Hangzhou Raycloud Technology Co.,Ltd (SHSE:688365) Stock Rockets 42% As Investors Are Less Pessimistic Than Expected

Despite an already strong run, Hangzhou Raycloud Technology Co.,Ltd (SHSE:688365) shares have been powering on, with a gain of 42% in the last thirty days. The last month tops off a massive increase of 173% in the last year.

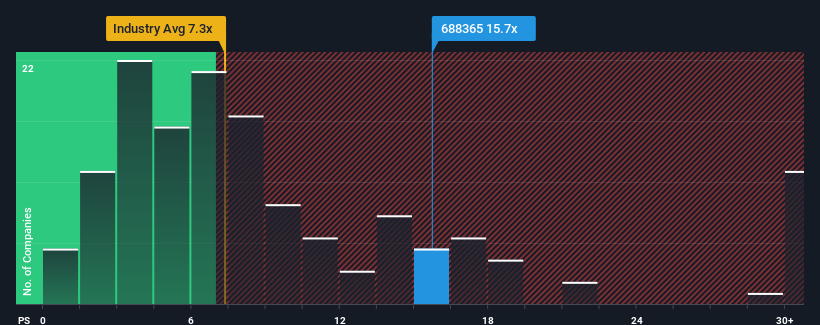

Since its price has surged higher, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 7.3x, you may consider Hangzhou Raycloud TechnologyLtd as a stock not worth researching with its 15.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Hangzhou Raycloud TechnologyLtd

What Does Hangzhou Raycloud TechnologyLtd's Recent Performance Look Like?

Recent revenue growth for Hangzhou Raycloud TechnologyLtd has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Hangzhou Raycloud TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

Hangzhou Raycloud TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 12% decline in revenue over the last three years in total. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 20% over the next year. Meanwhile, the rest of the industry is forecast to expand by 28%, which is noticeably more attractive.

In light of this, it's alarming that Hangzhou Raycloud TechnologyLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

The strong share price surge has lead to Hangzhou Raycloud TechnologyLtd's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Hangzhou Raycloud TechnologyLtd trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hangzhou Raycloud TechnologyLtd you should be aware of, and 1 of them doesn't sit too well with us.

If these risks are making you reconsider your opinion on Hangzhou Raycloud TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Raycloud TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688365

Hangzhou Raycloud TechnologyLtd

Operates as an e-commerce software and service technology company in China and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026