In November 2024, global markets have experienced a mixed performance, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating amid a busy earnings season and cautious economic signals. As growth stocks lag behind value shares, particularly in the tech sector due to cautious earnings reports from key players, investors may find it beneficial to focus on companies that demonstrate strong fundamentals and resilience in navigating the current economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

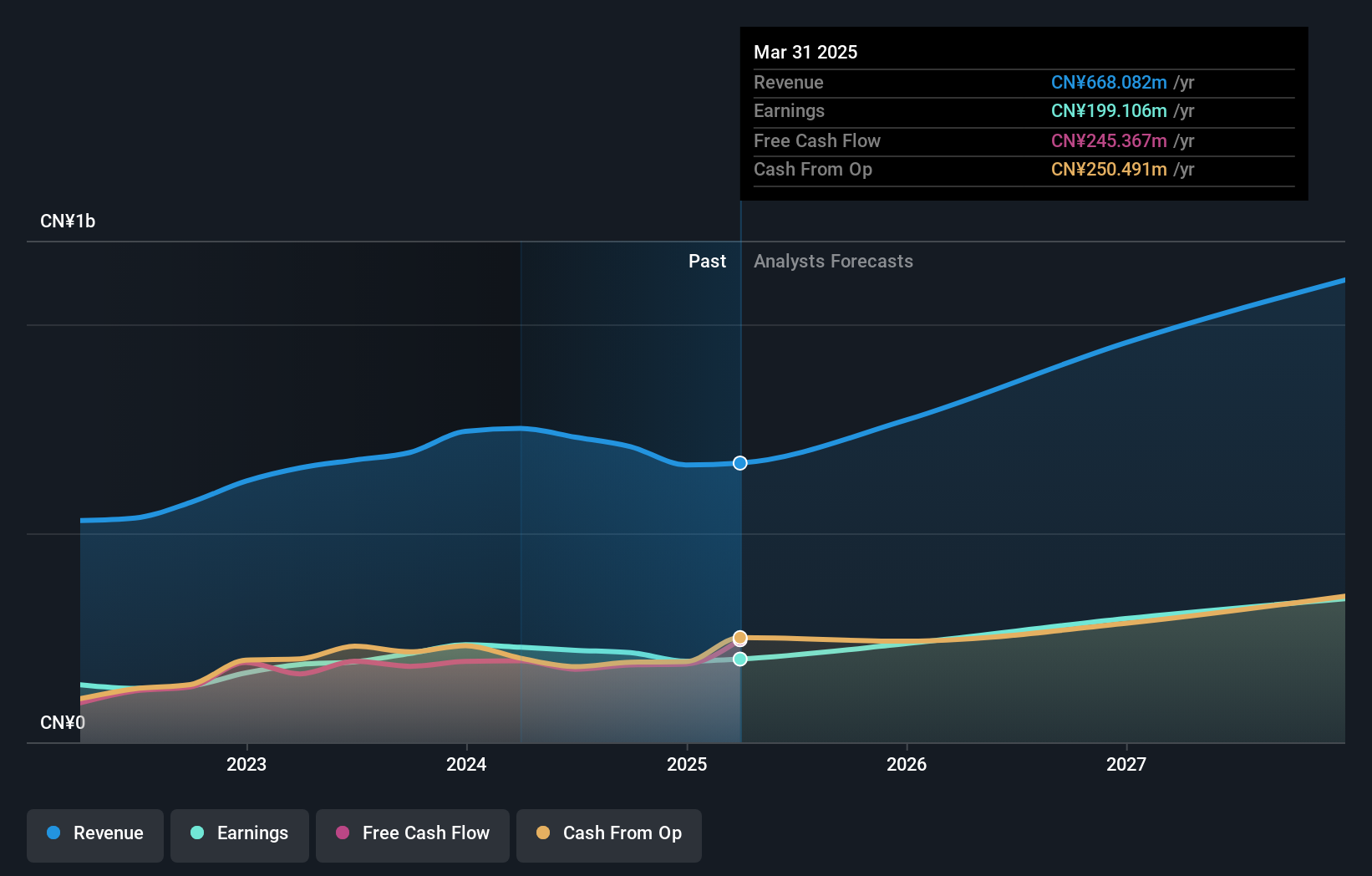

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider company in China with a market capitalization of CN¥8.67 billion.

Operations: Apex Software focuses on providing application software services, generating revenue of CN¥707.34 million from this segment. The company operates within the software and information service industry in China.

Fujian Apex Software Co., LTD, navigating a challenging fiscal year with sales dipping to CNY 420.63 million from CNY 457.21 million, still showcases resilience in its R&D commitment. Despite a softer revenue outlook, the company's dedication to innovation is evident as it continues to allocate substantial resources towards R&D, striving for breakthroughs in software development. This strategy could bolster long-term growth, especially as the industry shifts more towards SaaS models which demand constant technological enhancement and offer recurring revenue streams. The firm's recent earnings reflect a strategic pivot that might not only cushion against current market volatilities but also position it advantageously as industry demands evolve.

- Click here to discover the nuances of Fujian Apex SoftwareLTD with our detailed analytical health report.

Learn about Fujian Apex SoftwareLTD's historical performance.

Hangzhou Arcvideo Technology (SHSE:688039)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Arcvideo Technology Co., Ltd. offers smart and secure video solutions and video cloud services for media platforms, with a market cap of CN¥3.11 billion.

Operations: Arcvideo Technology specializes in providing advanced video solutions and cloud services tailored for media platforms. The company's business model focuses on leveraging technology to enhance video security and delivery, catering to the evolving needs of digital media industries.

Despite a challenging backdrop with sales dipping to CNY 169.11 million from CNY 214.07 million year-over-year, Hangzhou Arcvideo Technology demonstrates resilience with significant R&D investments aimed at reversing its fortunes. The company's recent earnings show a reduction in net loss to CNY 69.45 million from CNY 96.16 million, reflecting tighter cost management and potentially effective strategic shifts. With revenue expected to grow by an impressive 27.9% annually and earnings forecasted to surge by 124.1%, Arcvideo is positioning itself for a robust recovery as it navigates through operational adjustments and market dynamics that favor innovative tech solutions.

Aoshikang Technology (SZSE:002913)

Simply Wall St Growth Rating: ★★★★☆☆

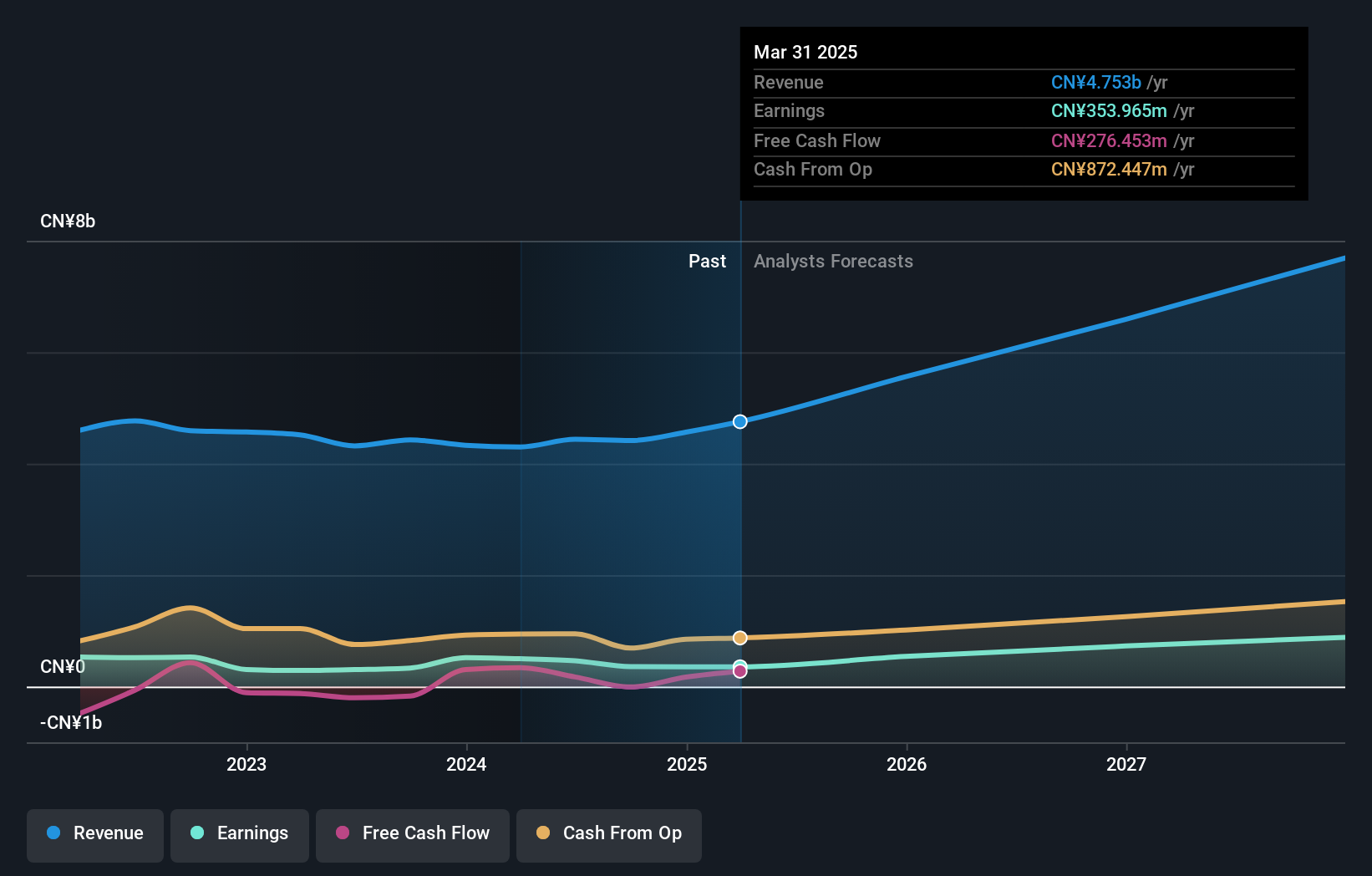

Overview: Aoshikang Technology Co., Ltd. focuses on the research, development, production, and sale of printed circuit boards and has a market capitalization of CN¥7.97 billion.

Operations: Aoshikang Technology Co., Ltd. generates revenue primarily from the production and sale of printed circuit boards. The company has a market capitalization of CN¥7.97 billion, reflecting its established presence in the electronics manufacturing industry.

Aoshikang Technology, amidst a competitive landscape, reported a modest increase in sales to CNY 3.31 billion from CNY 3.22 billion year-over-year, reflecting resilience despite market fluctuations. However, net income dipped to CNY 278.81 million from CNY 440.52 million due to increased operational costs and investments in innovation, particularly in R&D where expenses are rigorously aligned with long-term strategic goals aimed at enhancing technological capabilities and product offerings. This commitment is evident as the company's earnings are projected to grow by an impressive 30.7% annually over the next three years, outpacing the Chinese market's average growth rate of 26.3%, signaling potential robust future performance driven by its innovative edge and expanding market presence.

- Get an in-depth perspective on Aoshikang Technology's performance by reading our health report here.

Understand Aoshikang Technology's track record by examining our Past report.

Turning Ideas Into Actions

- Embark on your investment journey to our 1281 High Growth Tech and AI Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603383

Fujian Apex SoftwareLTD

Operates as a professional platform software and information service provider company in China.

Flawless balance sheet and good value.