Things Look Grim For Fujian Apex Software Co.,LTD (SHSE:603383) After Today's Downgrade

Market forces rained on the parade of Fujian Apex Software Co.,LTD (SHSE:603383) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

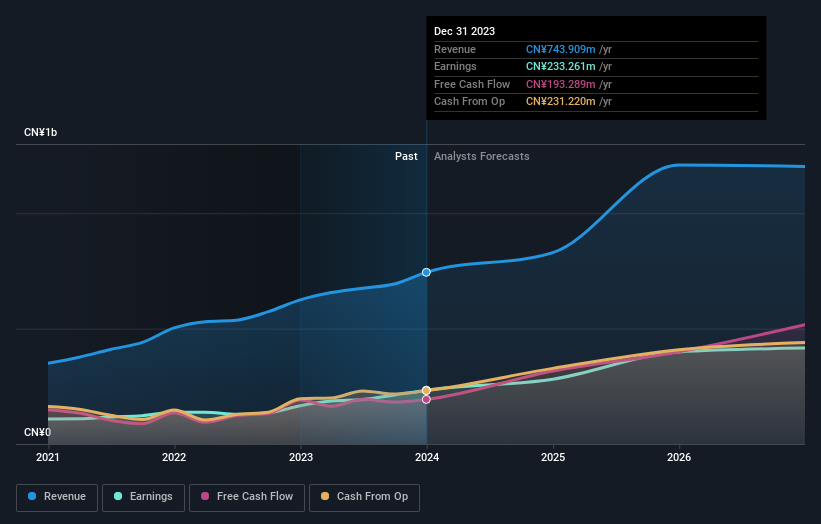

After this downgrade, Fujian Apex SoftwareLTD's seven analysts are now forecasting revenues of CN¥829m in 2024. This would be a decent 11% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to leap 20% to CN¥1.64. Prior to this update, the analysts had been forecasting revenues of CN¥983m and earnings per share (EPS) of CN¥1.84 in 2024. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a real cut to earnings per share numbers as well.

View our latest analysis for Fujian Apex SoftwareLTD

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Fujian Apex SoftwareLTD's revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 11% growth on an annualised basis. This is compared to a historical growth rate of 20% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 21% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Fujian Apex SoftwareLTD.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Fujian Apex SoftwareLTD. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Fujian Apex SoftwareLTD, and their negativity could be grounds for caution.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Fujian Apex SoftwareLTD going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a platform-based digital service provider company in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion