- China

- /

- Electrical

- /

- SZSE:002452

3 Growth Companies With High Insider Ownership And Up To 108% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing out a strong year despite recent fluctuations and economic indicators showing varied trends, investors are keenly observing growth companies that demonstrate resilience and potential for expansion. In such an environment, firms with high insider ownership often stand out as promising candidates for growth, as they typically align management interests with those of shareholders, fostering confidence in their long-term strategies.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Zhejiang Power New Energy (SHSE:688184)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Power New Energy Co., Ltd. focuses on the research, development, production, and sale of lithium-ion battery ternary cathode material precursors in China and has a market cap of approximately CN¥2.07 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to CN¥1.29 billion.

Insider Ownership: 33.5%

Earnings Growth Forecast: 108.4% p.a.

Zhejiang Power New Energy, despite reporting a net loss of CNY 400.18 million for the first nine months of 2024, is forecasted to achieve significant growth with expected annual revenue increases of 25.7%, outpacing the broader Chinese market. The company has completed share buybacks totaling CNY 34.45 million but shows no substantial insider trading activity in recent months. While profitability is anticipated within three years, its return on equity remains low at a projected 3.3%.

- Unlock comprehensive insights into our analysis of Zhejiang Power New Energy stock in this growth report.

- The analysis detailed in our Zhejiang Power New Energy valuation report hints at an inflated share price compared to its estimated value.

Chison Medical Technologies (SHSE:688358)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chison Medical Technologies Co., Ltd. manufactures and sells diagnostic ultrasound systems both in China and internationally, with a market cap of CN¥2.67 billion.

Operations: The company's revenue segment is primarily derived from its Ultrasound Medical Imaging Equipment Business, totaling CN¥444.28 million.

Insider Ownership: 23.6%

Earnings Growth Forecast: 34.9% p.a.

Chison Medical Technologies, despite a decline in revenue to CNY 362.25 million for the first nine months of 2024, is projected to achieve robust growth with expected annual earnings increases of 34.9%, surpassing the broader Chinese market's growth rate. The company's stock trades at a significant discount to its estimated fair value and shows no substantial insider trading activity recently. However, its return on equity is forecasted to remain modest at 16.3%.

- Click to explore a detailed breakdown of our findings in Chison Medical Technologies' earnings growth report.

- In light of our recent valuation report, it seems possible that Chison Medical Technologies is trading behind its estimated value.

Changgao Electric Group (SZSE:002452)

Simply Wall St Growth Rating: ★★★★★☆

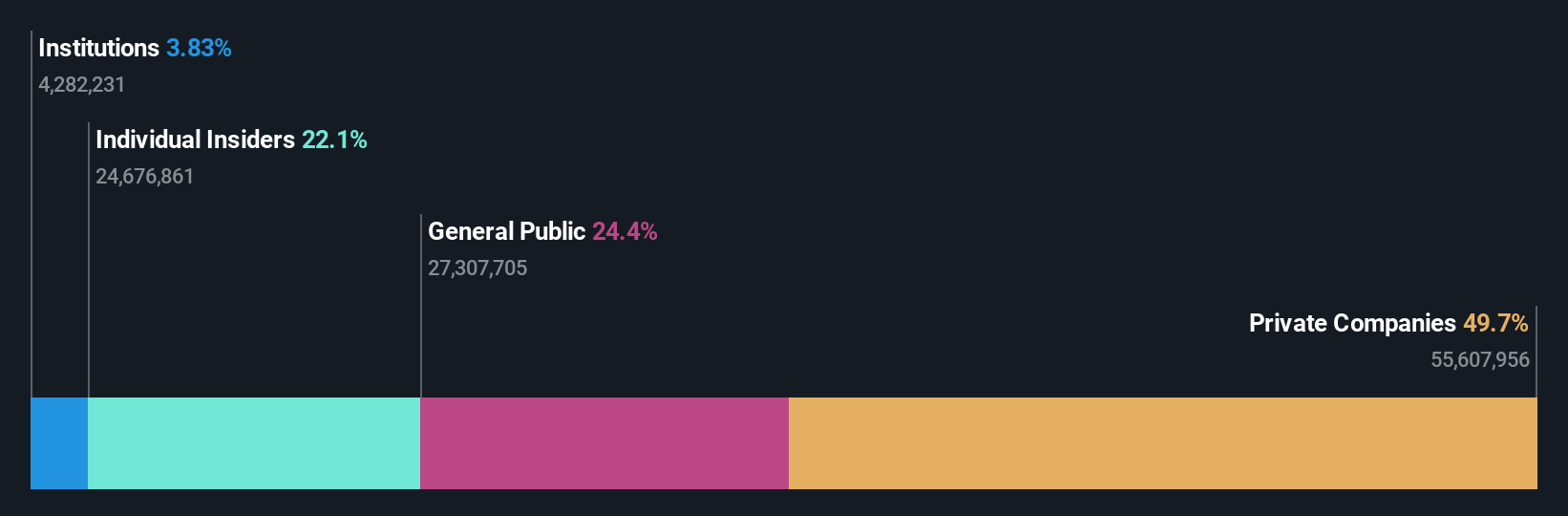

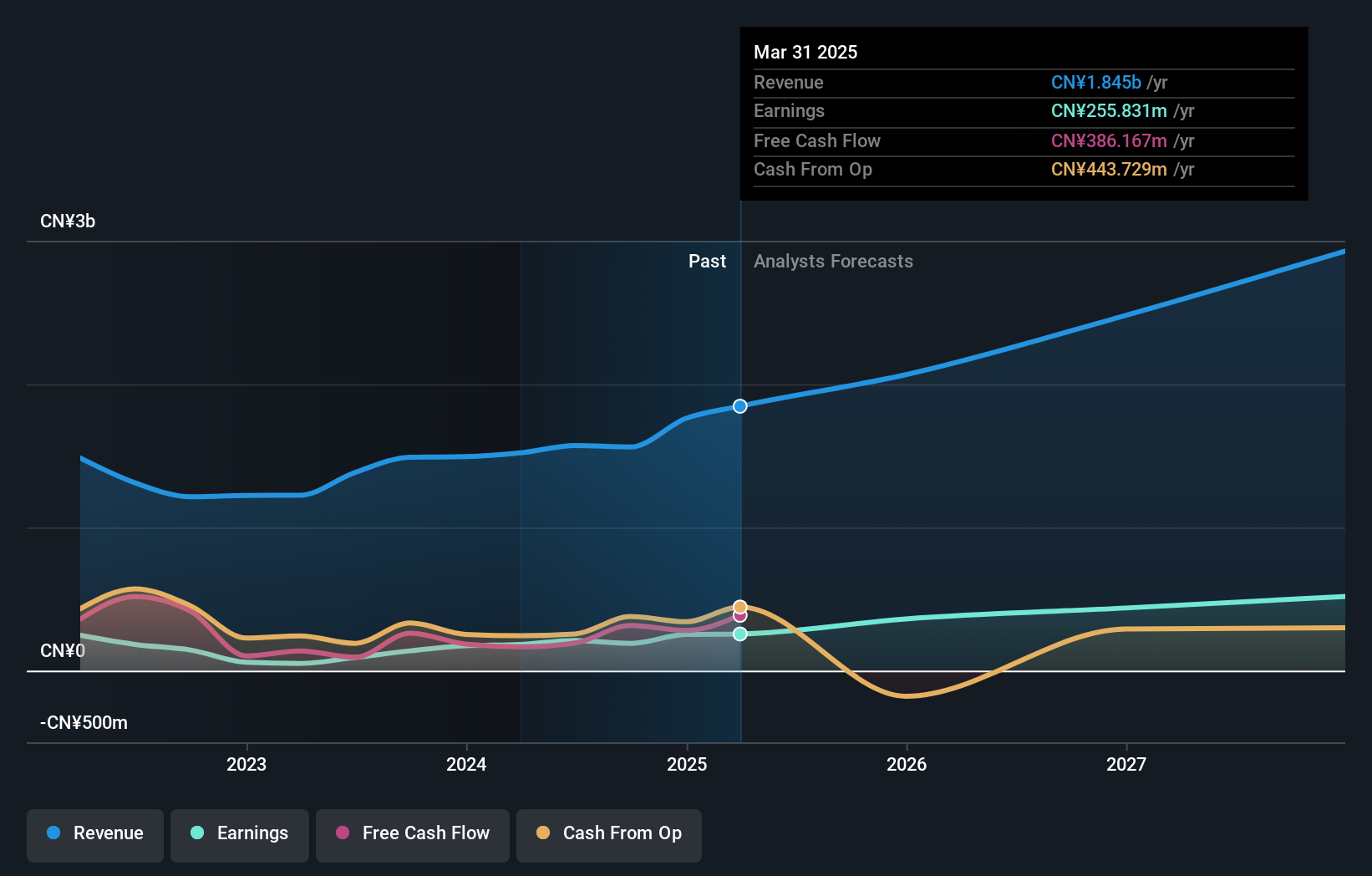

Overview: Changgao Electric Group Co., Ltd. focuses on the research, development, manufacture, and sale of power transmission equipment in China with a market cap of CN¥4.43 billion.

Operations: The company generates revenue from the research, development, manufacturing, and sales of power transmission equipment within China.

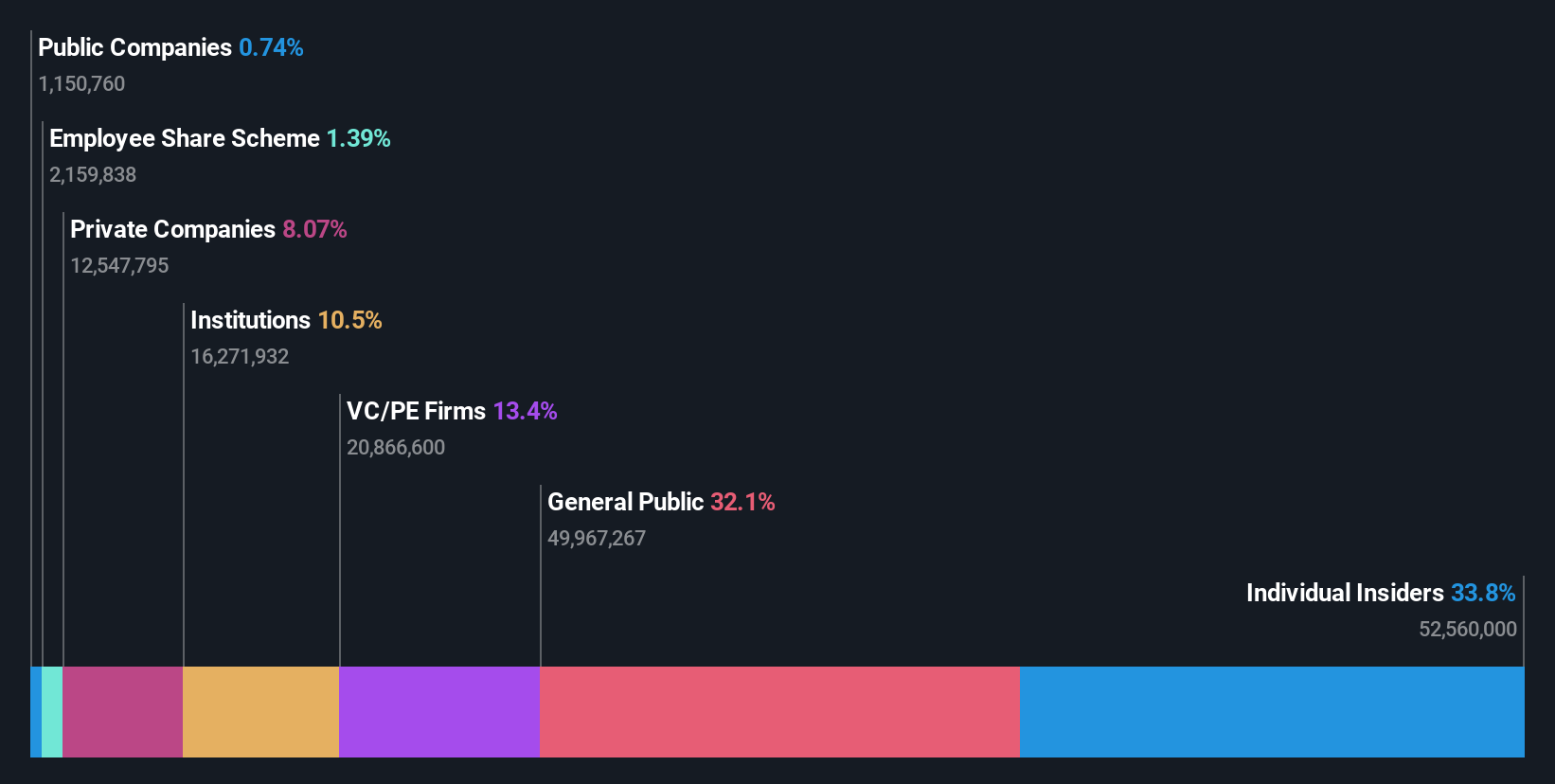

Insider Ownership: 30%

Earnings Growth Forecast: 30.6% p.a.

Changgao Electric Group reported a rise in sales to CNY 1.13 billion for the first nine months of 2024, with net income increasing to CNY 181.04 million. The stock trades at a favorable price-to-earnings ratio compared to the CN market and is expected to see significant annual earnings growth of over 30%, outpacing the broader market. Despite this, its return on equity is projected to be relatively low at 13.4% in three years, and it has an unstable dividend history.

- Dive into the specifics of Changgao Electric Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Changgao Electric Group's current price could be quite moderate.

Seize The Opportunity

- Gain an insight into the universe of 1494 Fast Growing Companies With High Insider Ownership by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002452

Changgao Electric Group

Engages in the research, development, manufacture, and sale of power transmission equipment in the People's Republic of China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives