- China

- /

- Construction

- /

- SZSE:002929

Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets are capturing attention with their potential for growth and resilience in the face of external economic pressures. In this environment, companies with high insider ownership often stand out as they may signal confidence from those closest to the business, making them intriguing prospects for investors.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| M31 Technology (TPEX:6643) | 30.8% | 69.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Suzhou Gyz Electronic TechnologyLtd (SHSE:688260) | 16.4% | 121.7% |

Here's a peek at a few of the choices from the screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global algorithm and software solution provider in the computer vision industry with a market cap of CN¥18.15 billion.

Operations: ArcSoft Corporation Limited generates revenue through its operations as an algorithm and software solution provider in the computer vision industry on a global scale.

Insider Ownership: 34.5%

Revenue Growth Forecast: 28.3% p.a.

ArcSoft has demonstrated robust growth, with earnings increasing by 101% over the past year and forecasts predicting a 34.35% annual increase, outpacing the CN market's expected growth. Despite high volatility in its share price recently, ArcSoft's revenue is projected to grow at 28.3% annually, surpassing market averages. Recent earnings reports show continued strong performance with Q1 sales rising to CNY 209.26 million and net income reaching CNY 49.66 million from CNY 34.17 million last year.

- Click here and access our complete growth analysis report to understand the dynamics of ArcSoft.

- Our valuation report here indicates ArcSoft may be overvalued.

Landai Technology Group (SZSE:002765)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Landai Technology Group Corp., Ltd. focuses on the R&D, manufacturing, and sale of power transmission assemblies, transmission parts, and die-casting products for automotive, textile machinery, and general machinery sectors in China with a market cap of CN¥10.28 billion.

Operations: The company's revenue is primarily derived from its Touch Display Division, which generated CN¥1.76 billion, and its Power Transmission Division, contributing CN¥1.79 billion.

Insider Ownership: 31.3%

Revenue Growth Forecast: 16.7% p.a.

Landai Technology Group's earnings are forecast to grow significantly at 33.3% annually, outpacing the CN market's 24.1%. Despite a volatile share price, revenue is set to increase by 16.7% per year, faster than the market average of 12.8%. Recent Q1 results show sales rising to CNY 813.11 million from CNY 752.45 million last year, with net income improving to CNY 52.16 million from CNY 35.75 million previously reported.

- Click here to discover the nuances of Landai Technology Group with our detailed analytical future growth report.

- The analysis detailed in our Landai Technology Group valuation report hints at an inflated share price compared to its estimated value.

Runjian (SZSE:002929)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runjian Co., Ltd. is a communication technology service company involved in network construction and maintenance in China, with a market cap of CN¥14.12 billion.

Operations: Runjian Co., Ltd. generates revenue through its communication network construction and maintenance services in China.

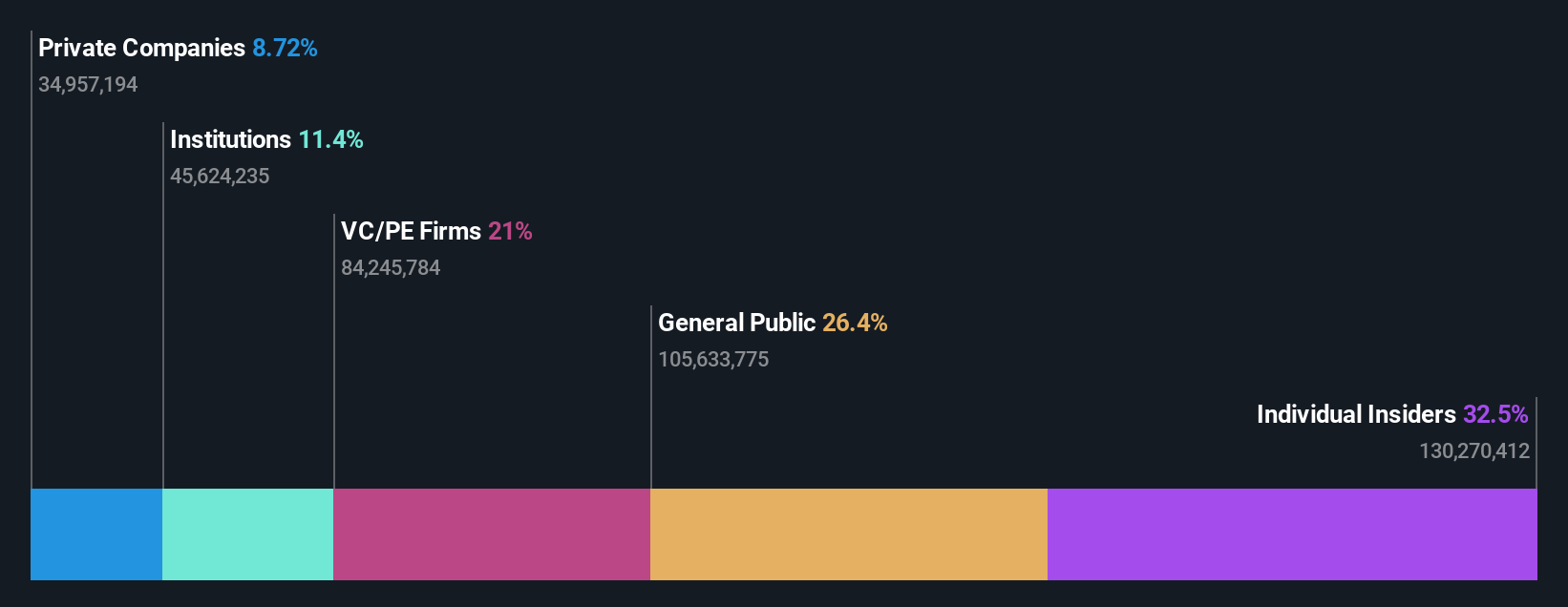

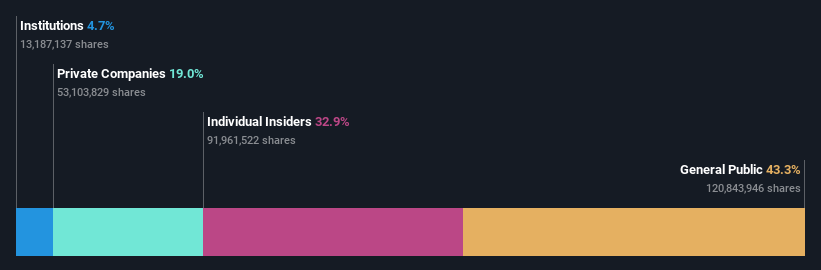

Insider Ownership: 32.7%

Revenue Growth Forecast: 13.3% p.a.

Runjian's earnings are expected to grow significantly at 30.1% annually, surpassing the CN market's 24.1%. Despite volatile share prices and lower profit margins than last year, revenue is forecast to grow by 13.3% per year, above the market average of 12.8%. Recent full-year results showed sales increased to CNY 9.20 billion from CNY 8.83 billion, though net income fell to CNY 246.57 million from CNY 438.53 million previously reported.

- Dive into the specifics of Runjian here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Runjian is trading beyond its estimated value.

Key Takeaways

- Unlock our comprehensive list of 622 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? We've found 21 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Runjian, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002929

Runjian

A communication technology service company, engages in the communication network construction and maintenance business in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives