As global markets navigate a complex landscape marked by cautious earnings reports and fluctuating economic signals, investors are keenly observing the performance of major indices. Despite some sectors facing headwinds, dividend stocks continue to attract attention for their potential to provide steady income amid market volatility. In such an environment, selecting stocks with strong fundamentals and consistent dividend histories can be a prudent strategy for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.12% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.00% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

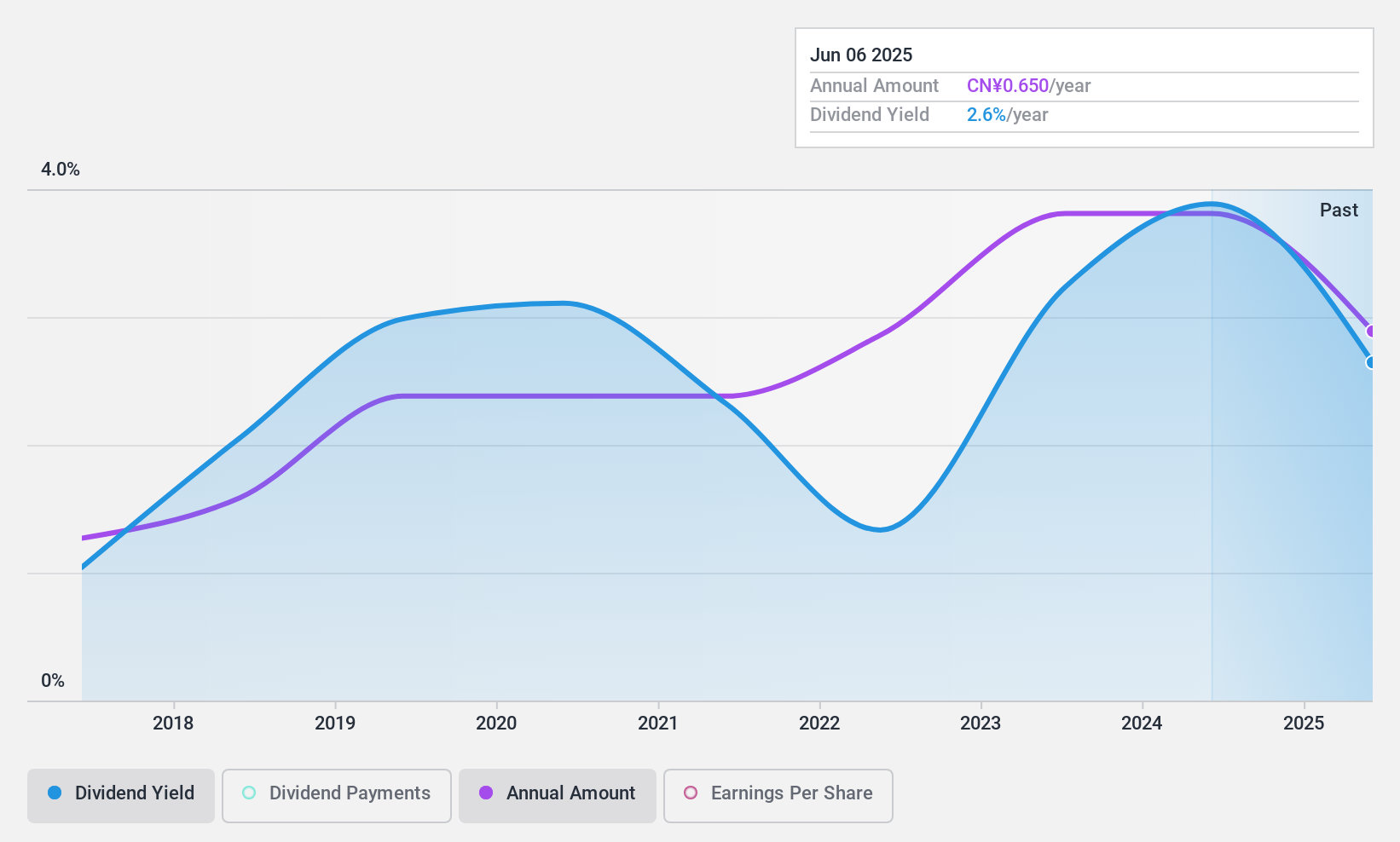

Comefly Outdoor (SHSE:603908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Comefly Outdoor Co., Ltd., operating as MOBI GARDEN, focuses on the research, design, development, and sale of outdoor products in China with a market capitalization of CN¥2.04 billion.

Operations: Comefly Outdoor Co., Ltd. generates its revenue through the sale of outdoor products in China.

Dividend Yield: 3.6%

Comefly Outdoor's dividend strategy shows strengths and weaknesses. Despite a decline in sales and net income, the company's dividends are well-covered by earnings (76.1% payout ratio) and cash flows (51.3% cash payout ratio). The dividend yield is competitive at 3.57%, ranking in the top 25% of CN market payers, though its track record is short at eight years with some instability noted. The stock trades below estimated fair value, suggesting potential for capital appreciation alongside income generation.

- Get an in-depth perspective on Comefly Outdoor's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Comefly Outdoor is trading behind its estimated value.

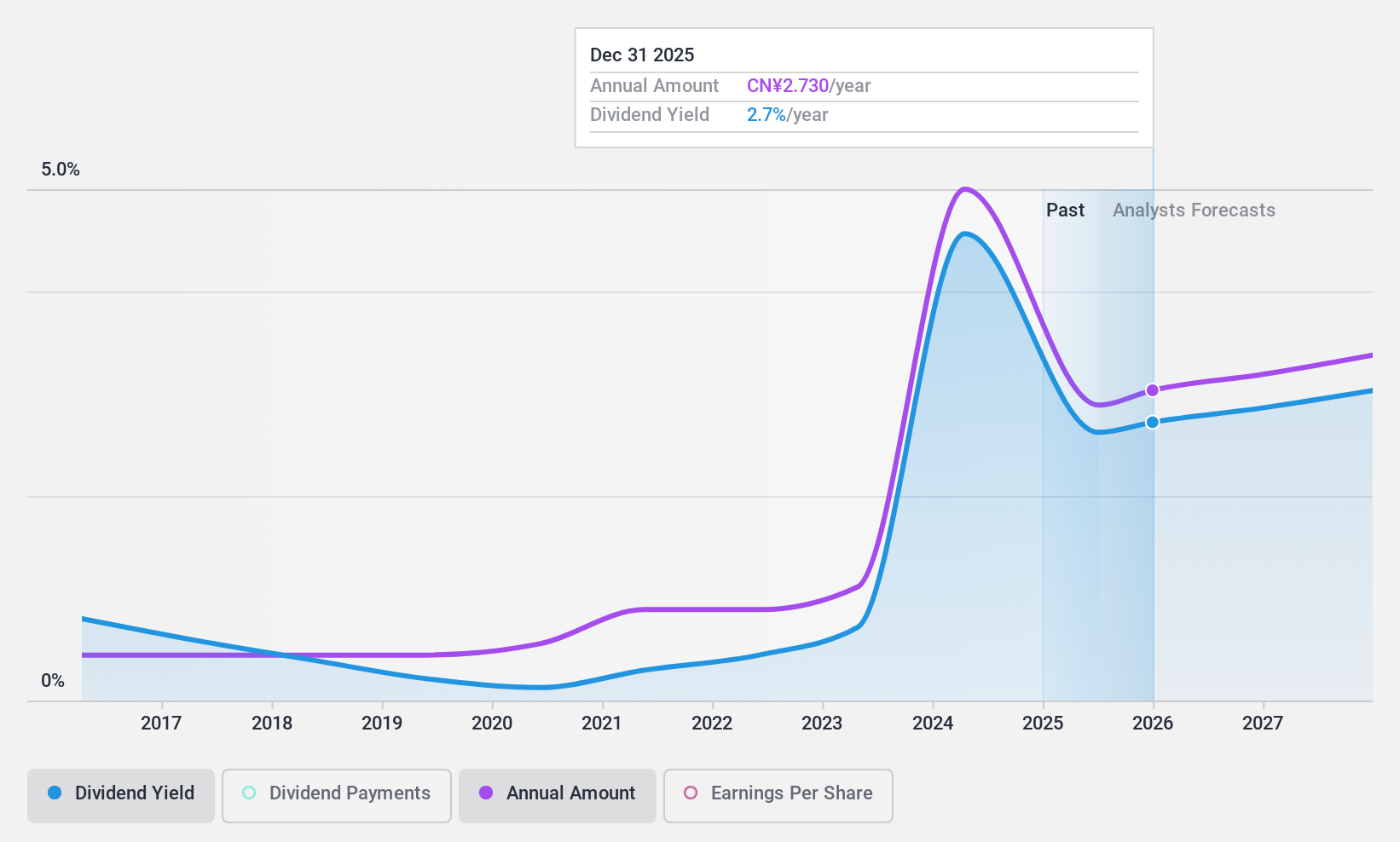

Changchun High-Tech Industry (Group) (SZSE:000661)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changchun High-Tech Industry (Group) Co., Ltd. engages in the research, development, manufacturing, and sale of biopharmaceuticals and traditional Chinese medicine products in China, with a market cap of CN¥43.51 billion.

Operations: Changchun High-Tech Industry (Group) Co., Ltd. generates revenue primarily from its biopharmaceuticals and traditional Chinese medicine products in China.

Dividend Yield: 3.9%

Changchun High-Tech Industry's dividend strategy is notable for its reliability and growth over the past decade, supported by a manageable payout ratio of 49.1% and cash flow coverage at 81.5%. Despite recent declines in net income to CNY 2.79 billion for the first nine months of 2024, dividends remain well-covered by earnings and cash flows. The stock offers an attractive dividend yield of 3.91%, ranking in the top quartile among Chinese market payers, while trading at a favorable price-to-earnings ratio of 12.5x compared to the broader market.

- Take a closer look at Changchun High-Tech Industry (Group)'s potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Changchun High-Tech Industry (Group) is priced lower than what may be justified by its financials.

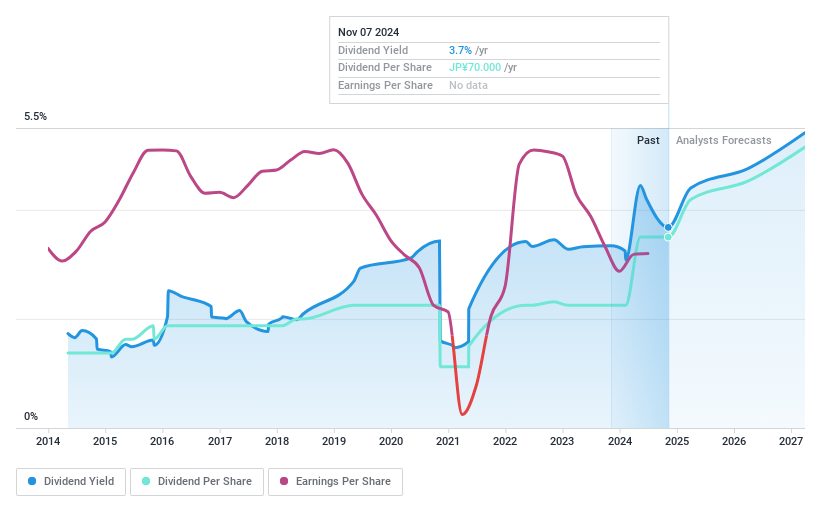

Nippon Shokubai (TSE:4114)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Shokubai Co., Ltd. is involved in the manufacturing and sale of a wide range of chemical products both in Japan and globally, with a market capitalization of ¥256.35 billion.

Operations: Nippon Shokubai Co., Ltd.'s revenue is primarily derived from its Materials segment, which generated ¥304.94 billion, and its Solutions segment, contributing ¥113.75 billion.

Dividend Yield: 3.7%

Nippon Shokubai's dividends are supported by a payout ratio of 63.2% and a cash payout ratio of 26.9%, indicating strong coverage by earnings and cash flows. Despite a recent dividend cut, the company's dividends have been stable over the past decade. The stock trades below its estimated fair value, while recent share buybacks totaling ¥4,999.93 million may enhance shareholder value amid ongoing business expansions in battery materials production.

- Click here and access our complete dividend analysis report to understand the dynamics of Nippon Shokubai.

- In light of our recent valuation report, it seems possible that Nippon Shokubai is trading beyond its estimated value.

Taking Advantage

- Investigate our full lineup of 1933 Top Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603908

Comefly Outdoor

Comefly Outdoor Co., Ltd., doing business as MOBI GARDEN, engages in the research, design, development, and sale of outdoor products in China.

Excellent balance sheet, good value and pays a dividend.