software

Provides collaborative management software, solutions, platforms, and cloud services for organizational customers in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.