As global markets navigate through easing trade tensions and mixed economic signals, Asia's tech sector remains a focal point for investors seeking high growth opportunities. In this dynamic environment, identifying promising tech stocks involves evaluating companies that demonstrate resilience amid economic uncertainties and possess the potential to capitalize on technological advancements.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Eoptolink Technology | 26.83% | 26.04% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

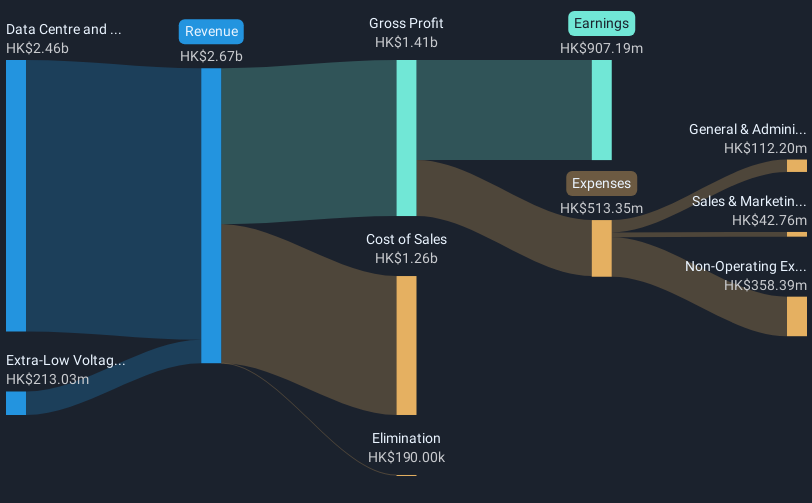

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market cap of approximately HK$26.87 billion.

Operations: The company primarily generates revenue through its data centre and IT facilities segment, which contributed HK$2.64 billion. Additionally, it earns from Extra-Low Voltage (ELV) and IT systems services, adding HK$217.70 million to the total revenue.

SUNeVision Holdings, demonstrating robust financial health with a 14% increase in sales to HKD 1.47 billion and a net income rise to HKD 484 million from the previous year, outpaces its sector's average growth. This performance is underscored by an annualized revenue growth rate of 19.1%, significantly higher than Hong Kong's market average of 8.7%. Despite challenges in free cash flow, the company's strategic focus on innovative tech solutions has led to earnings growing by 5.3% over the past year, surpassing the IT industry’s contraction of -5.3%. Looking ahead, SUNeVision is poised for continued advancement with forecasted earnings growth of 18.3% annually, leveraging high-profile projects and client engagements that could further solidify its market position.

- Click here and access our complete health analysis report to understand the dynamics of SUNeVision Holdings.

Evaluate SUNeVision Holdings' historical performance by accessing our past performance report.

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology is a clinical stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics with a market capitalization of approximately HK$7.55 billion.

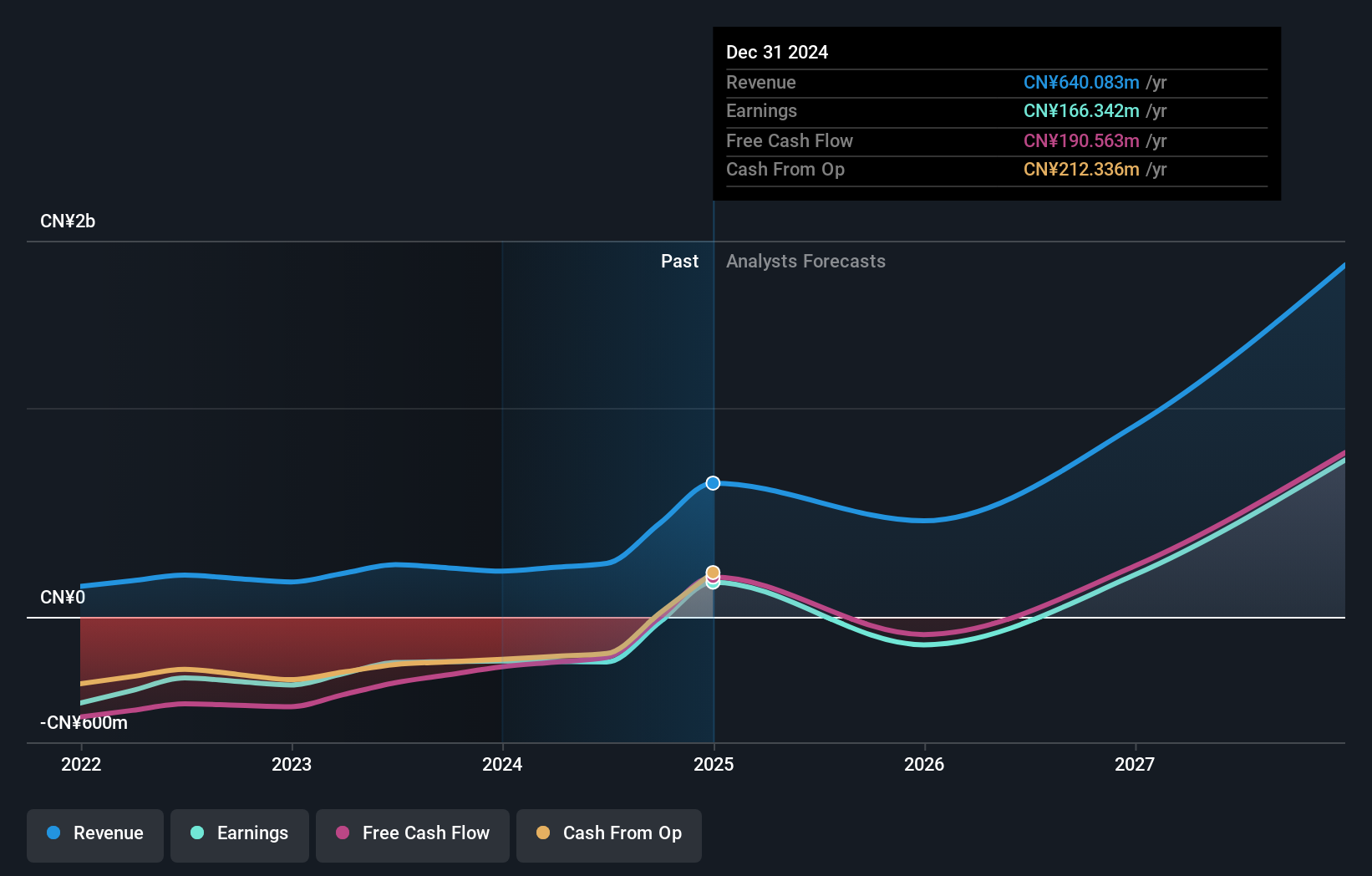

Operations: The company generates revenue primarily from its pharmaceuticals segment, amounting to CN¥640.08 million. The focus is on oncology biologics, reflecting its commitment to advancing cancer treatments through innovative research and development efforts.

Alphamab Oncology has demonstrated notable financial and operational progress, transforming from a loss to a profit with its latest annual figures showing sales of CNY 640.08 million, up from CNY 218.77 million, and net income at CNY 166.34 million compared to a previous loss. This turnaround is pivotal as it reflects not only growth but also the successful market penetration of its innovative therapies in high-stakes areas like oncology. The company's R&D commitment is evident in its strategic collaborations and breakthrough therapy designations, enhancing its portfolio's potential in addressing critical medical needs. Notably, the recent approval and ongoing Phase III trials of JSKN003 indicate Alphamab's strong positioning for future growth within biotechnology sectors focused on complex diseases like cancer.

China National Software & Service (SHSE:600536)

Simply Wall St Growth Rating: ★★★★★☆

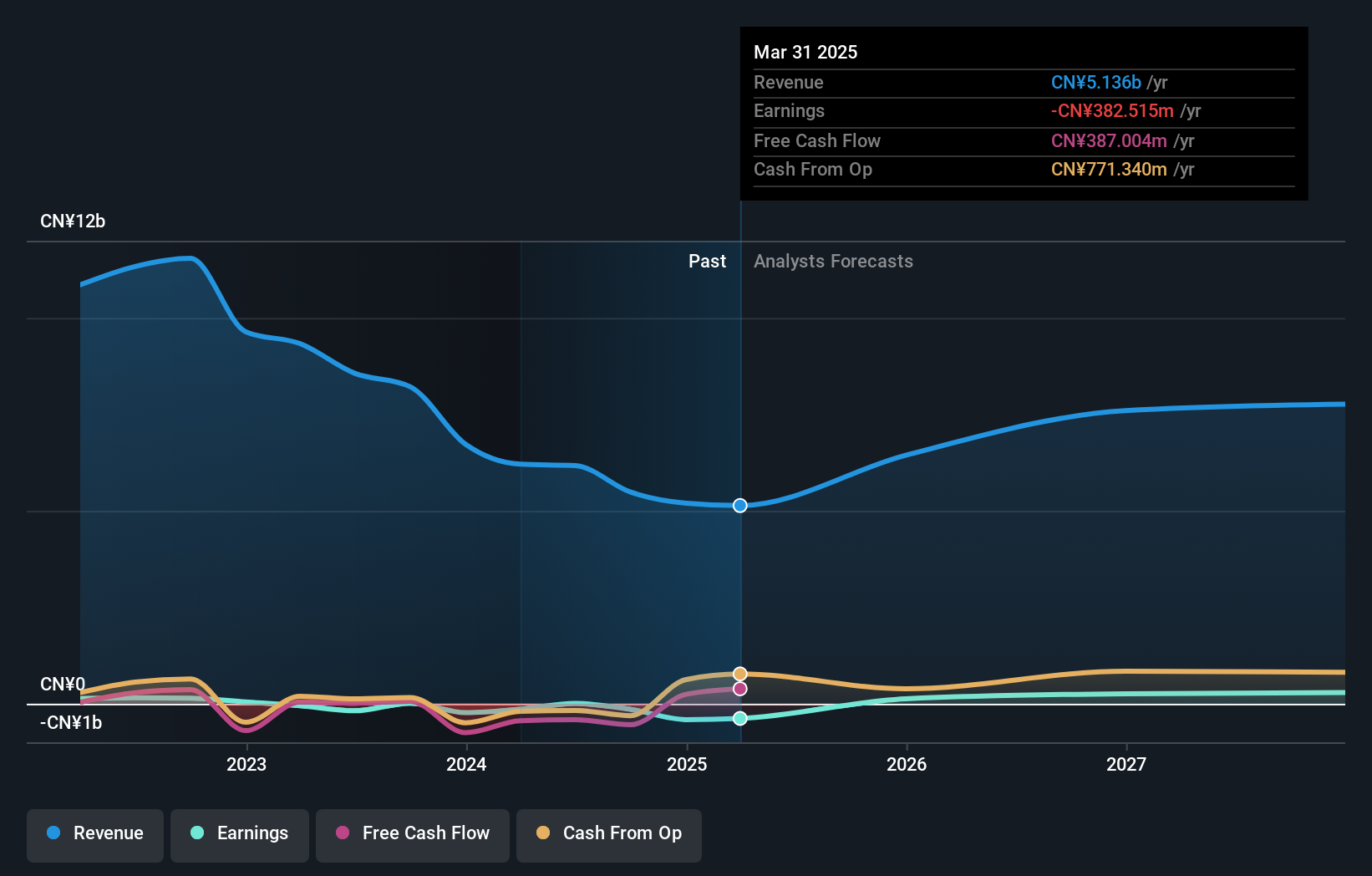

Overview: China National Software & Service Company Limited is a software company in China with a market capitalization of CN¥38.44 billion.

Operations: The company generates revenue primarily from its Software Service Business, amounting to approximately CN¥5.14 billion.

China National Software & Service, despite a recent net loss of CNY 80.62 million, shows potential with a forecasted annual revenue growth of 20.2%, outpacing the Chinese market's average of 12.6%. This growth is supported by strategic shifts towards scalable software solutions in response to increasing demand for cloud-based services across Asia. The company's commitment to innovation is underscored by its R&D expenses, crucial for maintaining competitiveness in the fast-evolving tech landscape. With earnings expected to surge by 100% annually, China National Software & Service is positioned to capitalize on market trends favoring digital transformation and integrated software services.

Next Steps

- Access the full spectrum of 485 Asian High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade China National Software & Service, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600536

China National Software & Service

Operates as a software company in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives