Shanghai Wondertek Software Co., Ltd's (SHSE:603189) P/S Is Still On The Mark Following 28% Share Price Bounce

Shanghai Wondertek Software Co., Ltd (SHSE:603189) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

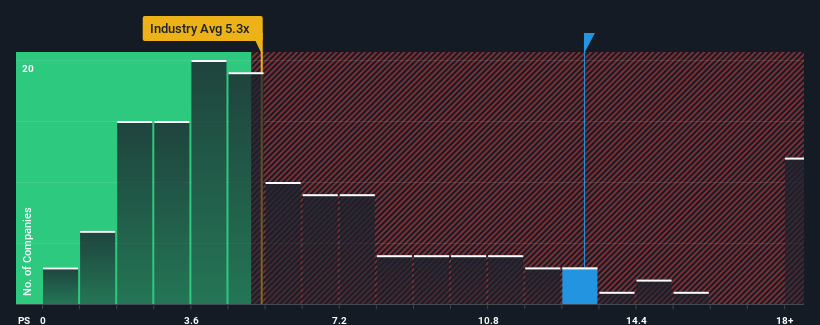

Since its price has surged higher, you could be forgiven for thinking Shanghai Wondertek Software is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.1x, considering almost half the companies in China's Software industry have P/S ratios below 5.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shanghai Wondertek Software

How Shanghai Wondertek Software Has Been Performing

Shanghai Wondertek Software hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shanghai Wondertek Software.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shanghai Wondertek Software would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 149% over the next year. With the industry only predicted to deliver 33%, the company is positioned for a stronger revenue result.

With this information, we can see why Shanghai Wondertek Software is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Shanghai Wondertek Software's P/S?

Shanghai Wondertek Software's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shanghai Wondertek Software maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Software industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shanghai Wondertek Software you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603189

Shanghai Wondertek Software

Provides software products and solutions in the video intelligence field in China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives