- China

- /

- Personal Products

- /

- SHSE:603605

3 Promising Stocks Estimated To Be Undervalued By Up To 46.8%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed earnings reports and economic uncertainties, investors are keenly observing shifts in major indices. With growth stocks lagging behind value shares and small-caps performing better than large-caps, the focus on identifying undervalued opportunities has intensified. In this context, finding stocks that are potentially undervalued can be particularly appealing as they may offer growth potential despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Nordic Waterproofing Holding (OM:NWG) | SEK175.00 | SEK347.63 | 49.7% |

| On the Beach Group (LSE:OTB) | £1.522 | £3.03 | 49.8% |

| Cosmax (KOSE:A192820) | ₩155700.00 | ₩310821.73 | 49.9% |

| EnomotoLtd (TSE:6928) | ¥1481.00 | ¥2955.21 | 49.9% |

| Laboratorio Reig Jofre (BME:RJF) | €2.88 | €5.74 | 49.8% |

| Redcentric (AIM:RCN) | £1.19 | £2.37 | 49.7% |

| Cavotec (OM:CCC) | SEK17.90 | SEK35.56 | 49.7% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.01 | US$545.05 | 49.9% |

| Orascom Development Holding (SWX:ODHN) | CHF3.90 | CHF7.79 | 49.9% |

| Cellnex Telecom (BME:CLNX) | €32.50 | €64.80 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

DPC Dash (SEHK:1405)

Overview: DPC Dash Ltd, along with its subsidiaries, operates a chain of fast-food restaurants in the People's Republic of China and has a market cap of HK$8.70 billion.

Operations: The company generates revenue primarily from its fast-food restaurant operations in the People’s Republic of China, amounting to CN¥3.72 billion.

Estimated Discount To Fair Value: 44.1%

DPC Dash is trading significantly below its estimated fair value of HK$128.14 at HK$71.65, suggesting it may be undervalued based on cash flows. The company is expected to achieve revenue growth of 24.9% annually, surpassing the Hong Kong market average of 7.8%. Despite low forecasted return on equity and recent insider selling, DPC Dash's earnings are projected to grow substantially by over 100% per year as it becomes profitable within three years.

- The growth report we've compiled suggests that DPC Dash's future prospects could be on the up.

- Take a closer look at DPC Dash's balance sheet health here in our report.

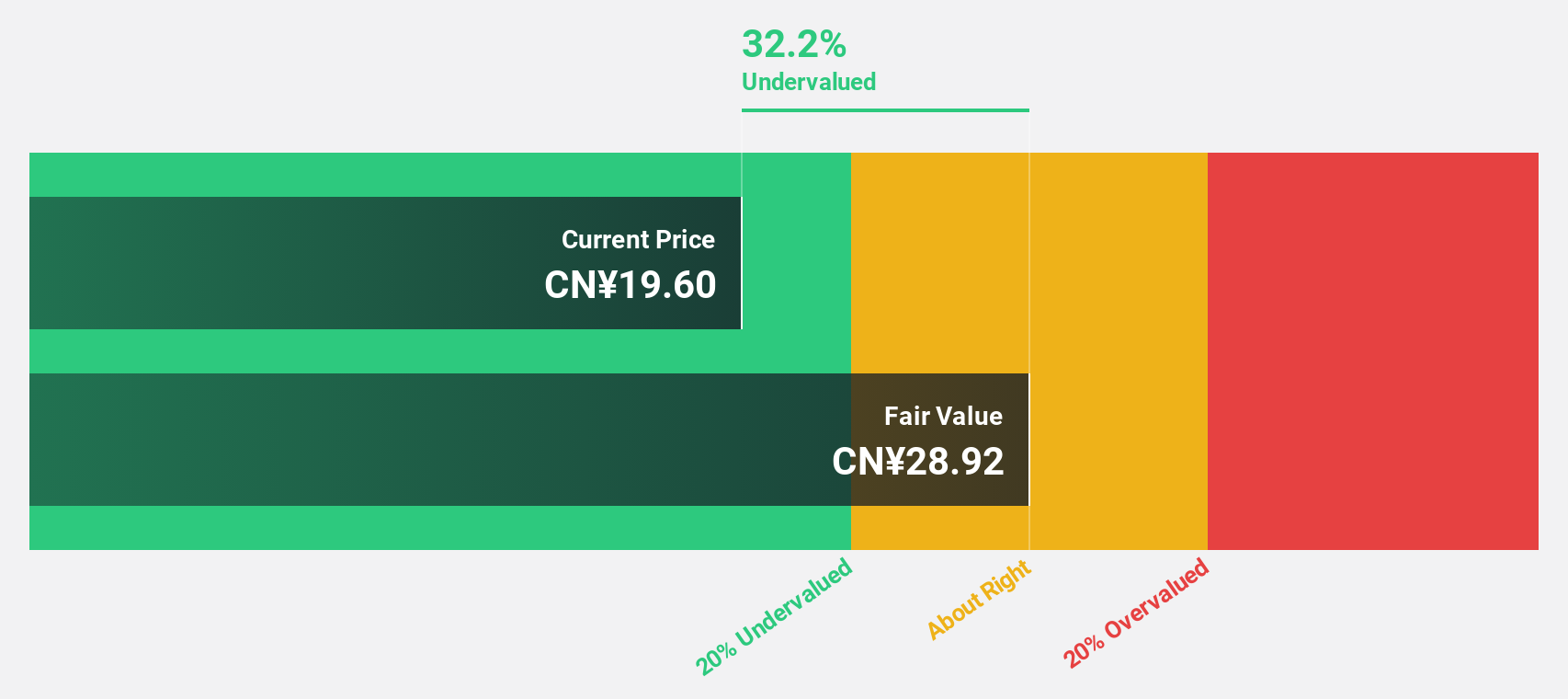

Proya CosmeticsLtd (SHSE:603605)

Overview: Proya Cosmetics Co., Ltd. is a beauty and personal care company that researches, develops, produces, and sells cosmetics in China with a market cap of CN¥38.18 billion.

Operations: Unfortunately, the specific revenue segment details for Proya Cosmetics Co., Ltd. are not provided in the text you shared. Please provide the relevant financial data so I can help summarize it for you.

Estimated Discount To Fair Value: 46.2%

Proya Cosmetics Ltd. is trading well below its estimated fair value of CN¥192.45 at CN¥103.54, indicating potential undervaluation based on cash flows. The company's revenue growth forecast of 20.5% annually outpaces the Chinese market average of 14%, and earnings are expected to grow significantly over the next three years despite being slower than the market's 26.3%. Recent reports show a robust increase in sales and net income for the nine months ended September 2024, highlighting strong financial performance amidst high-quality earnings levels.

- Our growth report here indicates Proya CosmeticsLtd may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Proya CosmeticsLtd's balance sheet health report.

Tongqinglou Catering (SHSE:605108)

Overview: Tongqinglou Catering Co., Ltd. operates in the catering services industry in China with a market capitalization of CN¥5.52 billion.

Operations: Revenue Segments (in millions of CN¥):

Estimated Discount To Fair Value: 46.8%

Tongqinglou Catering is trading at CN¥23.2, significantly below its estimated fair value of CN¥43.61, suggesting it may be undervalued based on cash flows. Despite a recent decline in net income to CN¥83.4 million for the nine months ended September 2024, revenue grew to CN¥1,865.17 million from the previous year. The company's earnings are forecasted to grow annually by 39.8%, outpacing both industry and market averages despite current high debt levels and low return on equity projections.

- The analysis detailed in our Tongqinglou Catering growth report hints at robust future financial performance.

- Dive into the specifics of Tongqinglou Catering here with our thorough financial health report.

Where To Now?

- Click this link to deep-dive into the 927 companies within our Undervalued Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603605

Proya CosmeticsLtd

A beauty and personal care company, researches for, develops, produces, and sells cosmetics in China.

Very undervalued with high growth potential.