3 Growth Companies With High Insider Ownership Growing Earnings At 73%

Reviewed by Simply Wall St

In the face of global market fluctuations, including tariff uncertainties and mixed economic data, investors are increasingly seeking stability and growth potential in their portfolios. As major indexes show varied performance amidst these challenges, companies with strong insider ownership and robust earnings growth present an attractive proposition for those looking to navigate the current economic landscape effectively.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.9% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 111.4% |

We'll examine a selection from our screener results.

Vanchip (Tianjin) Technology (SHSE:688153)

Simply Wall St Growth Rating: ★★★★★☆

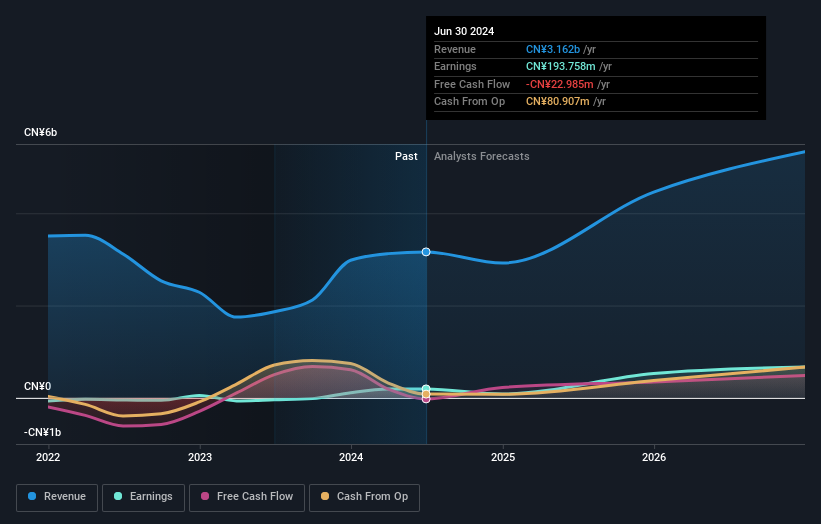

Overview: Vanchip (Tianjin) Technology Co., Ltd. designs, manufactures, and sells radio frequency front end and high end analog chips in China with a market cap of CN¥18.57 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥2.86 billion.

Insider Ownership: 16.9%

Earnings Growth Forecast: 73.4% p.a.

Vanchip (Tianjin) Technology exhibits robust growth potential, with revenue expected to increase by 29.9% annually, outpacing the broader Chinese market. Earnings are projected to grow significantly at 73.4% per year, despite a low forecasted return on equity of 5%. The company has recently become profitable and maintains high-quality earnings; however, its share price has been highly volatile recently. No substantial insider trading activity was noted over the past three months.

- Unlock comprehensive insights into our analysis of Vanchip (Tianjin) Technology stock in this growth report.

- Our comprehensive valuation report raises the possibility that Vanchip (Tianjin) Technology is priced higher than what may be justified by its financials.

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★★☆

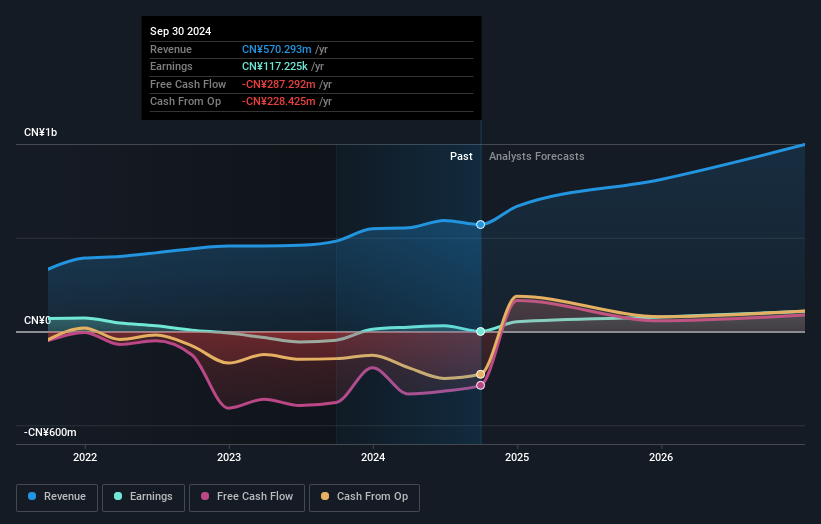

Overview: BeijingABT Networks Co., Ltd. develops and provides visualized network security technology solutions in China, with a market cap of CN¥4.88 billion.

Operations: The company generates revenue of CN¥570.29 million from its network security segment.

Insider Ownership: 25.1%

Earnings Growth Forecast: 69.1% p.a.

BeijingABT Networks Ltd. demonstrates strong growth potential with earnings forecasted to expand at 69.1% annually, significantly outpacing the Chinese market's growth rate. Revenue is also expected to grow robustly at 23.6% per year, surpassing market averages. Despite this, the company's return on equity is projected to be low in three years at 7.1%. The share price has been highly volatile recently, and there has been no notable insider trading activity in the past three months.

- Take a closer look at BeijingABT NetworksLtd's potential here in our earnings growth report.

- Our expertly prepared valuation report BeijingABT NetworksLtd implies its share price may be too high.

Topsec Technologies Group (SZSE:002212)

Simply Wall St Growth Rating: ★★★★☆☆

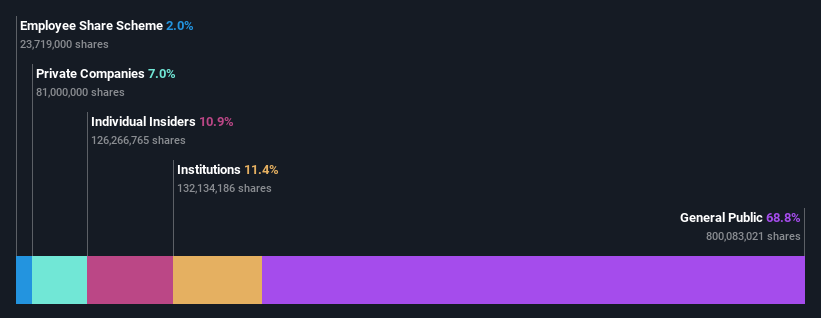

Overview: Topsec Technologies Group Inc. operates in China, offering cyber security, big data, and cloud services, with a market cap of CN¥10.31 billion.

Operations: The company generates revenue from its cybersecurity segment, amounting to CN¥3.06 billion.

Insider Ownership: 10.9%

Earnings Growth Forecast: 73.7% p.a.

Topsec Technologies Group is forecast to achieve a 73.67% annual earnings growth, positioning it above the average market growth as it becomes profitable within three years. Revenue is expected to rise at 15% annually, outpacing the Chinese market's 13.5% growth rate, though slower than some high-growth peers. Despite favorable trading value compared to industry standards, its return on equity remains low at 3.4%. Recent index removals may impact investor sentiment despite stable insider activity.

- Delve into the full analysis future growth report here for a deeper understanding of Topsec Technologies Group.

- In light of our recent valuation report, it seems possible that Topsec Technologies Group is trading behind its estimated value.

Make It Happen

- Discover the full array of 1447 Fast Growing Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Topsec Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002212

Topsec Technologies Group

Provides cyber security, big data, and cloud services in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives