- China

- /

- Semiconductors

- /

- SZSE:301348

Foshan Blue Rocket Electronics Co.,Ltd. (SZSE:301348) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Unfortunately for some shareholders, the Foshan Blue Rocket Electronics Co.,Ltd. (SZSE:301348) share price has dived 26% in the last thirty days, prolonging recent pain. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

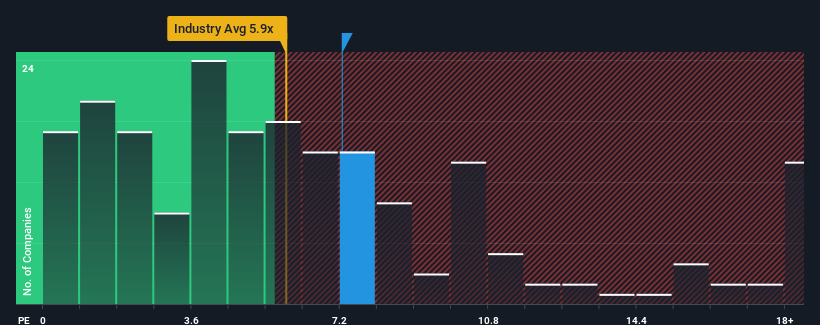

Although its price has dipped substantially, Foshan Blue Rocket ElectronicsLtd may still be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 7.2x, since almost half of all companies in the Semiconductor in China have P/S ratios under 5.9x and even P/S lower than 2x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Foshan Blue Rocket ElectronicsLtd

How Has Foshan Blue Rocket ElectronicsLtd Performed Recently?

For instance, Foshan Blue Rocket ElectronicsLtd's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Foshan Blue Rocket ElectronicsLtd will help you shine a light on its historical performance.How Is Foshan Blue Rocket ElectronicsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Foshan Blue Rocket ElectronicsLtd would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 3.3%. Regardless, revenue has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing that to the industry, which is predicted to deliver 34% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we find it concerning that Foshan Blue Rocket ElectronicsLtd is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Foshan Blue Rocket ElectronicsLtd's P/S Mean For Investors?

Foshan Blue Rocket ElectronicsLtd's P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Foshan Blue Rocket ElectronicsLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Foshan Blue Rocket ElectronicsLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Foshan Blue Rocket ElectronicsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Foshan Blue Rocket ElectronicsLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301348

Foshan Blue Rocket ElectronicsLtd

Engages in the research, development, manufacture, and sale of semiconductor devices in the People's Republic of China.

Excellent balance sheet slight.

Market Insights

Community Narratives