- China

- /

- Electronic Equipment and Components

- /

- SHSE:688401

Exploring Three High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst a backdrop of global economic shifts and evolving market sentiment, Asian tech stocks are capturing attention as investors seek opportunities in high-growth sectors. As small-cap stocks outperform their larger counterparts, driven by optimism in technology and artificial intelligence, identifying promising tech companies becomes crucial for navigating the dynamic landscape.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Zhongji Innolight | 34.82% | 35.50% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 37.19% | ★★★★★★ |

| Fositek | 37.48% | 49.53% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

BeiJing Seeyon Internet Software (SHSE:688369)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiJing Seeyon Internet Software Corp. offers collaborative management software, solutions, platforms, and cloud services to organizational customers in China and has a market cap of CN¥2.62 billion.

Operations: Seeyon Internet Software focuses on providing collaborative management software and cloud services to organizations in China. The company generates revenue primarily from its software solutions and platforms, catering to a diverse range of organizational needs.

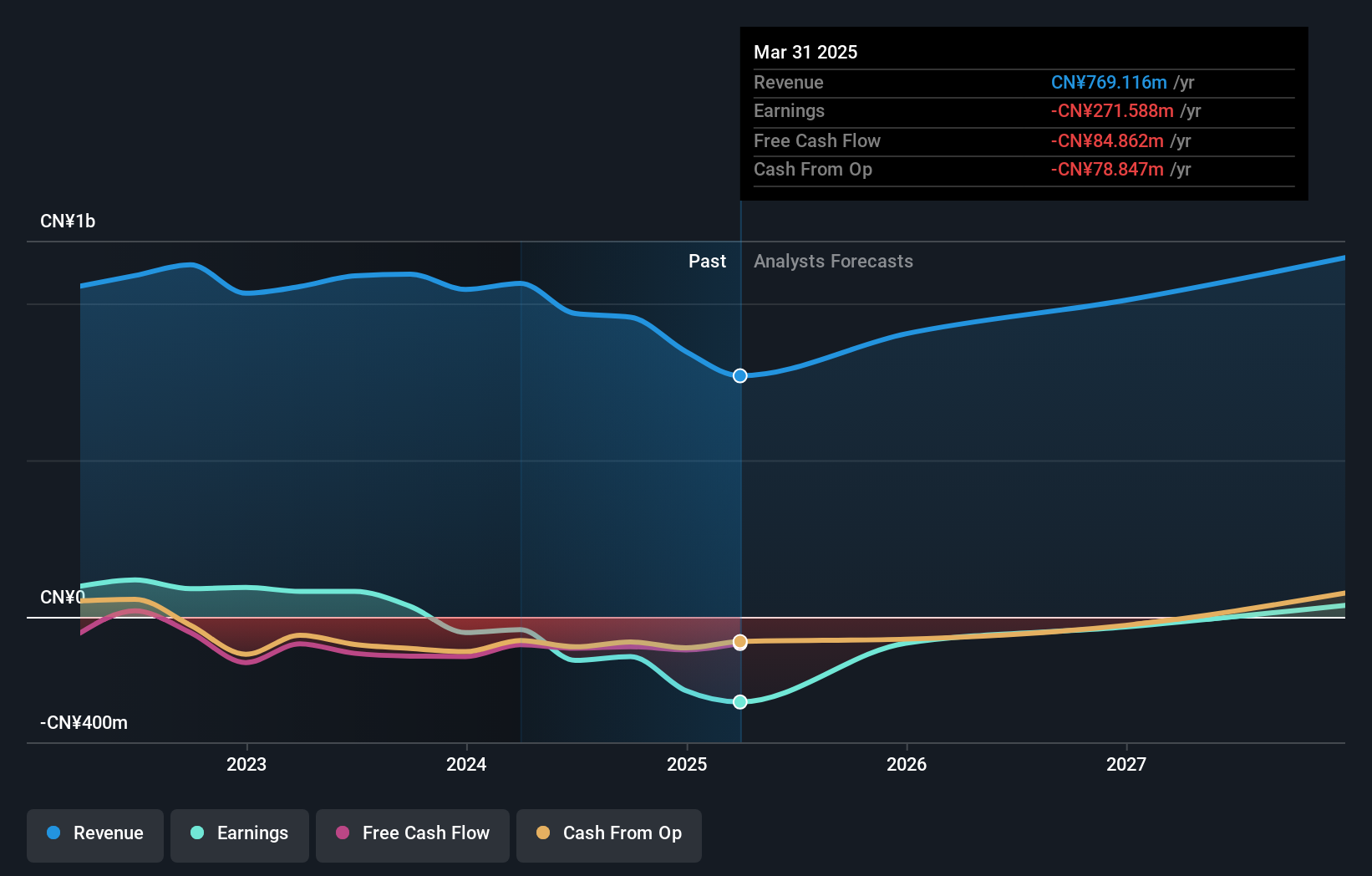

BeiJing Seeyon Internet Software, despite its current unprofitable status, shows promising signs of growth with a forecasted revenue increase of 15.4% annually, outpacing the Chinese market's 14.6%. The company's substantial R&D investment aligns with its strategic focus on innovation to capture more market share in the competitive software industry. However, it faces challenges as evidenced by a recent report showing a net loss widening to CNY 219.04 million from CNY 109.4 million year-over-year and a decline in sales to CNY 554.32 million from CNY 616.88 million previously. These figures underscore the volatility and risks involved but also highlight potential for significant earnings growth, projected at an impressive rate of 111.73% annually as it moves towards profitability within three years.

- Click here to discover the nuances of BeiJing Seeyon Internet Software with our detailed analytical health report.

Learn about BeiJing Seeyon Internet Software's historical performance.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Newway Photomask Making Co., Ltd is a lithography company focused on designing, developing, and producing mask products in China with a market cap of CN¥9.33 billion.

Operations: Shenzhen Newway Photomask Making Co., Ltd generates revenue primarily through its electronic components and parts segment, which contributed CN¥1.10 billion. The company's operations are centered around the design, development, and production of mask products within China.

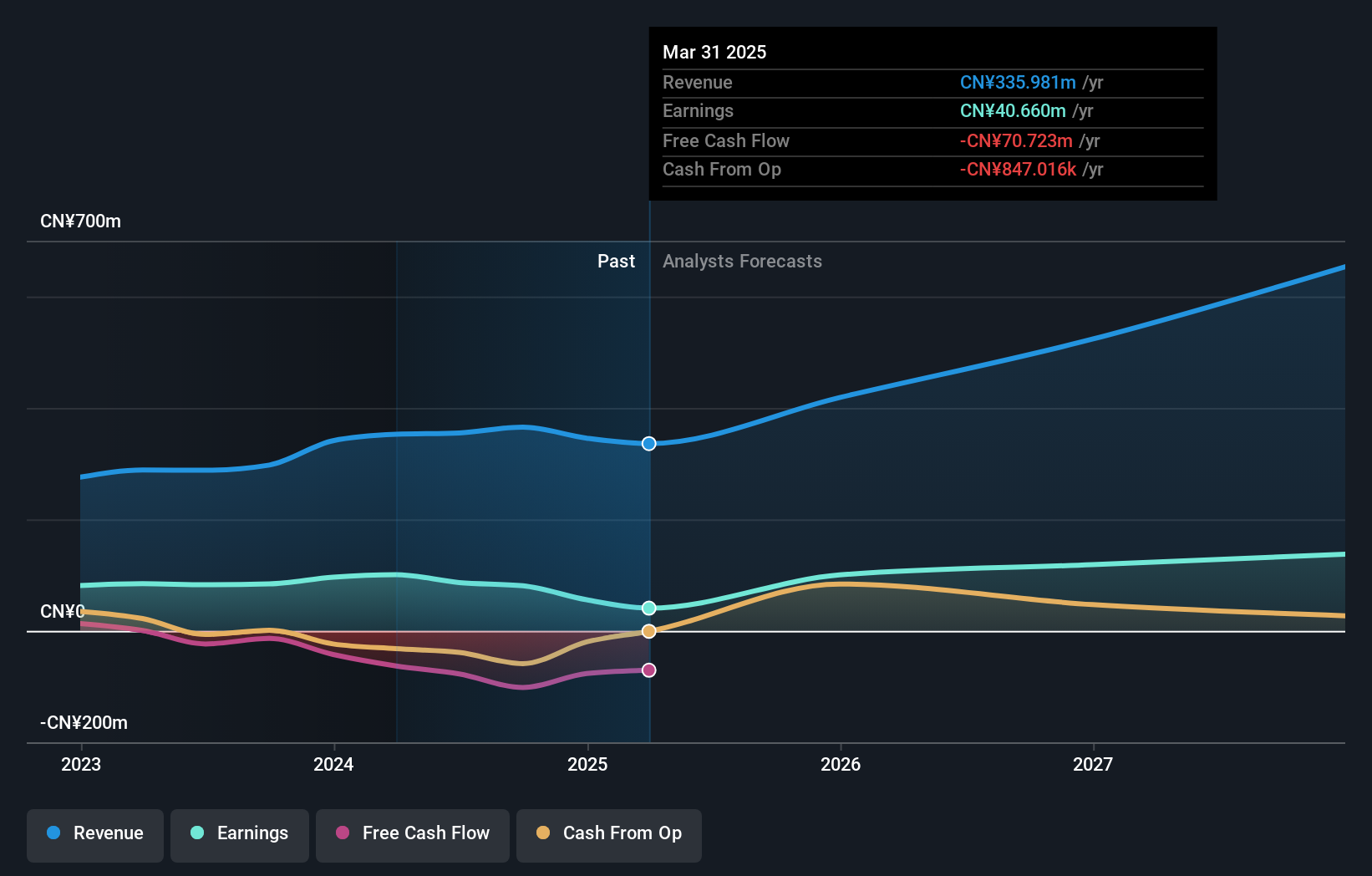

Shenzhen Newway Photomask Making has demonstrated robust growth with a 30.4% annual increase in revenue, outstripping the broader Chinese market's expansion of 14.6%. This performance is underpinned by significant R&D investment, which not only fuels innovation but also enhances its competitive edge in the high-tech sector. Recent earnings for the nine months ending September 2025 show a net income rise to CNY 171.76 million from CNY 121.06 million year-over-year, reflecting a solid earnings growth forecast of 35.5% annually. The company's strategic focus on photomask technology, essential for semiconductor manufacturing, positions it well amid increasing demand for electronic components, although it navigates a highly volatile share price and an unsteady free cash flow position.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NanJing GOVA Technology Co., Ltd. is involved in the research, design, development, production, and sale of sensors and sensor network systems in China with a market capitalization of CN¥6.54 billion.

Operations: GOVA Technology focuses on producing electronic test and measurement instruments, generating revenue of CN¥371.28 million from this segment. The company's operations are centered in China, contributing to its market presence in the sensor and sensor network systems industry.

Amidst a challenging landscape, NanJing GOVA Technology has managed to post a commendable 10.3% increase in revenue year-over-year, reaching CNY 272.86 million for the nine months ending September 2025. This growth is supported by an uptick in net income to CNY 51.99 million, up from CNY 45.22 million, reflecting a solid trajectory despite its highly volatile share price and negative earnings growth of -22.8% over the past year compared to the industry average of 9%. The company's commitment to innovation is evident from its R&D initiatives, crucial for maintaining competitiveness in the swiftly evolving tech sector of Asia.

- Navigate through the intricacies of NanJing GOVA Technology with our comprehensive health report here.

Assess NanJing GOVA Technology's past performance with our detailed historical performance reports.

Summing It All Up

- Click this link to deep-dive into the 188 companies within our Asian High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688401

Shenzhen Newway Photomask Making

A lithography company, engages in the design, development, and production of mask products in China.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026