- China

- /

- Semiconductors

- /

- SZSE:300316

The past three years for Zhejiang Jingsheng Mechanical & Electrical (SZSE:300316) investors has not been profitable

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Zhejiang Jingsheng Mechanical & Electrical Co., Ltd. (SZSE:300316) shareholders have had that experience, with the share price dropping 41% in three years, versus a market return of about 6.9%.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Zhejiang Jingsheng Mechanical & Electrical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate three years of share price decline, Zhejiang Jingsheng Mechanical & Electrical actually saw its earnings per share (EPS) improve by 40% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that, in three years, revenue has actually grown at a 43% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Zhejiang Jingsheng Mechanical & Electrical further; while we may be missing something on this analysis, there might also be an opportunity.

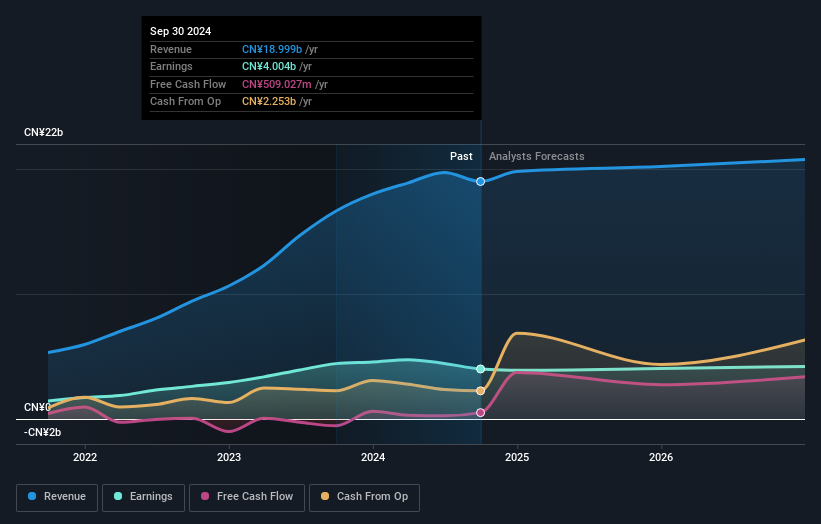

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Zhejiang Jingsheng Mechanical & Electrical has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Zhejiang Jingsheng Mechanical & Electrical's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Zhejiang Jingsheng Mechanical & Electrical had a tough year, with a total loss of 12% (including dividends), against a market gain of about 15%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Zhejiang Jingsheng Mechanical & Electrical better, we need to consider many other factors. Take risks, for example - Zhejiang Jingsheng Mechanical & Electrical has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Zhejiang Jingsheng Mechanical & Electrical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Jingsheng Mechanical & Electrical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300316

Zhejiang Jingsheng Mechanical & Electrical

Zhejiang Jingsheng Mechanical & Electrical Co., Ltd.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives