As we enter January 2025, global markets have shown a mixed performance with U.S. stocks closing out another strong year despite recent economic data indicating challenges such as the Chicago PMI's contraction and a downward revision of the GDP forecast by the Atlanta Fed. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience and adaptability to shifting market dynamics, particularly those that can thrive amidst broader economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1266 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Koal Software (SHSE:603232)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Koal Software Co., Ltd. is engaged in the development of public key infrastructure platforms in China and has a market capitalization of CN¥2.76 billion.

Operations: Koal Software Co., Ltd. focuses on developing public key infrastructure platforms within China, contributing to its CN¥2.76 billion market capitalization.

Koal Software, amidst a challenging financial landscape marked by a slight sales increase to CNY 332.79 million and a persistent net loss of CNY 38.04 million, is navigating through turbulent waters with strategic shareholder meetings and continuous dialogue with investors during earnings calls. Despite these hurdles, the company's projected annual earnings growth stands at an impressive 45.6%, significantly outpacing the broader Chinese market's expectations. This growth trajectory is bolstered by substantial one-off gains which have skewed recent financial outcomes but underscore potential for recalibration and future profitability in an evolving software industry landscape where innovation and strategic adaptation remain critical.

- Delve into the full analysis health report here for a deeper understanding of Koal Software.

Gain insights into Koal Software's historical performance by reviewing our past performance report.

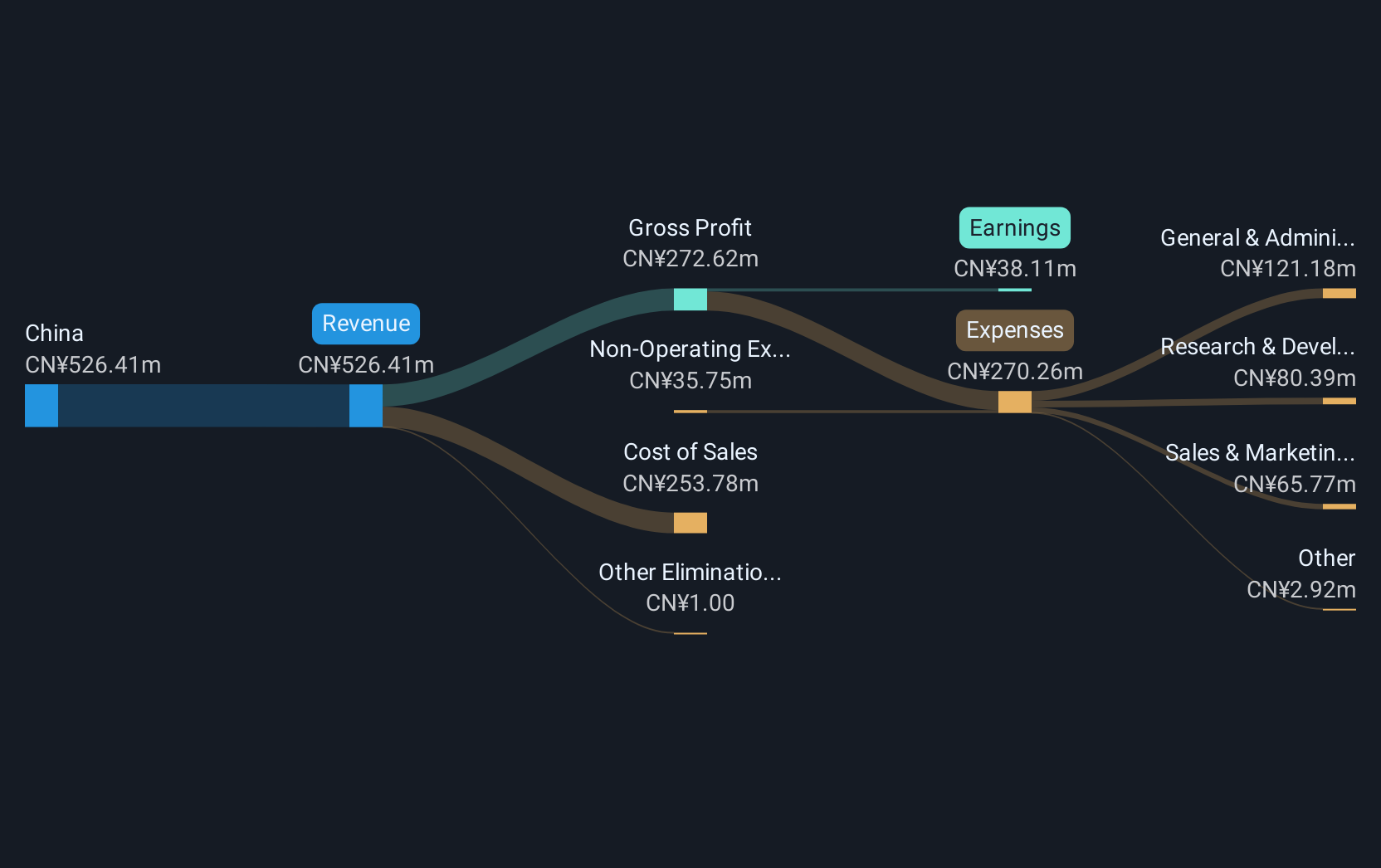

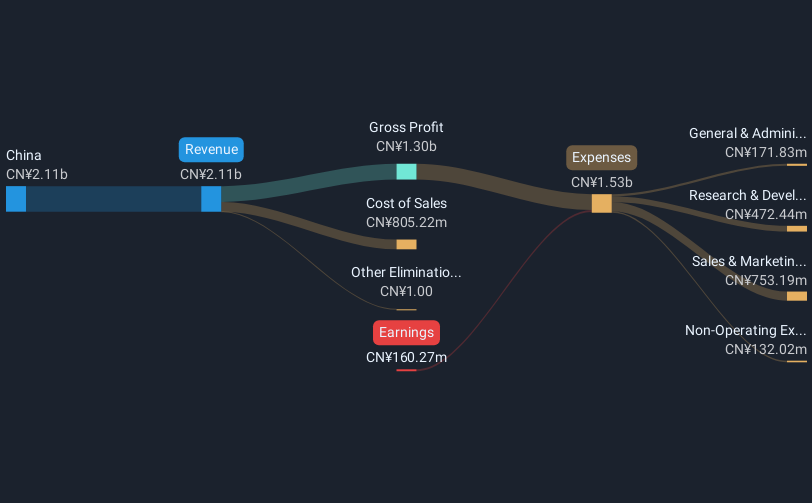

DBAPPSecurity (SHSE:688023)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DBAPPSecurity Co., Ltd. focuses on the research, development, manufacture, and sale of cybersecurity products in China with a market capitalization of CN¥3.92 billion.

Operations: DBAPPSecurity Co., Ltd. specializes in cybersecurity solutions, generating revenue primarily through the sale of its products in China. The company focuses on research and development to enhance its offerings, contributing to its market presence with a market capitalization of CN¥3.92 billion.

DBAPPSecurity, amidst a challenging backdrop, has demonstrated resilience with an 18.8% forecast in annual revenue growth, outpacing the broader Chinese market's 13.5%. Despite recent exclusion from the S&P Global BMI Index and a net loss reduction to CNY 336 million from CNY 535.53 million year-over-year, the company is on a path to profitability with earnings expected to surge by 53.26% annually. This potential turnaround is underscored by strategic adjustments and ongoing dialogues during quarterly earnings calls that could recalibrate its future trajectory in the competitive tech landscape.

- Dive into the specifics of DBAPPSecurity here with our thorough health report.

Assess DBAPPSecurity's past performance with our detailed historical performance reports.

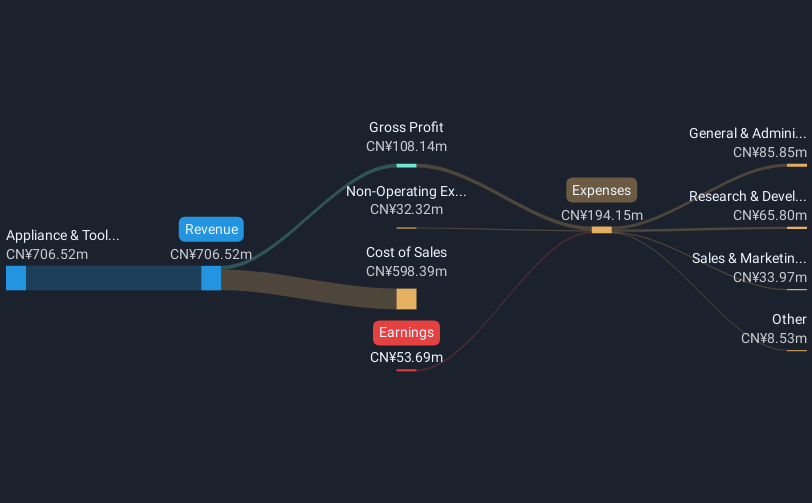

Nexwise Intelligence China (SZSE:301248)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nexwise Intelligence China Limited specializes in providing security and intelligent systems globally, with a market capitalization of CN¥2.12 billion.

Operations: The company generates revenue primarily from its Appliance & Tool segment, which contributes CN¥706.52 million.

Nexwise Intelligence China, navigating a turbulent market, has seen its revenue dip to CNY 458.28 million from CNY 604.93 million year-over-year, reflecting broader industry challenges. Despite this downturn, the company's strategic share repurchases—totaling 3,048,000 shares for CNY 39.82 million—signal a robust commitment to enhancing shareholder value. With an extraordinary shareholders meeting scheduled to discuss employee stock ownership plans and management measures, Nexwise aims to stabilize and potentially invigorate its workforce and operational strategies as it moves forward in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Nexwise Intelligence China.

Understand Nexwise Intelligence China's track record by examining our Past report.

Make It Happen

- Navigate through the entire inventory of 1266 High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nexwise Intelligence China might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301248

Nexwise Intelligence China

Engages in the provision of security and intelligent systems worldwide.

Reasonable growth potential with adequate balance sheet.