- China

- /

- Semiconductors

- /

- SZSE:300474

After Leaping 30% Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) Shares Are Not Flying Under The Radar

Changsha Jingjia Microelectronics Co., Ltd. (SZSE:300474) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

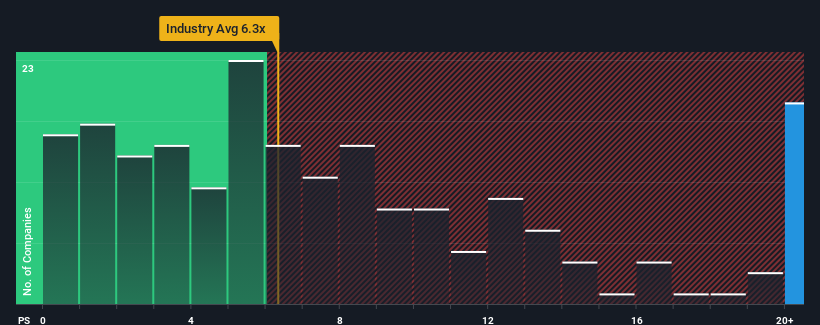

After such a large jump in price, Changsha Jingjia Microelectronics' price-to-sales (or "P/S") ratio of 33.8x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 6.3x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Changsha Jingjia Microelectronics

What Does Changsha Jingjia Microelectronics' Recent Performance Look Like?

Changsha Jingjia Microelectronics could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Changsha Jingjia Microelectronics will help you uncover what's on the horizon.How Is Changsha Jingjia Microelectronics' Revenue Growth Trending?

In order to justify its P/S ratio, Changsha Jingjia Microelectronics would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 11%. Even so, admirably revenue has lifted 46% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 75% over the next year. With the industry only predicted to deliver 38%, the company is positioned for a stronger revenue result.

With this information, we can see why Changsha Jingjia Microelectronics is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Changsha Jingjia Microelectronics' P/S?

The strong share price surge has lead to Changsha Jingjia Microelectronics' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Changsha Jingjia Microelectronics' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Having said that, be aware Changsha Jingjia Microelectronics is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300474

Changsha Jingjia Microelectronics

Changsha Jingjia Microelectronics Co., Ltd.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)