Asian Growth Companies With High Insider Ownership In October 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious monetary policies and fluctuating investor sentiment, Asia remains a focal point for growth opportunities. In this environment, companies with high insider ownership can offer unique insights into potential resilience and commitment to long-term growth strategies.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Techwing (KOSDAQ:A089030) | 19.1% | 122.3% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Leader Harmonious Drive Systems (SHSE:688017)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Leader Harmonious Drive Systems Co., Ltd. operates in the drive systems industry and has a market cap of CN¥33.14 billion.

Operations: Leader Harmonious Drive Systems Co., Ltd. generates its revenue from various segments within the drive systems industry.

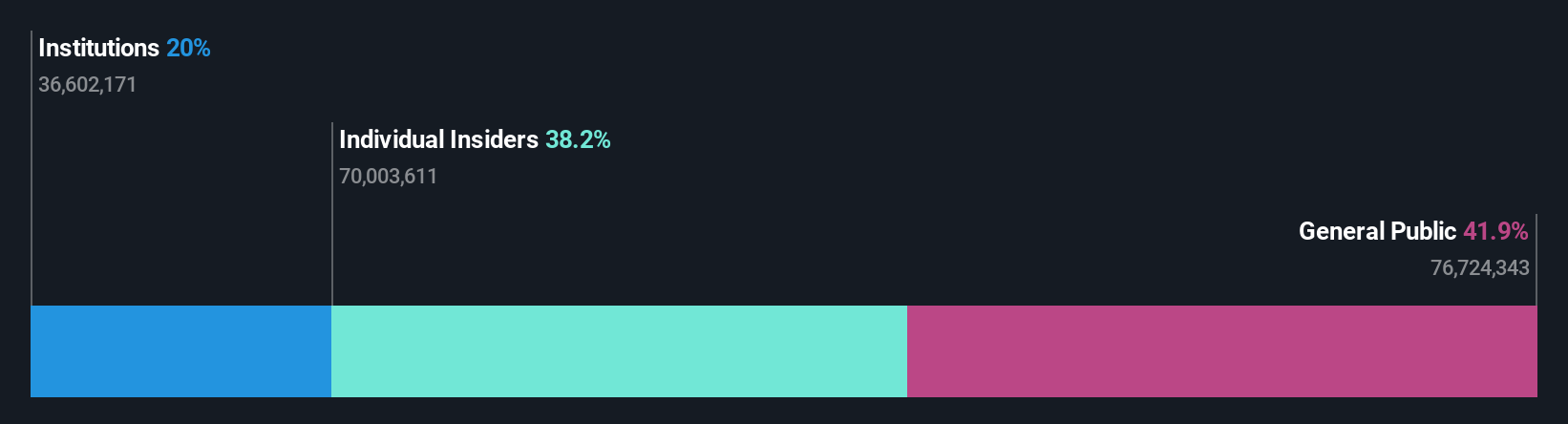

Insider Ownership: 38.2%

Leader Harmonious Drive Systems has demonstrated robust revenue growth, with recent half-year sales reaching CNY 246.22 million, up from CNY 171.04 million the previous year. Despite high volatility in its share price and low forecasted Return on Equity, the company's earnings are projected to grow significantly over the next three years at a rate of 28.3% annually, surpassing market expectations. High insider ownership aligns management interests with shareholders but requires monitoring due to financial result impacts from one-off items.

- Navigate through the intricacies of Leader Harmonious Drive Systems with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Leader Harmonious Drive Systems implies its share price may be too high.

SG Micro (SZSE:300661)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SG Micro Corp designs, markets, and sells analog integrated circuits in Mainland China, Hong Kong, Taiwan, and internationally with a market cap of CN¥51.46 billion.

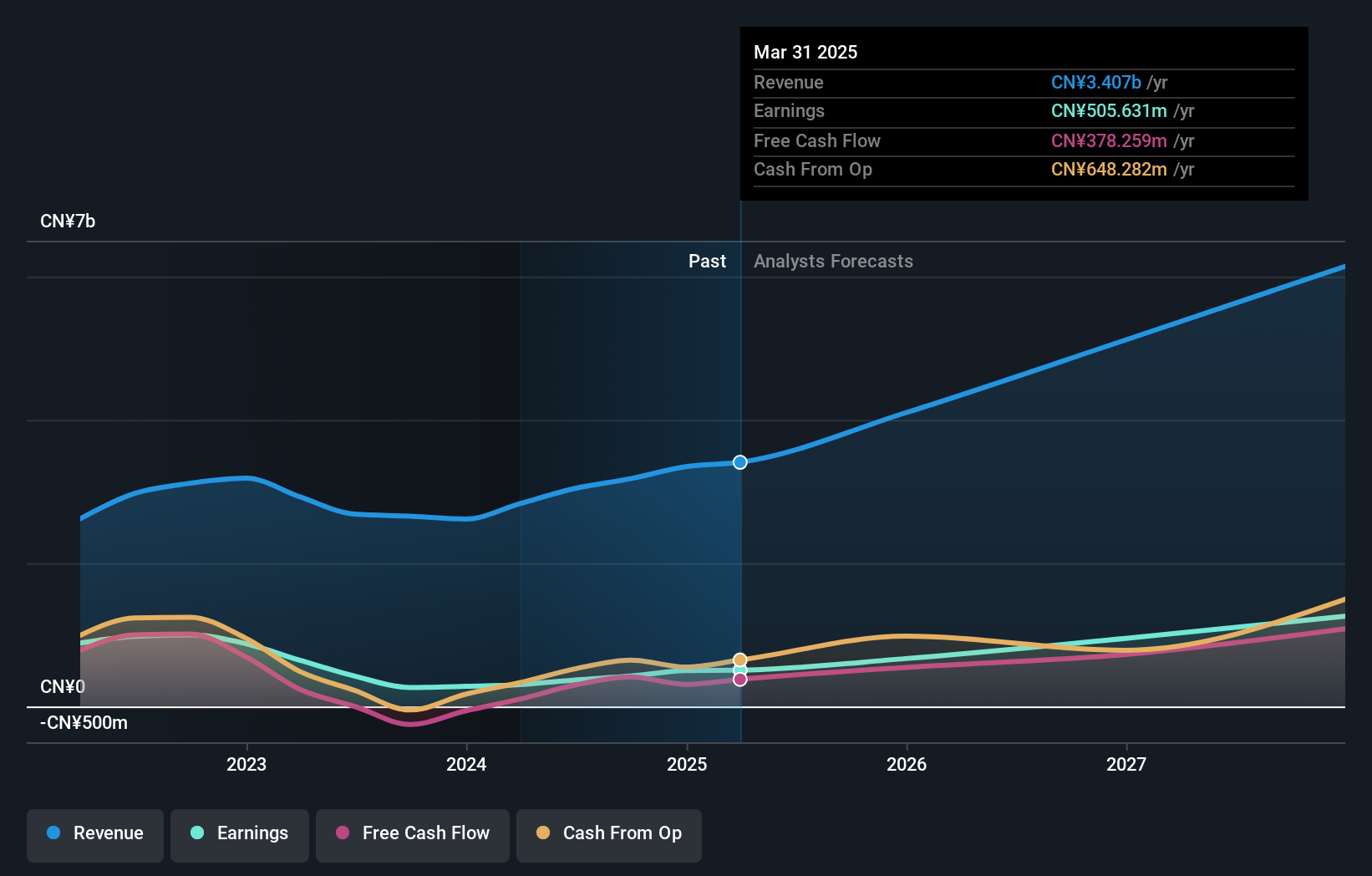

Operations: The company's revenue from the integrated circuit industry amounts to CN¥3.59 billion.

Insider Ownership: 32.7%

SG Micro's earnings and revenue are forecast to grow significantly, at 33.2% and 20.7% annually, respectively, outpacing the Chinese market. Recent amendments to its articles of association suggest strategic shifts, including a potential H-share offering in Hong Kong. Despite high share price volatility and a low future Return on Equity forecast of 16.4%, the company's insider ownership may align management with shareholder interests, enhancing governance amid these changes.

- Click here to discover the nuances of SG Micro with our detailed analytical future growth report.

- The analysis detailed in our SG Micro valuation report hints at an inflated share price compared to its estimated value.

Ningbo Zhenyu Technology (SZSE:300953)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ningbo Zhenyu Technology Co., Ltd. engages in the research, development, manufacture, and sale of progressive lamination dies both in China and internationally, with a market cap of CN¥32.15 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, totaling CN¥8.04 billion.

Insider Ownership: 38%

Ningbo Zhenyu Technology is experiencing robust earnings growth, with a forecasted increase of 35.6% annually, surpassing the Chinese market's average. Recent half-year results show significant revenue and net income growth compared to last year. Despite this, the company faces challenges with debt coverage by operating cash flow and shareholder dilution over the past year. The stock has been highly volatile recently, but substantial insider ownership could potentially align management interests with those of shareholders.

- Delve into the full analysis future growth report here for a deeper understanding of Ningbo Zhenyu Technology.

- The valuation report we've compiled suggests that Ningbo Zhenyu Technology's current price could be inflated.

Next Steps

- Discover the full array of 616 Fast Growing Asian Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688017

Leader Harmonious Drive Systems

Leader Harmonious Drive Systems Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives