- China

- /

- Semiconductors

- /

- SZSE:300474

The Price Is Right For Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) Even After Diving 33%

Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) shares have retraced a considerable 33% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

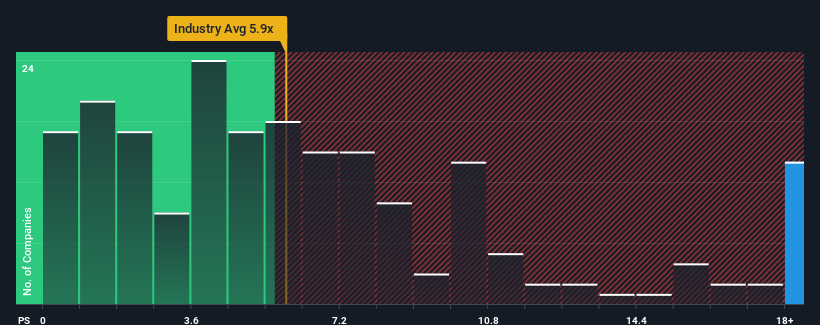

In spite of the heavy fall in price, Changsha Jingjia Microelectronics may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 30.8x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 5.9x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Changsha Jingjia Microelectronics

What Does Changsha Jingjia Microelectronics' P/S Mean For Shareholders?

Changsha Jingjia Microelectronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Changsha Jingjia Microelectronics will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Changsha Jingjia Microelectronics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 46% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 53% as estimated by the three analysts watching the company. With the industry only predicted to deliver 34%, the company is positioned for a stronger revenue result.

With this information, we can see why Changsha Jingjia Microelectronics is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Changsha Jingjia Microelectronics' P/S Mean For Investors?

Even after such a strong price drop, Changsha Jingjia Microelectronics' P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Changsha Jingjia Microelectronics shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 2 warning signs we've spotted with Changsha Jingjia Microelectronics.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300474

Changsha Jingjia Microelectronics

Changsha Jingjia Microelectronics Co., Ltd.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives