There's Reason For Concern Over Zwsoft Co.,Ltd.'s (SHSE:688083) Massive 32% Price Jump

Despite an already strong run, Zwsoft Co.,Ltd. (SHSE:688083) shares have been powering on, with a gain of 32% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 6.3% isn't as attractive.

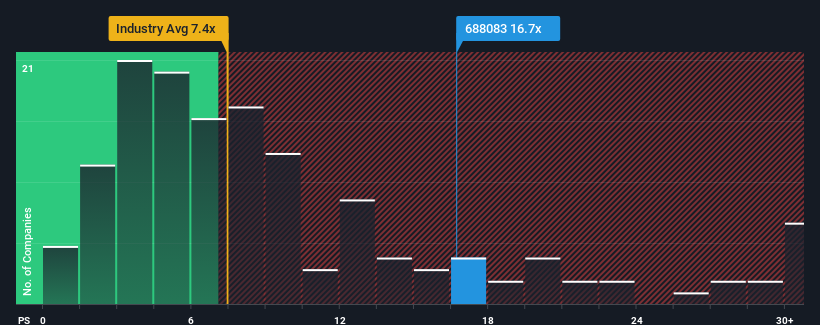

Since its price has surged higher, you could be forgiven for thinking ZwsoftLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 16.7x, considering almost half the companies in China's Software industry have P/S ratios below 7.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ZwsoftLtd

What Does ZwsoftLtd's Recent Performance Look Like?

Recent times have been advantageous for ZwsoftLtd as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ZwsoftLtd will help you uncover what's on the horizon.How Is ZwsoftLtd's Revenue Growth Trending?

ZwsoftLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 60% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 23% per year over the next three years. That's shaping up to be similar to the 24% per annum growth forecast for the broader industry.

With this information, we find it interesting that ZwsoftLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to ZwsoftLtd's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that ZwsoftLtd currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with ZwsoftLtd.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if ZwsoftLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688083

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives