Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, small-cap stocks have shown resilience compared to their large-cap counterparts, even as major indexes like the S&P 500 and Nasdaq Composite experienced declines. This environment of cautious optimism presents an opportunity to explore lesser-known small-cap stocks that exhibit strong potential due to their robust fundamentals and adaptability in navigating current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Thai Energy Storage Technology | 11.21% | -1.12% | 0.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Petchsrivichai Enterprise | 31.46% | -14.18% | nan | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

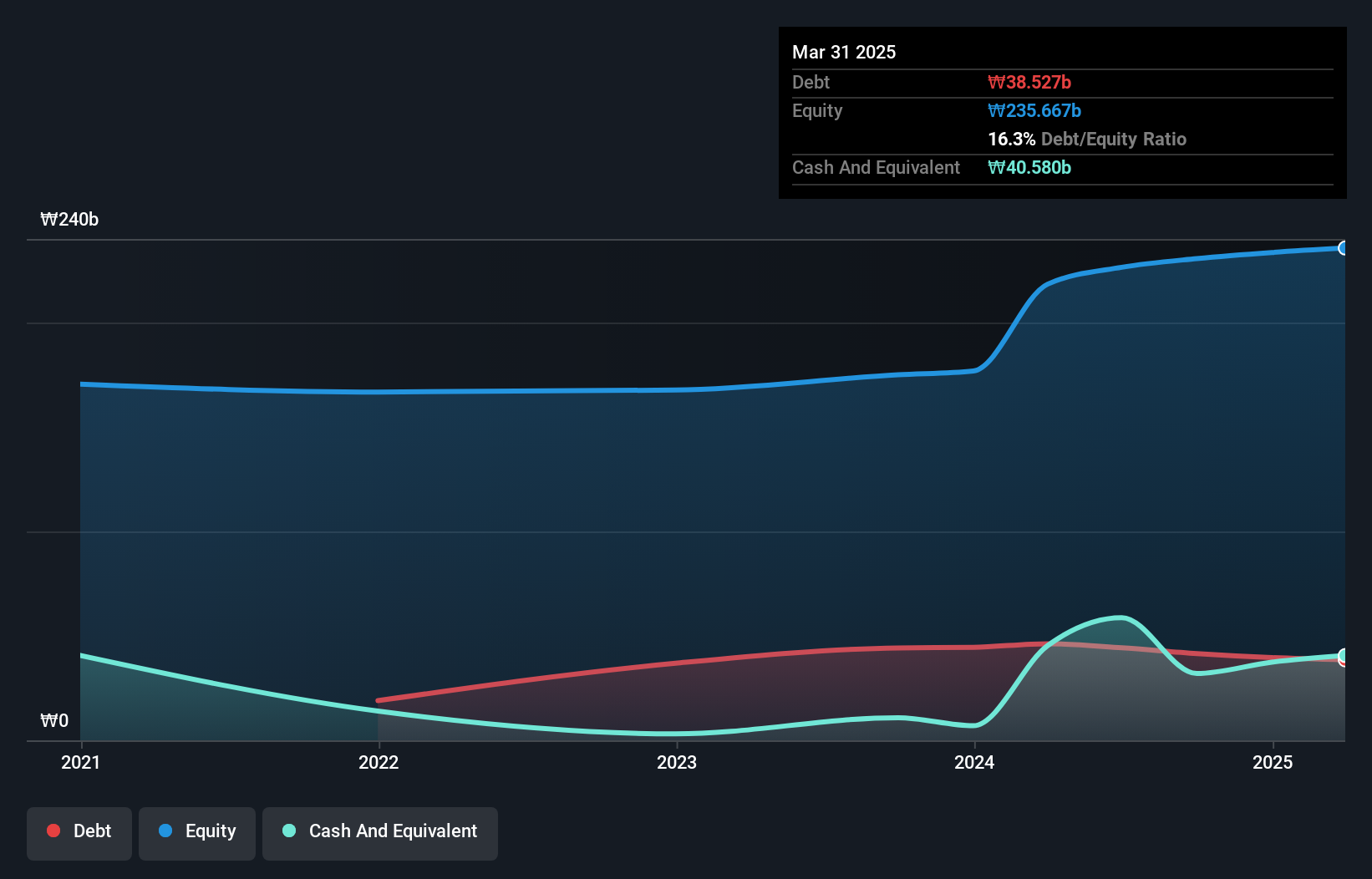

Hyundai Hyms (KOSDAQ:A460930)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai Hyms Co., Ltd. is a South Korean company that manufactures and sells shipbuilding equipment, with a market cap of ₩364 billion.

Operations: Hyundai Hyms generates revenue primarily from its shipbuilding segment, amounting to ₩214.43 billion.

Hyundai Hyms, a notable player in the machinery sector, has recently been added to the S&P Global BMI Index. Over the past year, its earnings surged by 89.9%, outpacing the industry's 5.4% growth rate. The company's financial health appears robust with cash exceeding total debt and interest payments well-covered at 8.3 times by EBIT. Free cash flow turned positive in recent quarters, reaching US$15 million as of June 2024, indicating improved operational efficiency despite capital expenditures of about US$10 million during the same period. These factors suggest Hyundai Hyms is on a promising trajectory within its industry context.

- Delve into the full analysis health report here for a deeper understanding of Hyundai Hyms.

Understand Hyundai Hyms' track record by examining our Past report.

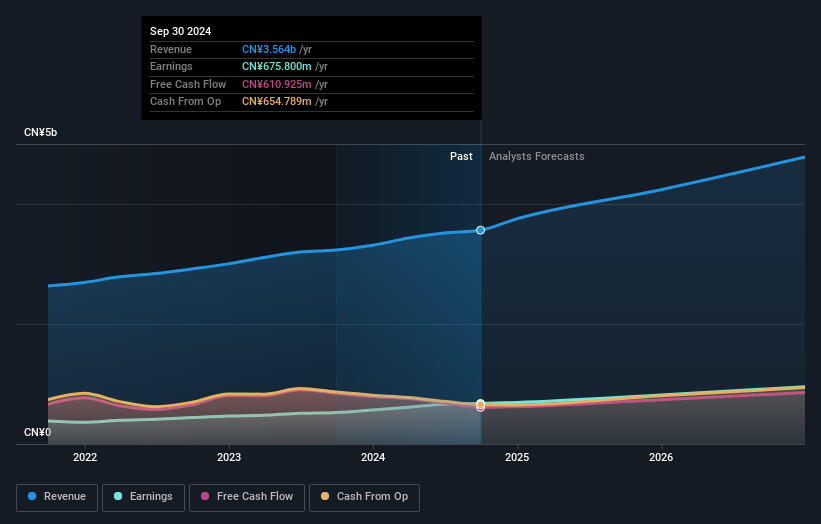

Henan Lingrui Pharmaceutical (SHSE:600285)

Simply Wall St Value Rating: ★★★★★★

Overview: Henan Lingrui Pharmaceutical Co., Ltd. is a company that produces and sells medicines in China, with a market cap of CN¥12.13 billion.

Operations: Henan Lingrui Pharmaceutical generates revenue primarily from the production and sale of medicines within China. The company's market capitalization stands at CN¥12.13 billion, reflecting its scale in the pharmaceutical industry.

Henan Lingrui Pharmaceutical, a nimble player in the pharmaceuticals sector, showcases impressive financial health with earnings growth of 28.4% over the past year, outpacing an industry decline of 1.2%. The company is trading at a compelling value, estimated to be 50.1% below its fair value, and has reduced its debt-to-equity ratio from 9% to just 0.4% over five years. Recent earnings reports reveal sales climbing to CNY 2.76 billion from CNY 2.51 billion year-on-year and net income rising to CNY 573 million from CNY 466 million, indicating robust performance amidst market challenges.

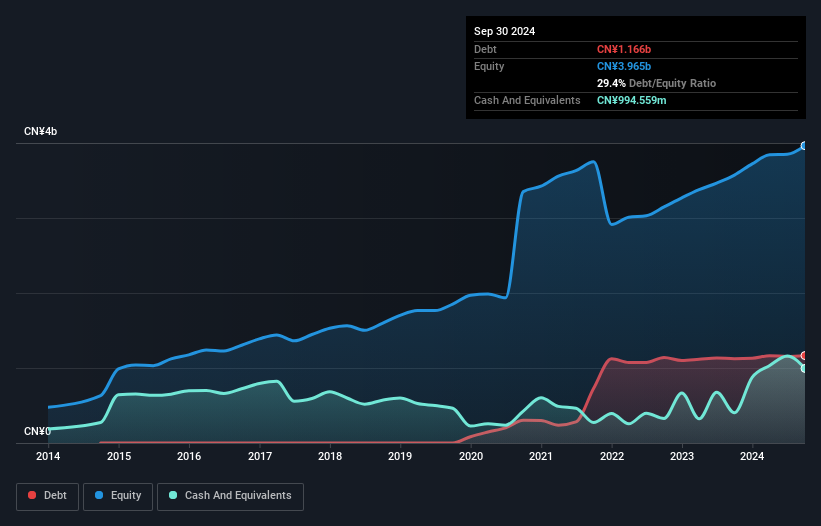

Beijing Strong BiotechnologiesInc (SZSE:300406)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Strong Biotechnologies, Inc. provides in-vitro diagnostics products and services both domestically in China and internationally, with a market capitalization of approximately CN¥8.19 billion.

Operations: The company's primary revenue stream is from its biomedicine segment, generating CN¥1.75 billion.

Beijing Strong Biotechnologies, with its high-quality earnings, seems to be an intriguing player in the biotech arena. The company reported CNY 1.24 billion in sales for the first nine months of 2024, showing a stable performance compared to last year. Net income reached CNY 373 million, reflecting consistent profitability. Despite a rise in debt-to-equity ratio from 0% to 29.4% over five years, its interest payments are well-covered by EBIT at a robust 28x coverage. Trading at nearly half below estimated fair value and forecasted earnings growth of over 23% annually suggests potential upside for investors looking into this sector.

Taking Advantage

- Explore the 4702 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henan Lingrui Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600285

Outstanding track record with flawless balance sheet and pays a dividend.