- China

- /

- Semiconductors

- /

- SZSE:301678

Discovering Undiscovered Gems in Asia for July 2025

Reviewed by Simply Wall St

Amid a backdrop of mixed global market performances, Asia's small-cap stocks are capturing attention as potential opportunities for investors seeking growth. With economic indicators showing resilience and regional indices like China's CSI 300 Index posting gains, the environment may be ripe for uncovering lesser-known companies poised to benefit from these dynamics. In this context, identifying stocks with strong fundamentals and growth potential can be crucial in navigating the evolving landscape of Asian markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 5.53% | 8.75% | 11.19% | ★★★★★★ |

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| FALCO HOLDINGS | 4.93% | -0.16% | 1.44% | ★★★★★★ |

| Araya Industrial | 17.96% | 3.77% | 10.32% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 1.17% | 14.31% | ★★★★★★ |

| Nikko | 29.66% | 6.43% | -3.15% | ★★★★★☆ |

| TOMONY Holdings | 58.26% | 7.99% | 14.24% | ★★★★★☆ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| OUG Holdings | 68.97% | 2.94% | 34.51% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Chongqing Machinery & Electric (SEHK:2722)

Simply Wall St Value Rating: ★★★★★☆

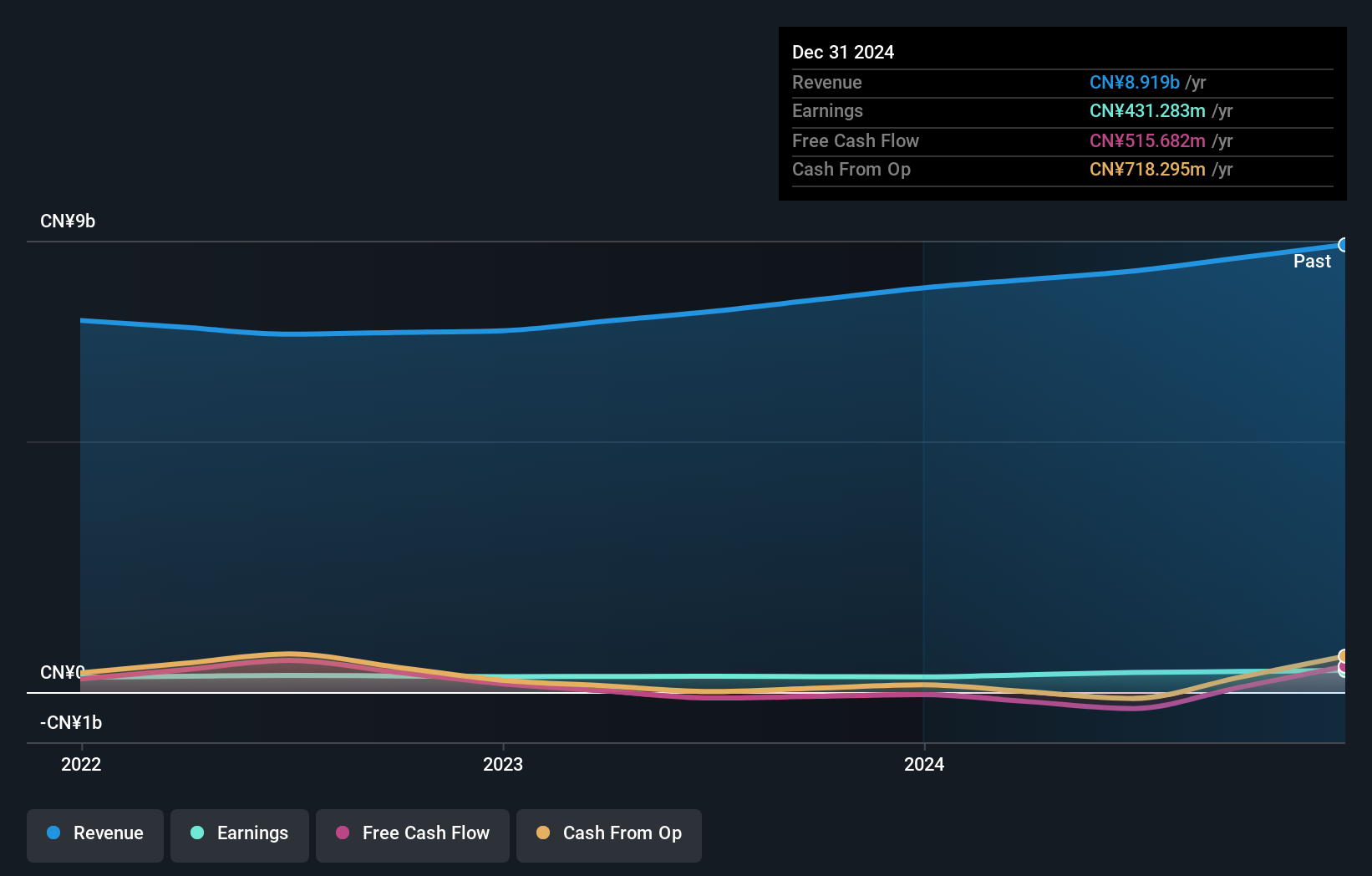

Overview: Chongqing Machinery & Electric Co., Ltd. focuses on designing, manufacturing, and selling clean energy equipment and high-end smart manufacturing equipment, with a market capitalization of HK$6.08 billion.

Operations: The company's primary revenue streams are from General Machinery (CN¥2.60 billion), Wind Turbine Blades (CN¥2.41 billion), and Material Sales (CN¥3.66 billion). The Wire and Cable segment also contributes significantly with CN¥2.03 billion in revenue, while the Numerically Controlled Machine Tool segment adds CN¥798.20 million.

Chongqing Machinery & Electric, a small player in the industrial sector, has demonstrated notable financial resilience. Its earnings surged by 42% over the past year, outpacing the industry's 2.4% growth rate. The company also boasts a reduced debt-to-equity ratio from 41.9% to 25.6% in five years and trades at an appealing valuation, being 89.3% below estimated fair value. Recent board appointments and amendments to its Articles of Association suggest strategic shifts are underway, while shareholders can look forward to a final dividend of RMB0.035 per share for the year ending December 2024.

Tibet Rhodiola Pharmaceutical Holding (SHSE:600211)

Simply Wall St Value Rating: ★★★★★☆

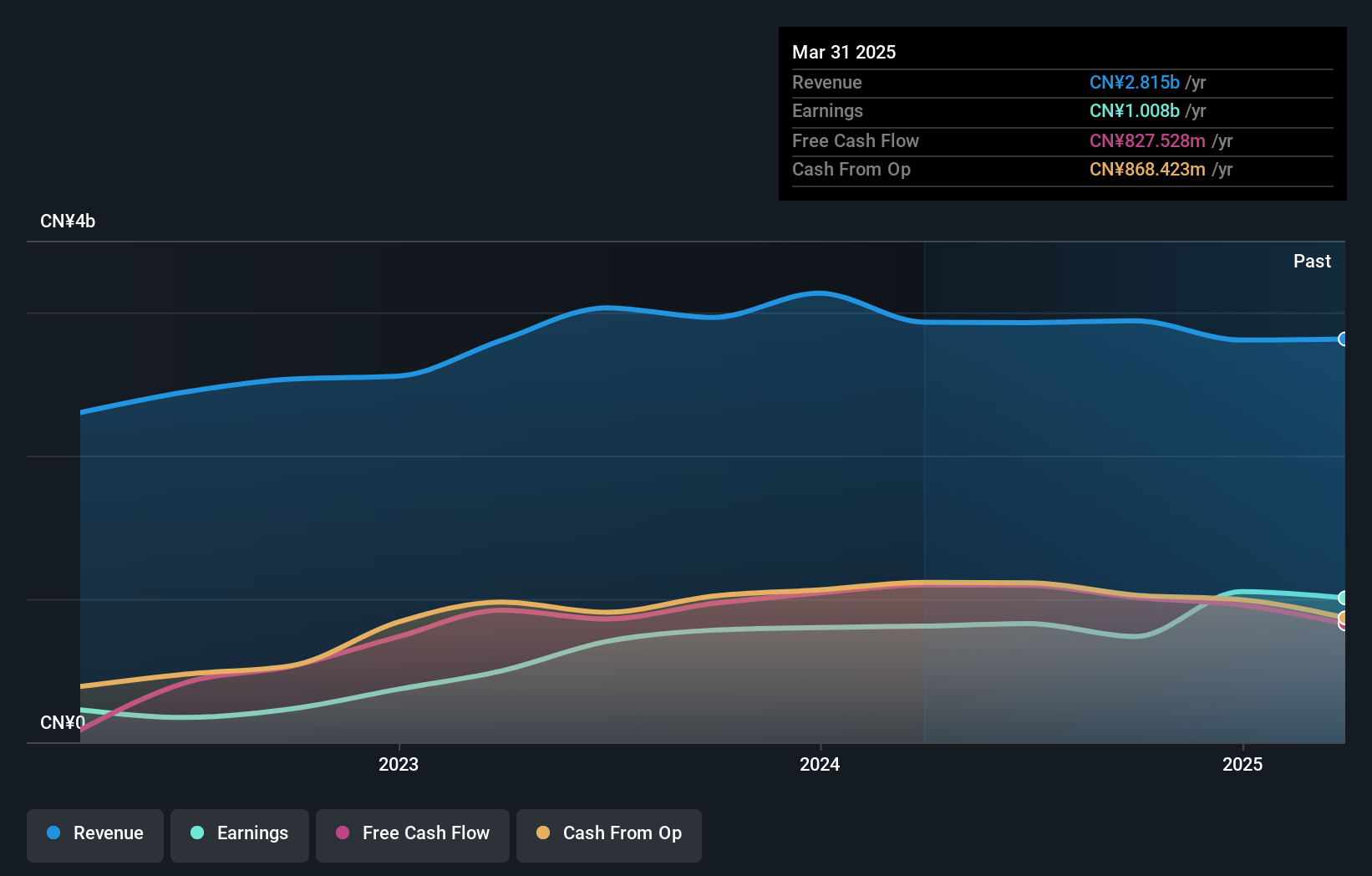

Overview: Tibet Rhodiola Pharmaceutical Holding Co. is a company engaged in the production and sale of pharmaceutical products with a market cap of CN¥13.33 billion.

Operations: The company's revenue is primarily derived from the sale of pharmaceutical products. It reported a market cap of CN¥13.33 billion, with significant financial data related to its operations not detailed in the provided text.

Tibet Rhodiola, a pharmaceutical player, has outpaced its industry with earnings growth of 24.3% over the past year, while trading at 21.4% below fair value estimates. Despite an increase in debt to equity from 0% to 12.5% over five years, it holds more cash than total debt, suggesting financial stability. However, recent results show net income at CN¥269 million compared to CN¥313 million a year earlier due to large one-off gains impacting financials by CN¥207 million. With basic EPS dropping from CN¥0.97 to CN¥0.84, the company seems poised for cautious optimism amidst these mixed signals.

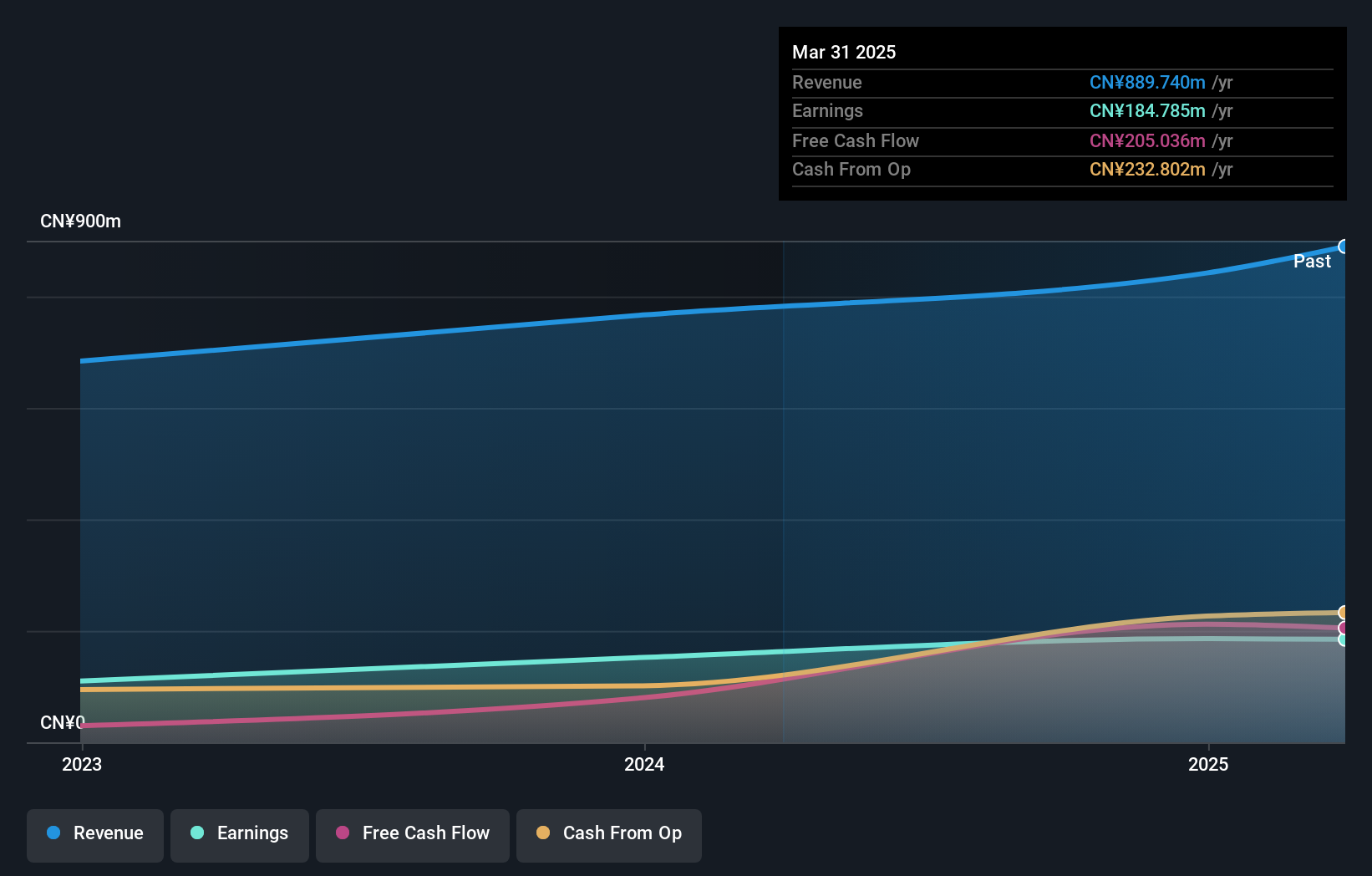

HENGHUI Technology (SZSE:301678)

Simply Wall St Value Rating: ★★★★★★

Overview: HENGHUI Technology Corporation Limited focuses on the research, development, manufacture, and sale of integrated circuit card packaging frames and module products mainly in China, with a market cap of CN¥13.65 billion.

Operations: HENGHUI Technology generates revenue primarily from its Semiconductor Equipment and Services segment, amounting to CN¥889.74 million.

HENGHUI Technology, a lesser-known player in the semiconductor industry, recently completed an IPO raising CNY 766.58 million, adding momentum to its growth trajectory. Over the past year, earnings rose by 15%, outpacing the industry's average of 9.6%. The company reported sales of CNY 842.07 million for 2024 with net income at CNY 185.97 million and basic earnings per share at CNY 1.04. Its debt to equity ratio improved from 3.5 to a healthier 2.3 over five years, reflecting better financial management while being added to the Shenzhen Stock Exchange A Share Index further enhances its visibility in the market.

- Unlock comprehensive insights into our analysis of HENGHUI Technology stock in this health report.

Explore historical data to track HENGHUI Technology's performance over time in our Past section.

Taking Advantage

- Embark on your investment journey to our 2604 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HENGHUI Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301678

HENGHUI Technology

Engages in the research, development, manufacture, and sale of integrated circuit (IC) card packaging frames and module products primarily in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives