- China

- /

- Communications

- /

- SHSE:600105

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and competitive pressures in the tech sector, particularly following the emergence of DeepSeek's new AI model, investors have witnessed a volatile week with mixed performance across key indices. In this environment, identifying high growth tech stocks requires careful consideration of companies that demonstrate resilience and adaptability to rapidly changing technological advancements and market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 1233 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jiangsu Etern (SHSE:600105)

Simply Wall St Growth Rating: ★★★★★☆

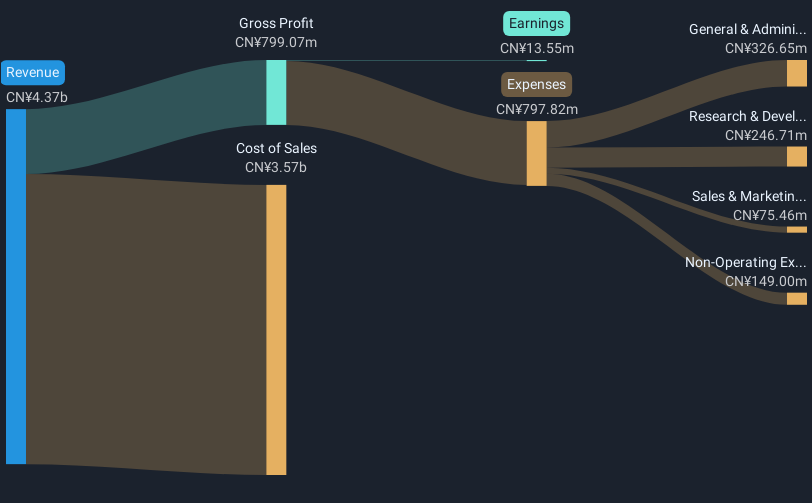

Overview: Jiangsu Etern Company Limited operates in the communication cable industry with a market capitalization of CN¥7.18 billion.

Operations: The company focuses on the communication cable industry, generating revenue primarily through the production and sale of various types of cables.

Jiangsu Etern, a player in the tech sector, is navigating a dynamic landscape marked by rapid changes. With an impressive annual revenue growth rate of 20.5%, the company outpaces the Chinese market average of 13.3%. This growth is complemented by an even more striking earnings increase, forecasted at 71.7% annually, significantly above the market's 25.1%. However, challenges persist as evidenced by a volatile share price and profit margins that have dipped to 0.3% from last year's 5.4%. The firm's R&D commitment is pivotal for sustaining innovation and competitiveness but specific spending figures are crucial for evaluating its strategic focus in this area.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Etern.

Examine Jiangsu Etern's past performance report to understand how it has performed in the past.

AisinoLtd (SHSE:600271)

Simply Wall St Growth Rating: ★★★★☆☆

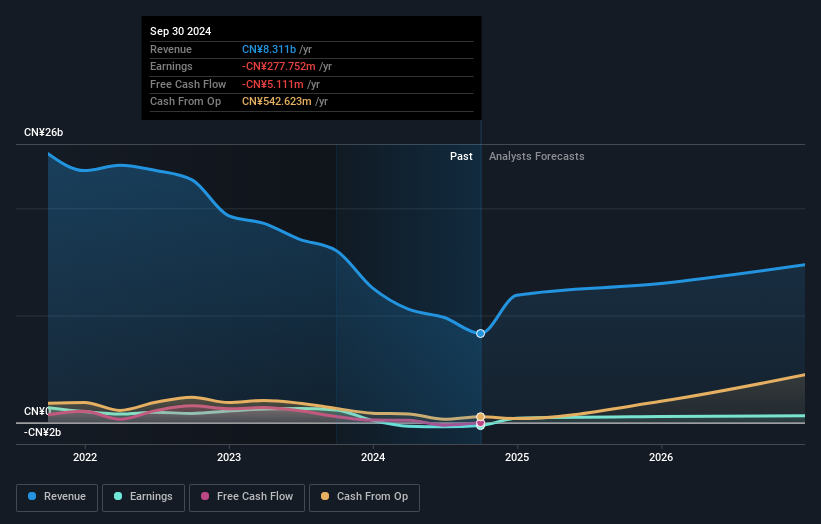

Overview: Aisino Co. Ltd. offers information security solutions both in China and internationally, with a market capitalization of CN¥15.84 billion.

Operations: Aisino Co. Ltd. generates revenue primarily from its Security Software & Services segment, which accounts for CN¥8.31 billion in sales.

AisinoLtd is poised for significant transformation, with earnings expected to surge by 65.74% annually, outstripping broader market projections. This growth trajectory is bolstered by a robust annual revenue increase of 19.5%, surpassing the CN market average of 13.3%. Despite current unprofitability and lack of free cash flow, these figures suggest a strong upward momentum. The company's strategic R&D investments are crucial as it navigates towards profitability within three years, aligning with industry demands for innovative software solutions.

- Click to explore a detailed breakdown of our findings in AisinoLtd's health report.

Gain insights into AisinoLtd's historical performance by reviewing our past performance report.

WCON Electronics (Guangdong) (SZSE:301328)

Simply Wall St Growth Rating: ★★★★★☆

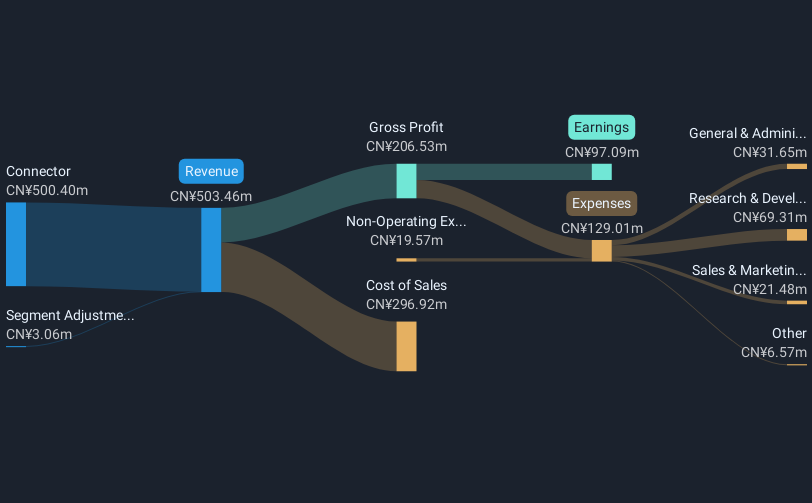

Overview: WCON Electronics (Guangdong) Co., Ltd. focuses on the research and development, manufacturing, and marketing of connectors and cable assemblies in China with a market capitalization of approximately CN¥4.61 billion.

Operations: WCON Electronics (Guangdong) derives its revenue primarily from the connector segment, contributing CN¥500.40 million. The company is involved in manufacturing and marketing activities within China, focusing on connectors and cable assemblies.

WCON Electronics (Guangdong) demonstrates robust growth dynamics, with an impressive annual revenue growth rate of 20.8%, outpacing the CN market average of 13.3%. The company's earnings are also on an upward trajectory, expected to grow by 26.5% annually. Strategic R&D investments play a pivotal role in sustaining this momentum; last year alone, WCON allocated significant resources towards innovation, accounting for a substantial portion of their expenditures. This focus on advanced technology development is crucial as it continues to expand its market share in competitive tech sectors. Additionally, the recent extraordinary shareholder meeting underscores a commitment to aligning employee interests with corporate goals through stock ownership plans, potentially boosting long-term loyalty and performance.

- Take a closer look at WCON Electronics (Guangdong)'s potential here in our health report.

Gain insights into WCON Electronics (Guangdong)'s past trends and performance with our Past report.

Taking Advantage

- Click this link to deep-dive into the 1233 companies within our High Growth Tech and AI Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600105

High growth potential moderate.

Similar Companies

Market Insights

Community Narratives