- China

- /

- Semiconductors

- /

- SZSE:301348

Is Foshan Blue Rocket ElectronicsLtd (SZSE:301348) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Foshan Blue Rocket Electronics Co.,Ltd. (SZSE:301348) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Foshan Blue Rocket ElectronicsLtd's Net Debt?

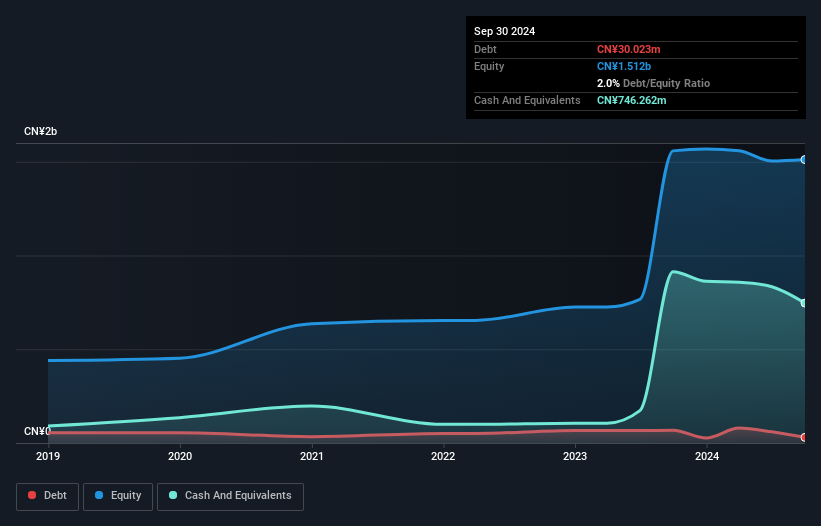

The image below, which you can click on for greater detail, shows that Foshan Blue Rocket ElectronicsLtd had debt of CN¥30.0m at the end of September 2024, a reduction from CN¥68.3m over a year. However, its balance sheet shows it holds CN¥746.3m in cash, so it actually has CN¥716.2m net cash.

How Strong Is Foshan Blue Rocket ElectronicsLtd's Balance Sheet?

The latest balance sheet data shows that Foshan Blue Rocket ElectronicsLtd had liabilities of CN¥351.8m due within a year, and liabilities of CN¥10.9m falling due after that. On the other hand, it had cash of CN¥746.3m and CN¥473.5m worth of receivables due within a year. So it can boast CN¥857.1m more liquid assets than total liabilities.

This surplus suggests that Foshan Blue Rocket ElectronicsLtd is using debt in a way that is appears to be both safe and conservative. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Foshan Blue Rocket ElectronicsLtd boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Foshan Blue Rocket ElectronicsLtd will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Check out our latest analysis for Foshan Blue Rocket ElectronicsLtd

Over 12 months, Foshan Blue Rocket ElectronicsLtd saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is Foshan Blue Rocket ElectronicsLtd?

Although Foshan Blue Rocket ElectronicsLtd had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥9.7m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with Foshan Blue Rocket ElectronicsLtd (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301348

Foshan Blue Rocket ElectronicsLtd

Engages in the research, development, manufacture, and sale of semiconductor devices in the People's Republic of China.

Excellent balance sheet slight.

Market Insights

Community Narratives