3 Growth Companies With Insider Ownership And 125% Earnings Growth

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets saw mixed performances, with major U.S. indices like the Nasdaq Composite and S&P MidCap 400 experiencing highs before retreating. Amidst this backdrop of cautious optimism and volatility, investors are increasingly drawn to growth companies with strong insider ownership, as these firms often demonstrate robust alignment between management interests and shareholder value—a key consideration in today's fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's take a closer look at a couple of our picks from the screened companies.

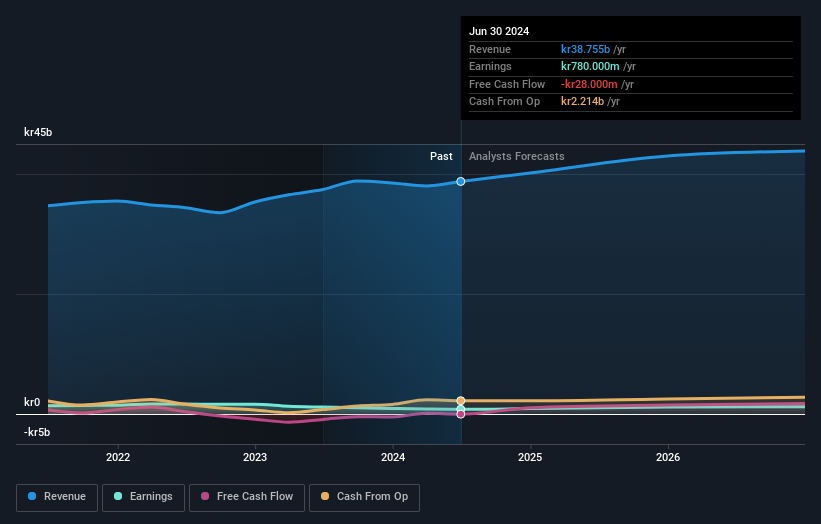

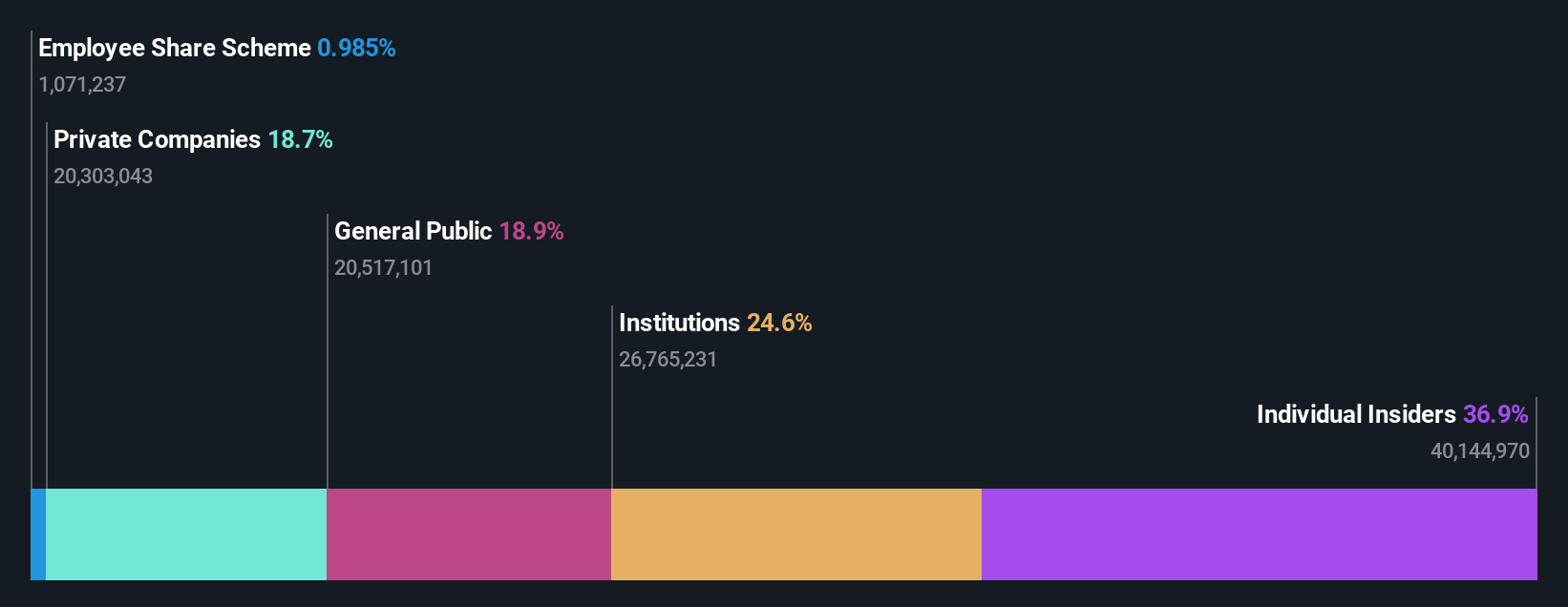

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership operating in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK11.76 billion.

Operations: The company's revenue segments include Car - Sweden with SEK19.85 billion, Car - Norway with SEK7.39 billion, Service - Sweden with SEK6.50 billion, Car - Western Europe with SEK3.53 billion, Service - Norway with SEK2.29 billion, Fuel at SEK964 million, and Service - Western Europe at SEK678 million.

Insider Ownership: 16.9%

Earnings Growth Forecast: 24.6% p.a.

Bilia's insider ownership is highlighted by recent buying activity, albeit in modest volumes. Despite a decrease in net profit margin from 2.7% to 1.8%, Bilia remains undervalued, trading at 72.2% below estimated fair value. Earnings are expected to grow significantly at 24.56% annually, surpassing the Swedish market's growth rate of 15.6%. However, its dividend yield of 5.19% isn't well supported by free cash flows, indicating potential sustainability concerns.

- Click here and access our complete growth analysis report to understand the dynamics of Bilia.

- Our comprehensive valuation report raises the possibility that Bilia is priced lower than what may be justified by its financials.

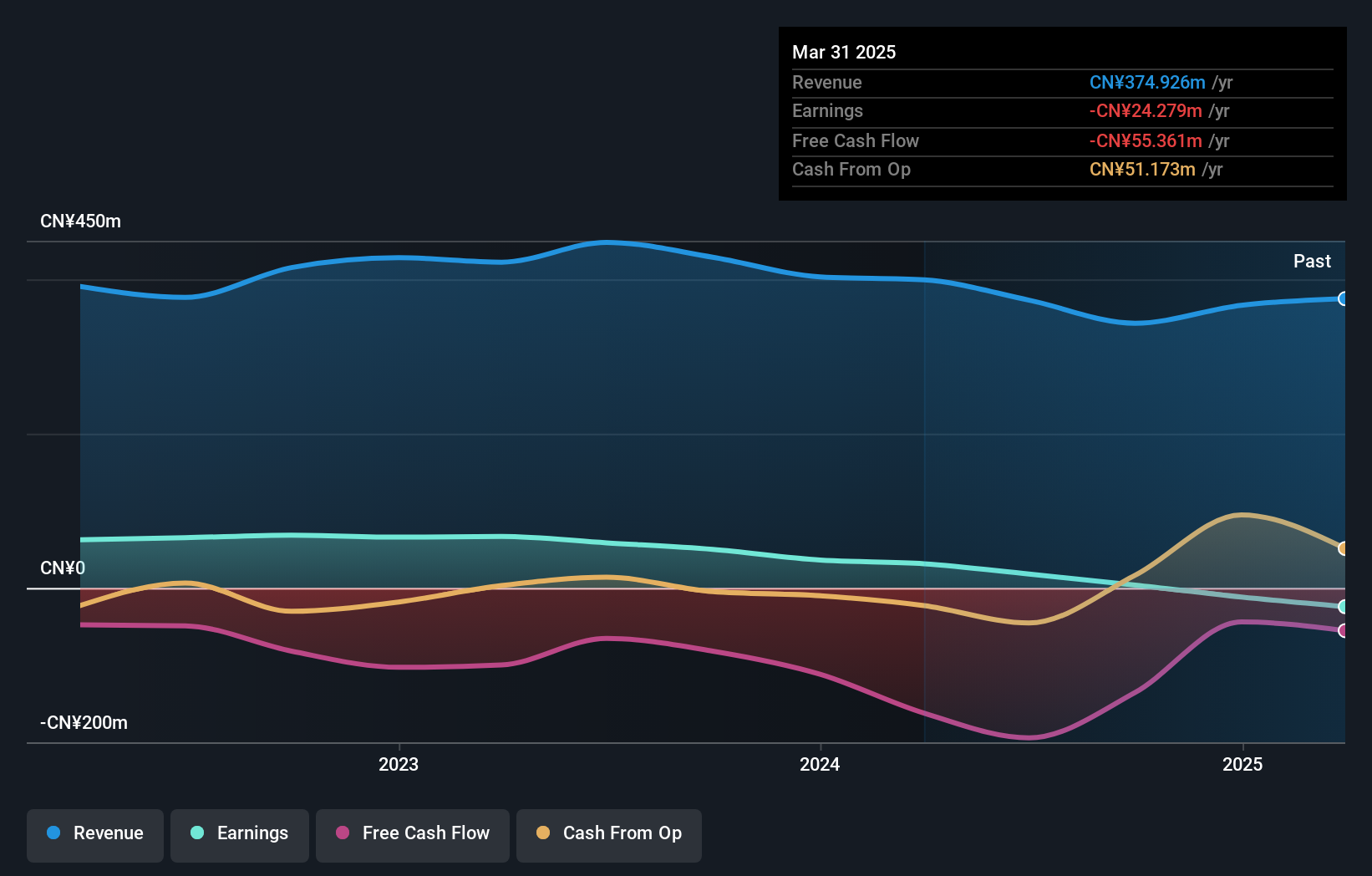

Chipsea Technologies (shenzhen) (SHSE:688595)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chipsea Technologies (shenzhen) Corp. is a chip design company specializing in ADCs, MCUs, measurement algorithms, and IoT solutions in China with a market cap of CN¥4.93 billion.

Operations: Chipsea Technologies (shenzhen) Corp.'s revenue is primarily derived from its expertise in designing analog-to-digital converters (ADCs), microcontroller units (MCUs), and developing measurement algorithms, alongside providing comprehensive IoT solutions within China.

Insider Ownership: 28.4%

Earnings Growth Forecast: 125.3% p.a.

Chipsea Technologies (Shenzhen) demonstrates strong growth potential with forecasted annual revenue growth of 27.2%, outpacing the Chinese market. Despite reporting a net loss of CNY 114.98 million for the nine months ended September 2024, its earnings are expected to grow by over 125% annually, becoming profitable within three years. However, the company's share price has been highly volatile recently and there is no substantial insider trading activity in the last three months.

- Navigate through the intricacies of Chipsea Technologies (shenzhen) with our comprehensive analyst estimates report here.

- The analysis detailed in our Chipsea Technologies (shenzhen) valuation report hints at an inflated share price compared to its estimated value.

Ningbo Joy Intelligent Logistics TechnologyLtd (SZSE:301198)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Joy Intelligent Logistics Technology Co., Ltd. operates in the logistics technology sector, focusing on intelligent solutions, with a market cap of CN¥1.86 billion.

Operations: The company generates revenue of CN¥343.05 million from its Packaging & Containers segment.

Insider Ownership: 13.6%

Earnings Growth Forecast: 52.7% p.a.

Ningbo Joy Intelligent Logistics Technology Ltd. faces challenges with declining revenue and net income, reporting CNY 255.52 million in sales for the first nine months of 2024, down from CNY 315.66 million a year ago. Despite this, earnings are forecasted to grow significantly at 52.65% annually over the next three years, surpassing market expectations. However, profit margins have decreased to 1.1%, and its share price has been highly volatile recently without substantial insider trading activity noted.

- Dive into the specifics of Ningbo Joy Intelligent Logistics TechnologyLtd here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Ningbo Joy Intelligent Logistics TechnologyLtd's current price could be inflated.

Summing It All Up

- Investigate our full lineup of 1522 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Joy Intelligent Logistics TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301198

Ningbo Joy Intelligent Logistics TechnologyLtd

Ningbo Joy Intelligent Logistics Technology Co.,Ltd.

Reasonable growth potential with adequate balance sheet.