3 Stocks Estimated To Be Trading Below Fair Value By Up To 35.2%

Reviewed by Simply Wall St

In the midst of a busy earnings week and mixed economic signals, global markets have experienced some volatility, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before pulling back. Amidst these fluctuations, value stocks have shown resilience compared to their growth counterparts, highlighting opportunities for investors seeking undervalued stocks. In such an environment, identifying stocks that trade below their fair value can be appealing as they may offer potential for appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.00 | SEK347.63 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| Cosmax (KOSE:A192820) | ₩155700.00 | ₩310821.73 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1481.00 | ¥2955.21 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Redcentric (AIM:RCN) | £1.19 | £2.37 | 49.7% |

| Cavotec (OM:CCC) | SEK17.90 | SEK35.56 | 49.7% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Let's review some notable picks from our screened stocks.

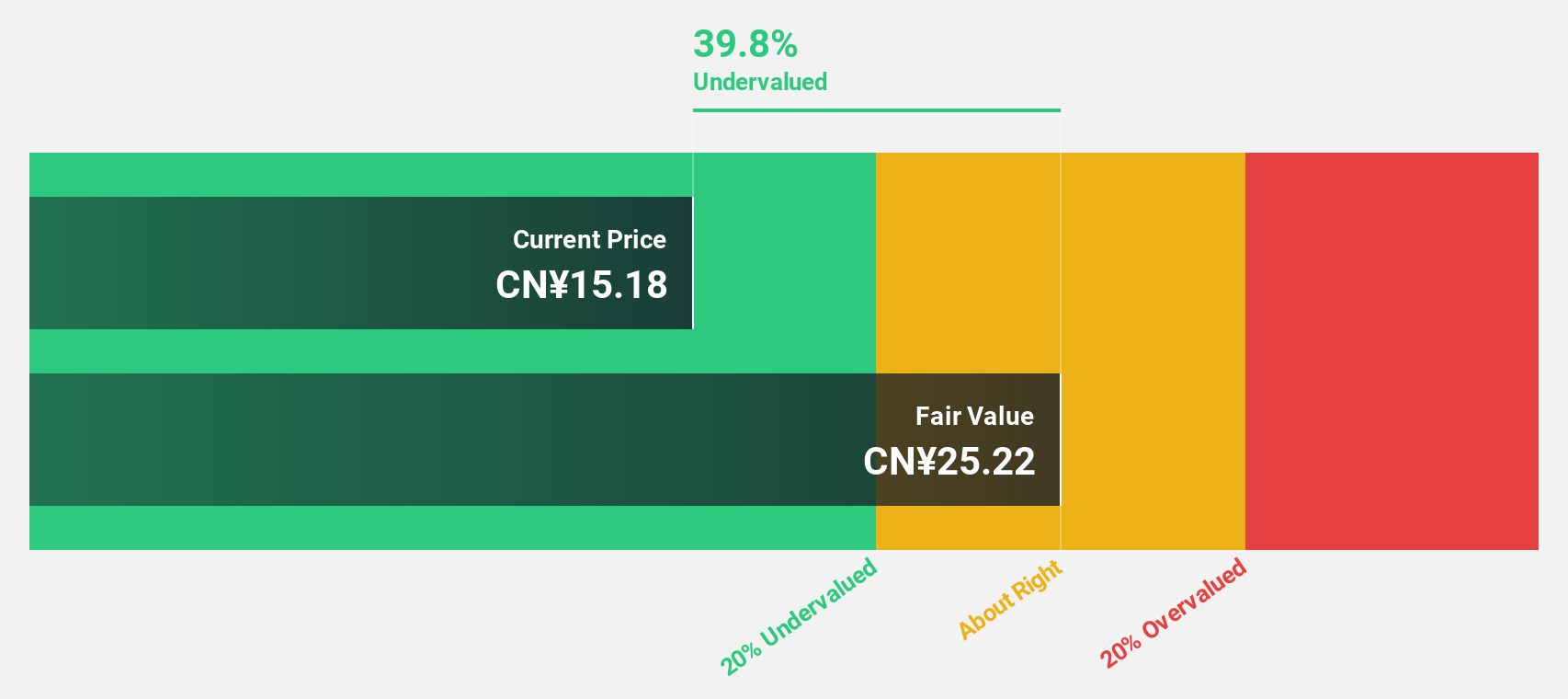

Sichuan Guoguang Agrochemical (SZSE:002749)

Overview: Sichuan Guoguang Agrochemical Co., Ltd. focuses on the research and development, manufacture, marketing, and distribution of agrochemical products and materials both in China and internationally, with a market cap of CN¥6.10 billion.

Operations: Sichuan Guoguang Agrochemical Co., Ltd. generates its revenue through the development, production, and sale of agrochemical products and materials across domestic and international markets.

Estimated Discount To Fair Value: 18%

Sichuan Guoguang Agrochemical is trading at CN¥13.49, below its estimated fair value of CN¥16.45, representing an 18% discount. Despite a low forecasted return on equity of 19.7% in three years and past shareholder dilution, earnings are expected to grow significantly over the next three years at 20.2% annually, outpacing market revenue growth rates. Recent earnings showed increased net income and sales for the nine months ending September 2024 compared to the previous year.

- Our expertly prepared growth report on Sichuan Guoguang Agrochemical implies its future financial outlook may be stronger than recent results.

- Take a closer look at Sichuan Guoguang Agrochemical's balance sheet health here in our report.

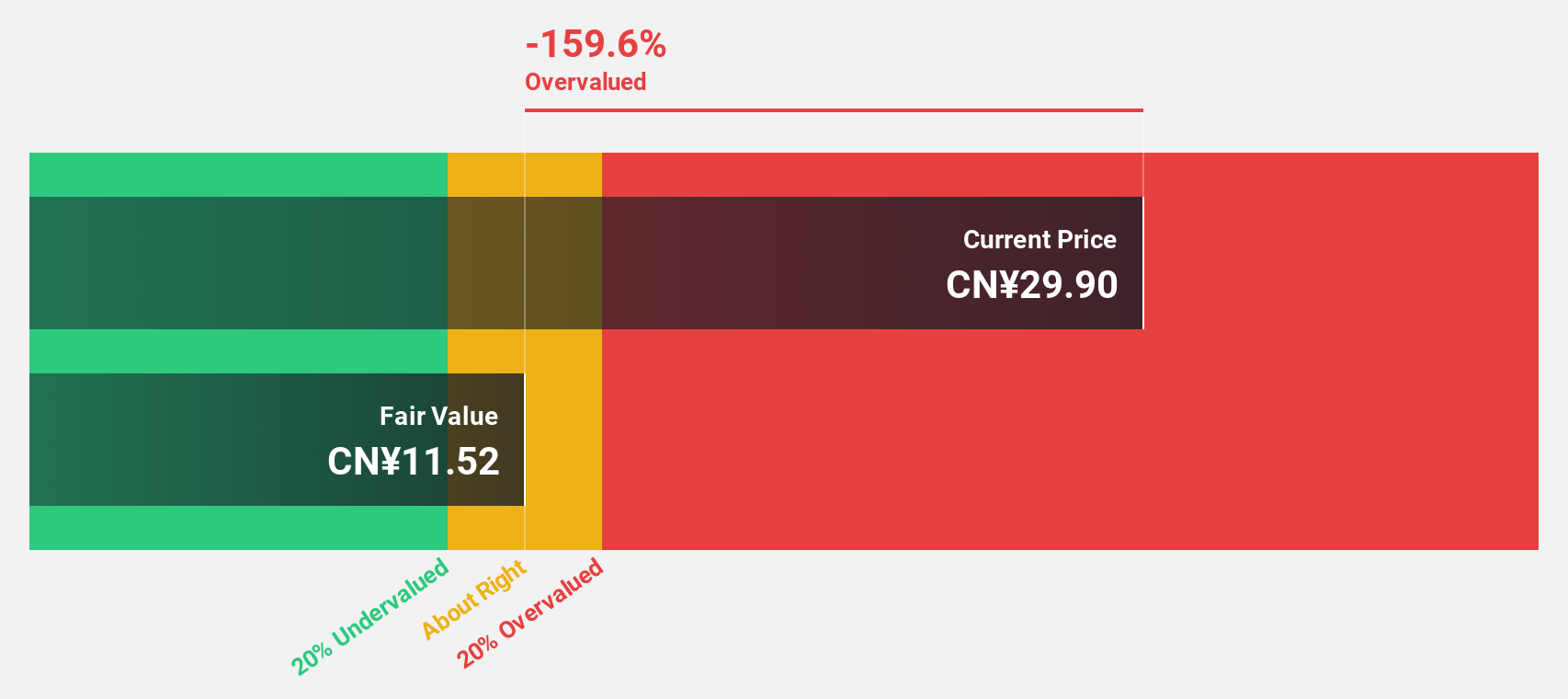

Beijing Career International (SZSE:300662)

Overview: Beijing Career International Co., Ltd. offers human resource and talent solutions, with a market cap of CN¥4.05 billion.

Operations: Beijing Career International Co., Ltd. generates revenue through its human resource and talent solutions offerings.

Estimated Discount To Fair Value: 35.2%

Beijing Career International is trading at CN¥22.69, significantly below its estimated fair value of CN¥34.99, indicating it may be undervalued by over 35%. Despite a volatile share price and reduced profit margins from 2.4% to 1.7%, the company's earnings are projected to grow significantly at 26.32% annually over the next three years, surpassing market averages. Recent results show increased sales but a decline in net income compared to last year’s figures for the nine months ending September 2024.

- Our growth report here indicates Beijing Career International may be poised for an improving outlook.

- Click here to discover the nuances of Beijing Career International with our detailed financial health report.

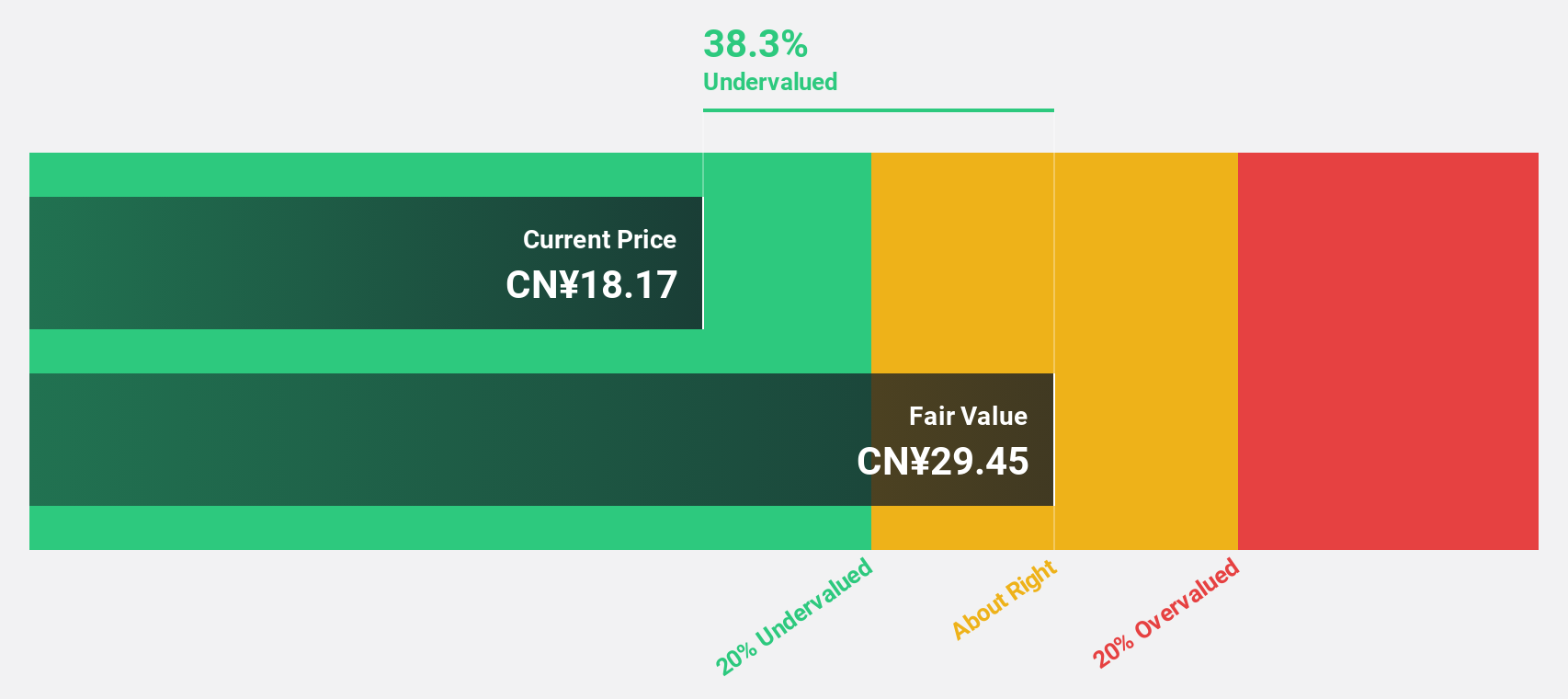

MeHow Innovative (SZSE:301363)

Overview: Mehow Innovative Ltd. designs, develops, manufactures, and sells precision medical device components and products both in China and internationally with a market cap of CN¥13.35 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 17.2%

MeHow Innovative, trading at CN¥33.53, is priced 17.2% below its estimated fair value of CN¥40.48, suggesting potential undervaluation. Despite a decrease in net income from CN¥300.07 million to CN¥257.85 million for the nine months ending September 2024, revenue increased from CN¥1,043.3 million to CN¥1,156.57 million year-over-year. Earnings are expected to grow significantly at 31.53% annually over the next three years, outpacing both market and revenue growth rates in China.

- In light of our recent growth report, it seems possible that MeHow Innovative's financial performance will exceed current levels.

- Dive into the specifics of MeHow Innovative here with our thorough financial health report.

Where To Now?

- Click through to start exploring the rest of the 924 Undervalued Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002749

Sichuan Guoguang Agrochemical

Engages in the research and development, manufacture, marketing, and distribution of agrochemical products and materials in China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives