As global markets navigate a period of mixed performances, with the Nasdaq Composite reaching new heights while other major indexes face declines, investors are closely watching central bank actions and economic indicators for guidance. Amidst this backdrop of fluctuating growth and interest rate expectations, dividend stocks remain an attractive option for those seeking steady income streams. A good dividend stock typically offers a reliable payout history, strong financial health, and resilience in various market conditions—qualities that can provide stability amid economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1869 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥67.30 billion.

Operations: Shanghai Baosight Software Co., Ltd.'s revenue is primarily derived from its industrial solutions in China.

Dividend Yield: 2.9%

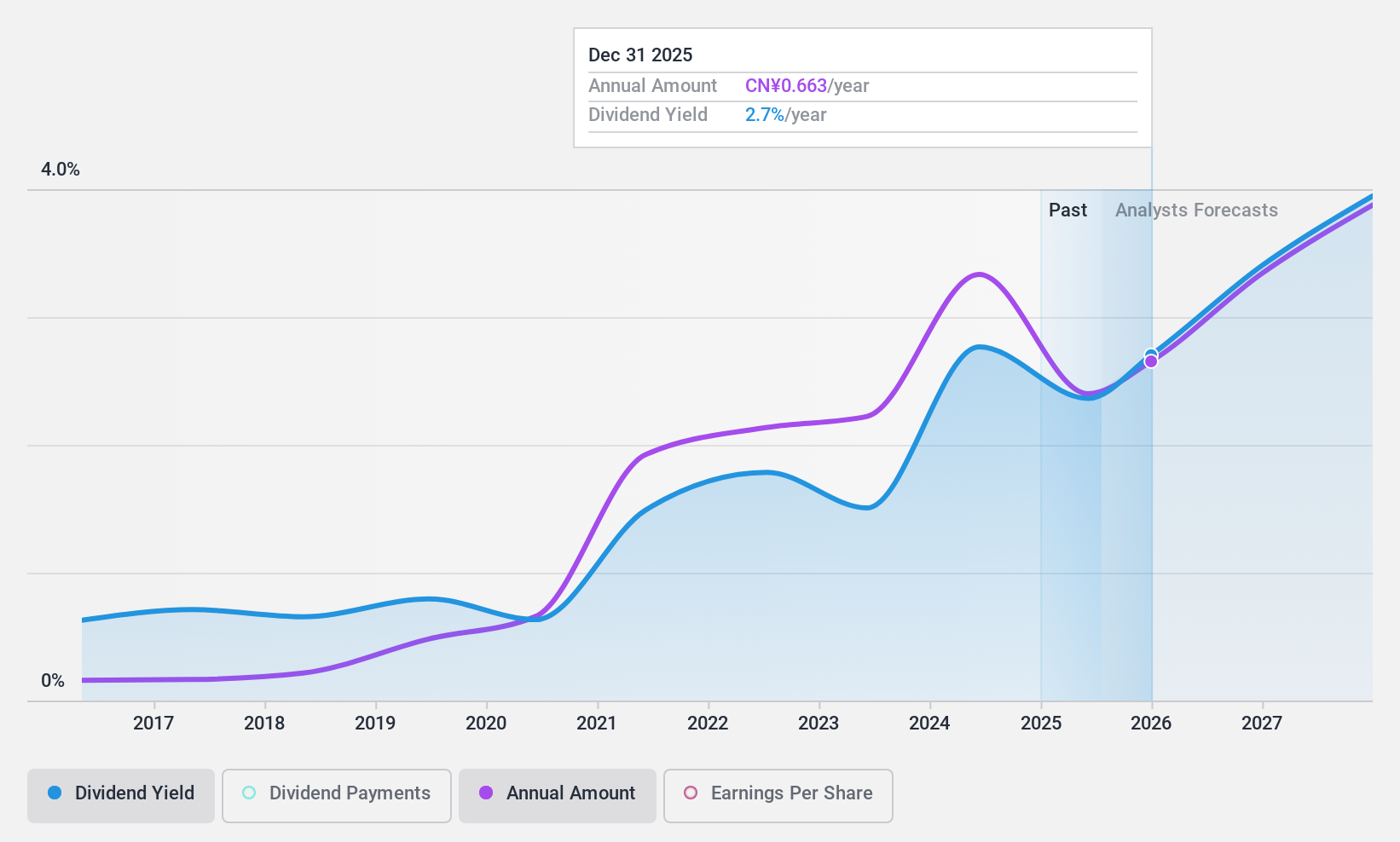

Shanghai Baosight Software Ltd. has shown reliable and stable dividend payments over the past decade, with dividends growing consistently. However, the dividend yield of 2.89%, while in the top 25% of CN market payers, is not well covered by earnings or free cash flows due to a high payout ratio (90.5%). Despite trading at a good value relative to peers and being added to key indices like SSE 180, sustainability concerns remain for its dividends.

- Click to explore a detailed breakdown of our findings in Shanghai Baosight SoftwareLtd's dividend report.

- Our comprehensive valuation report raises the possibility that Shanghai Baosight SoftwareLtd is priced lower than what may be justified by its financials.

Taikisha (TSE:1979)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taikisha Ltd. specializes in designing, managing, and constructing HVAC systems and automobile paint plants while selling related equipment both in Japan and internationally, with a market cap of ¥149.65 billion.

Operations: Taikisha Ltd.'s revenue is derived from its Environmental Systems Business, which generated ¥182.32 billion, and its Paint Finishing System Division, which contributed ¥95.47 billion.

Dividend Yield: 3%

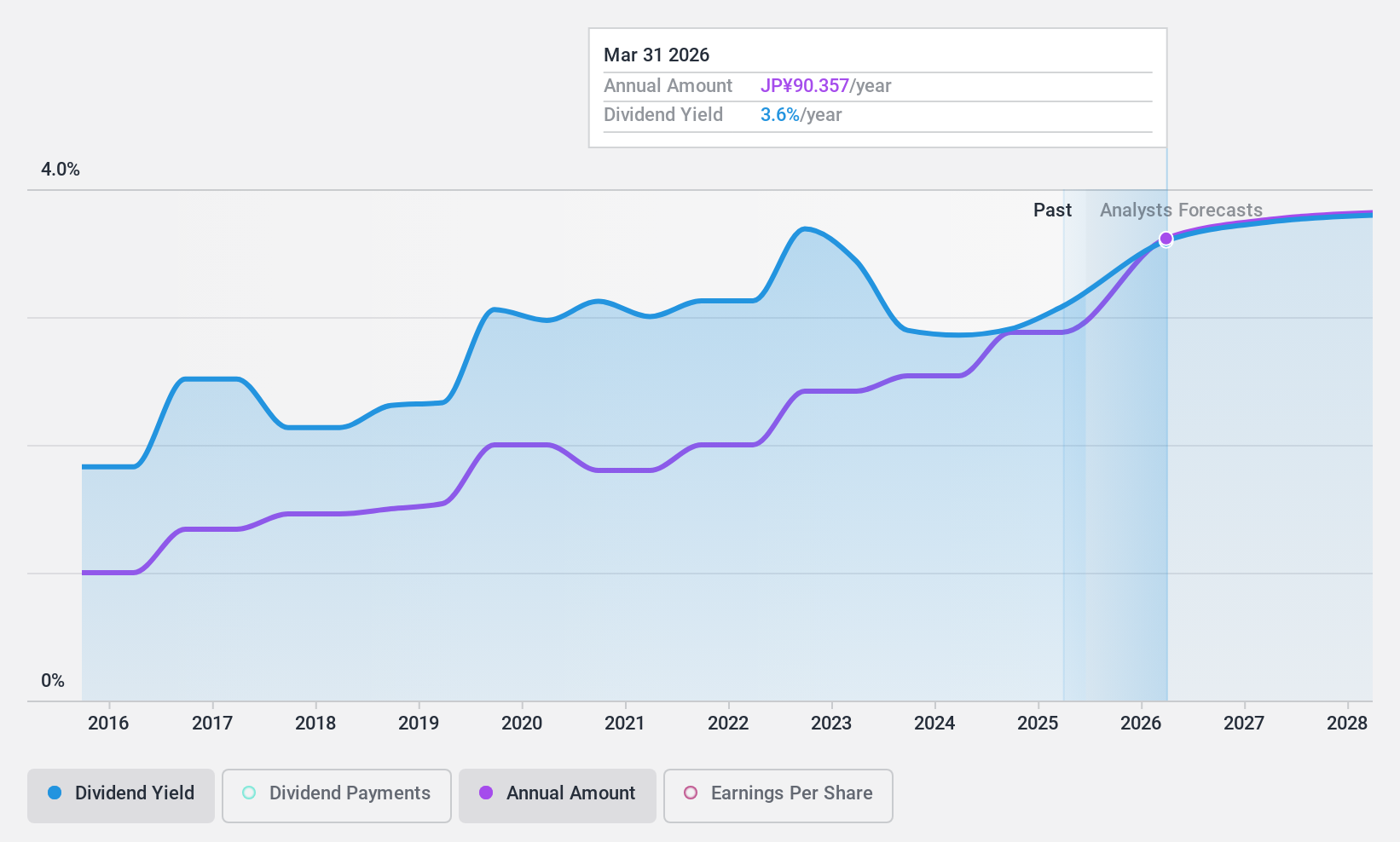

Taikisha Ltd. has consistently increased and maintained stable dividends over the past decade, recently raising its dividend to ¥60.00 per share from ¥50.00 a year ago. Despite a low yield of 3.03% compared to top JP market payers, dividends are well covered by earnings due to a low payout ratio (31.5%). However, the lack of free cash flow coverage raises sustainability concerns despite recent upward revisions in earnings guidance for fiscal 2025's first half.

- Click here to discover the nuances of Taikisha with our detailed analytical dividend report.

- Our valuation report unveils the possibility Taikisha's shares may be trading at a discount.

Nippon Beet Sugar ManufacturingLtd (TSE:2108)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Beet Sugar Manufacturing Co., Ltd. operates in Japan, focusing on the manufacturing and sale of functional products, with a market cap of ¥29.46 billion.

Operations: Nippon Beet Sugar Manufacturing Co., Ltd. generates its revenue through the production and sale of functional products within Japan.

Dividend Yield: 3.3%

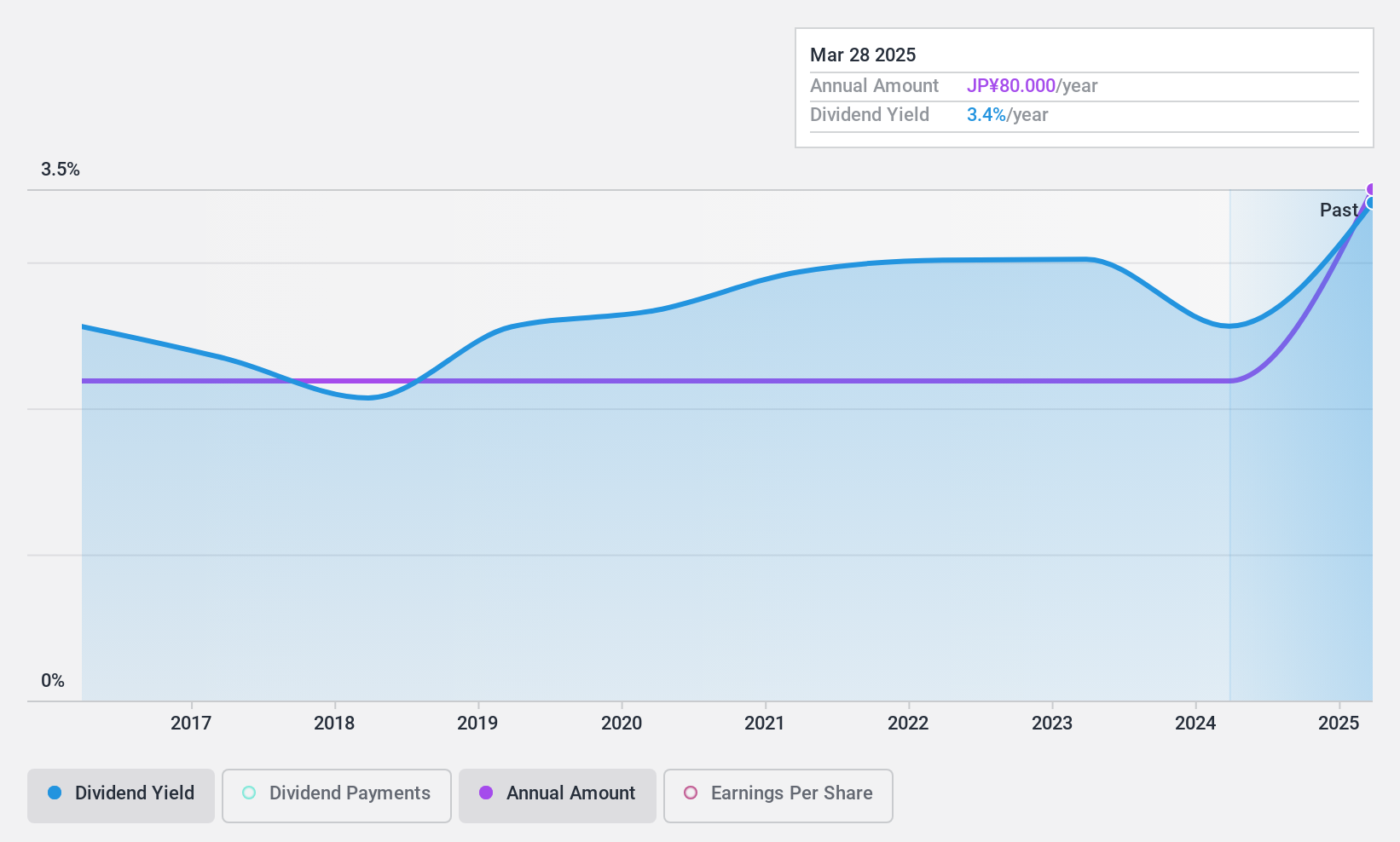

Nippon Beet Sugar Manufacturing Ltd. offers a stable and reliable dividend history, having increased payments over the past decade. Despite a modest yield of 3.3%, below top-tier JP market payers, dividends are well-supported by earnings with a low payout ratio of 10% and cash flows at 33.4%. Recent guidance projects net sales of ¥66 billion and profit attributable to owners at ¥5.9 billion, reflecting strong financial health despite large one-off items impacting results.

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Beet Sugar ManufacturingLtd.

- Our expertly prepared valuation report Nippon Beet Sugar ManufacturingLtd implies its share price may be lower than expected.

Where To Now?

- Click through to start exploring the rest of the 1866 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600845

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives