- China

- /

- Electronic Equipment and Components

- /

- SHSE:688665

High Growth Tech Stocks To Watch For Potential Portfolio Strength

Reviewed by Simply Wall St

In a week marked by cautious earnings reports and mixed economic signals, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 briefly hit record highs before retreating, while small-cap stocks showed resilience compared to their larger counterparts. As investors navigate this landscape of fluctuating market sentiment and economic uncertainty, identifying high growth tech stocks with strong fundamentals and potential for innovation can be crucial for strengthening portfolios amidst these dynamic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1282 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

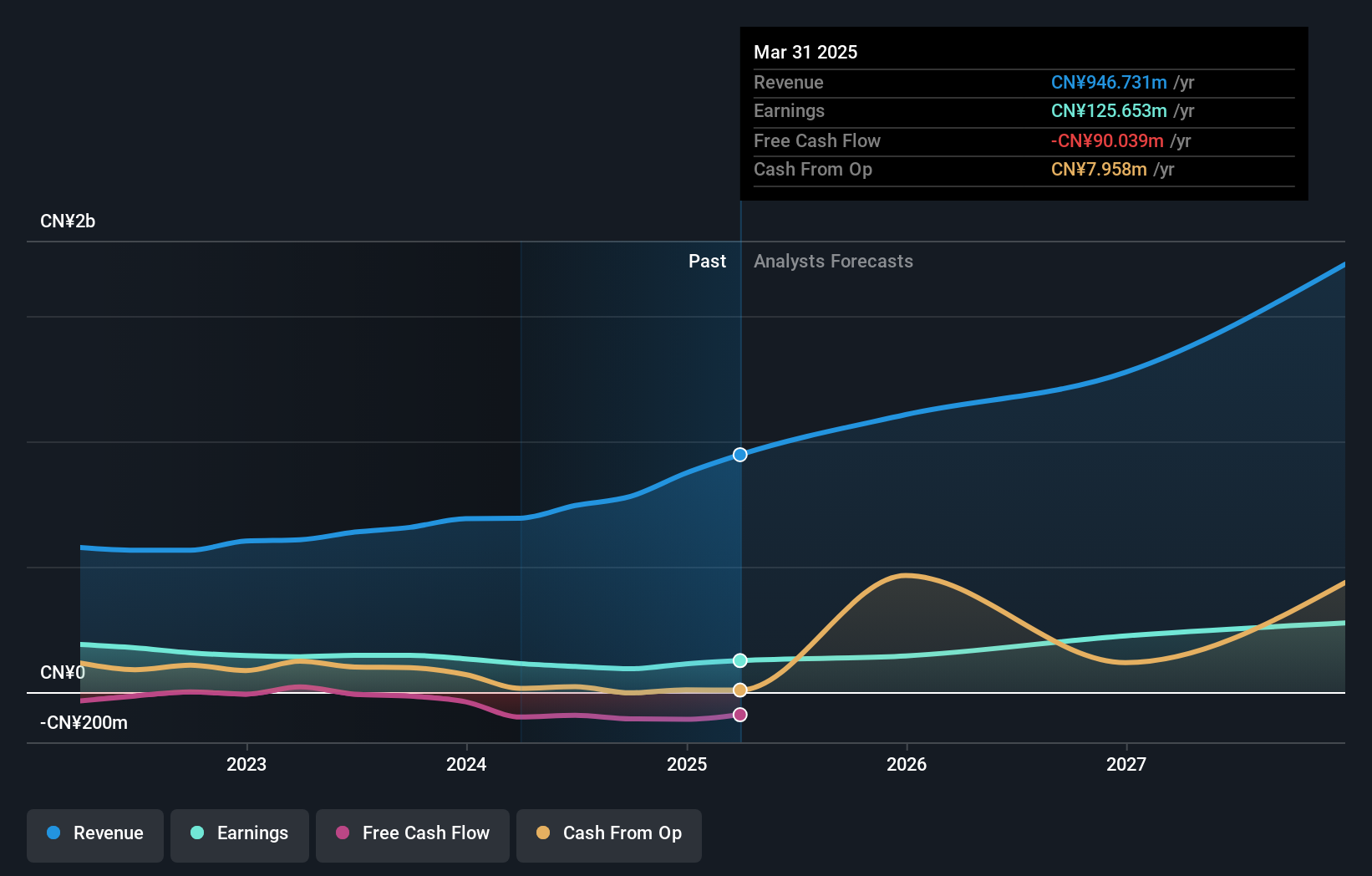

Cubic Sensor and InstrumentLtd (SHSE:688665)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cubic Sensor and Instrument Co., Ltd. is a Chinese company specializing in the manufacturing of gas sensors and sensor solutions, with a market cap of CN¥3.08 billion.

Operations: Cubic Sensor and Instrument Co., Ltd. focuses on producing gas sensors and sensor solutions in China. The company generates revenue primarily from its sensor products, which are integral to various industrial applications.

Cubic Sensor and Instrument Co., Ltd. has demonstrated a robust trajectory in revenue growth, reporting a 19.6% increase year-over-year to CNY 540.44 million for the first nine months of 2024, despite a downturn in net income from CNY 101.28 million to CNY 61.56 million over the same period. This decline reflects broader challenges but is juxtaposed with an optimistic earnings forecast, expecting a surge of approximately 42.9% annually over the next three years. The company's commitment to innovation is evident from its R&D spending trends which align closely with its strategic priorities in high-tech development, crucial for maintaining competitive edge in the fast-evolving tech landscape. With revenue growth outpacing the Chinese market average at an impressive rate of 25.8% per year, Cubic Sensor and Instrument is poised above many peers, suggesting strong market demand for its offerings. However, it's crucial to note that while earnings are projected to grow significantly, current profit margins have contracted to 11.9%, down sharply from last year's 22.3%. This contraction underscores the need for careful monitoring of operational efficiencies and cost management strategies as they scale up their technological advancements and capitalize on emerging opportunities within the tech sector.

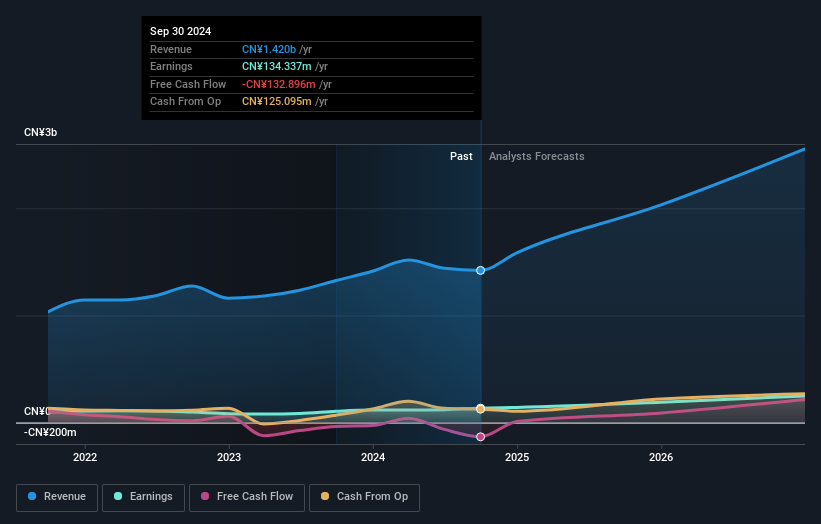

Beijing Kawin Technology Share-Holding (SHSE:688687)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Kawin Technology Share-Holding Co., Ltd. operates in the field of medicine manufacturing and has a market capitalization of approximately CN¥4.63 billion.

Operations: Kawin Technology generates its revenue primarily from medicine manufacturing, amounting to CN¥1.42 billion.

Beijing Kawin Technology Share-Holding Co., Ltd. has shown a promising uptick in its financial performance, with a revenue increase to CNY 1.01 billion and net income rising to CNY 108.07 million in the nine months ending September 2024, up from CNY 90.25 million the previous year. This growth is underpinned by substantial investments in R&D, reflecting a strategic focus on innovation to stay competitive within the tech industry; indeed, their commitment to research has facilitated a notable earnings forecast of an annual increase of 28.6%. Additionally, this firm's ability to outpace industry average revenue growth rates—20.4% compared to the broader market's 14%—signals strong market demand and potential leadership in its sector moving forward.

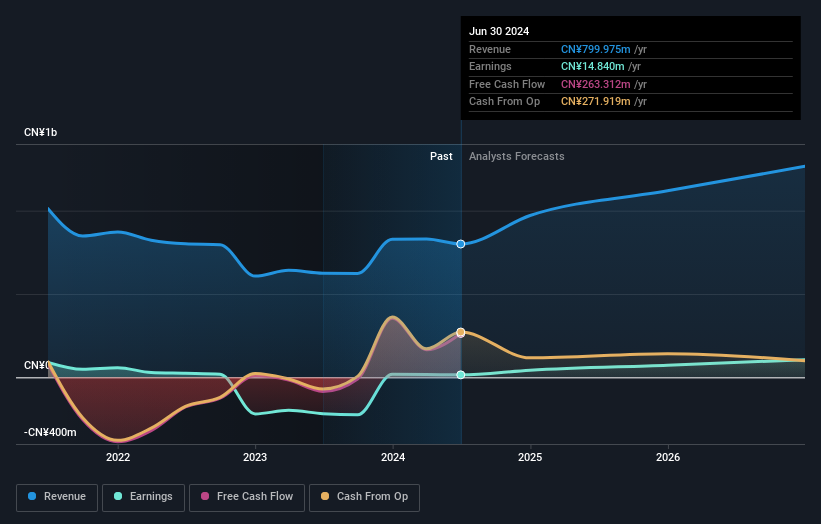

Beijing Forever Technology (SZSE:300365)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Forever Technology Co., Ltd. offers smart grid solutions and services both within China and internationally, with a market capitalization of CN¥3.88 billion.

Operations: The company specializes in smart grid solutions, catering to both domestic and international markets. It operates with a market capitalization of CN¥3.88 billion.

Beijing Forever Technology has demonstrated resilience with a revenue of CNY 313.98 million for the nine months ending September 2024, despite a slight dip from the previous year's CNY 338 million. This period's net income settled at CNY 9.29 million, reflecting challenges yet underscoring potential in strategic areas like R&D where expenses are keenly allocated to foster innovation and competitiveness in the tech sector. Notably, their commitment to research has propelled expectations of earnings growth by an impressive 64.6% annually, suggesting robust future prospects despite current volatility and market pressures.

- Dive into the specifics of Beijing Forever Technology here with our thorough health report.

Learn about Beijing Forever Technology's historical performance.

Key Takeaways

- Investigate our full lineup of 1282 High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688665

Cubic Sensor and InstrumentLtd

Manufactures gas sensors and sensor solutions in China.

Exceptional growth potential with adequate balance sheet.