Revenues Tell The Story For Hunan Kylinsec Technology Co., Ltd. (SHSE:688152) As Its Stock Soars 33%

Hunan Kylinsec Technology Co., Ltd. (SHSE:688152) shares have continued their recent momentum with a 33% gain in the last month alone. Unfortunately, despite the strong performance over the last month, the full year gain of 3.5% isn't as attractive.

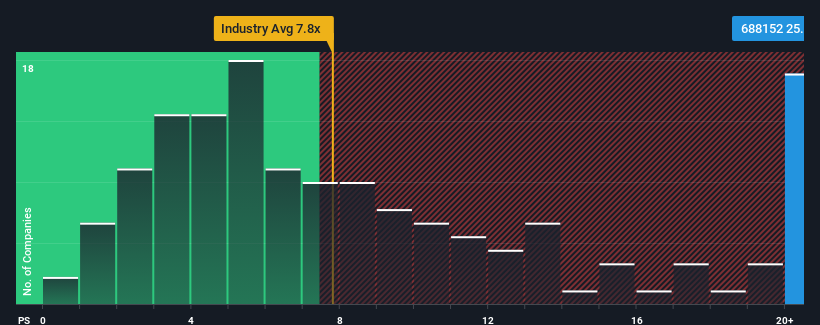

Following the firm bounce in price, given around half the companies in China's Software industry have price-to-sales ratios (or "P/S") below 7.8x, you may consider Hunan Kylinsec Technology as a stock to avoid entirely with its 25.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Hunan Kylinsec Technology

What Does Hunan Kylinsec Technology's P/S Mean For Shareholders?

Hunan Kylinsec Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Hunan Kylinsec Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Hunan Kylinsec Technology?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Hunan Kylinsec Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. As a result, revenue from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 91% over the next year. That's shaping up to be materially higher than the 33% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Hunan Kylinsec Technology's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Hunan Kylinsec Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Hunan Kylinsec Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Hunan Kylinsec Technology you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hunan Kylinsec Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688152

Flawless balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026