Subdued Growth No Barrier To 360 Security Technology Inc. (SHSE:601360) With Shares Advancing 41%

360 Security Technology Inc. (SHSE:601360) shareholders would be excited to see that the share price has had a great month, posting a 41% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

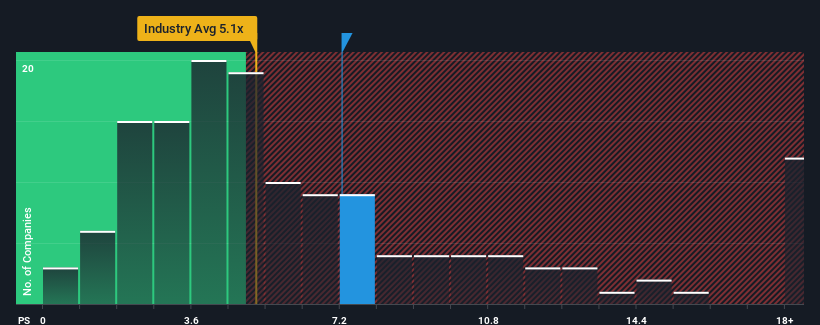

Following the firm bounce in price, when almost half of the companies in China's Software industry have price-to-sales ratios (or "P/S") below 5.1x, you may consider 360 Security Technology as a stock probably not worth researching with its 7.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for 360 Security Technology

How Has 360 Security Technology Performed Recently?

Recent times haven't been great for 360 Security Technology as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think 360 Security Technology's future stacks up against the industry? In that case, our free report is a great place to start.How Is 360 Security Technology's Revenue Growth Trending?

In order to justify its P/S ratio, 360 Security Technology would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 17% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 12% over the next year. With the industry predicted to deliver 34% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that 360 Security Technology's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

360 Security Technology's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that 360 Security Technology currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for 360 Security Technology with six simple checks will allow you to discover any risks that could be an issue.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if 360 Security Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601360

360 Security Technology

An internet security company, provides Internet and mobile security products in China.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives